The Rake Review: December 2023

The Rake Review: December 2023

The year 2023 witnessed significant strides in the cryptocurrency market, characterized by both maturation and innovation. Amidst regulatory advancements, technological breakthroughs, and shifting investor sentiments, the industry demonstrated resilience and adaptability. This comprehensive research report delves into the key themes and developments that shaped the cryptocurrency landscape throughout 2023.

1. Regulatory Landscape:

1. Regulatory Landscape:

One of the defining aspects of 2023 was the maturation of regulatory frameworks globally. Various jurisdictions took decisive steps toward clearer guidelines for cryptocurrency exchanges, initial coin offerings (ICOs), and decentralized finance (DeFi) platforms. Increased regulatory clarity contributed to a more secure and institutional-friendly environment, attracting traditional investors to the market.

2. Decentralized Finance (DeFi) Evolution:

2. Decentralized Finance (DeFi) Evolution:

The DeFi sector experienced exponential growth, surpassing expectations in 2023. The emergence of innovative protocols, yield farming mechanisms, and decentralized exchanges (DEXs) contributed to the sector's prominence. However, challenges such as smart contract vulnerabilities and regulatory scrutiny highlighted the need for ongoing development and risk management within the DeFi space.

3. NFTs and Digital Assets:

3. NFTs and Digital Assets:

Non-fungible tokens (NFTs) continued to captivate the market, extending beyond art and collectibles to encompass a diverse range of industries. The gaming sector embraced NFTs, offering unique in-game assets, while industries like real estate explored tokenization. The maturation of NFT standards and interoperability facilitated broader adoption and integration into mainstream markets.

4. Institutional Adoption:

4. Institutional Adoption:

Institutional interest in cryptocurrencies reached new heights in 2023. Established financial institutions and corporations increasingly added Bitcoin and other digital assets to their balance sheets. The development of crypto-based exchange-traded funds (ETFs) in certain jurisdictions provided institutional investors with regulated exposure to the market, contributing to overall market legitimacy.

5. Technological Advancements:

5. Technological Advancements:

The year 2023 showcased continuous technological innovation within the cryptocurrency space. The advent of Layer 2 scaling solutions, advancements in consensus mechanisms, and the integration of privacy-focused technologies enhanced the scalability, security, and privacy features of various blockchain networks. This technological progress laid the groundwork for a more robust and user-friendly ecosystem.

6. AI Revolutionises Crypto in 2023:

6. AI Revolutionises Crypto in 2023:

7. Market Performance and Trends:

7. Market Performance and Trends:

Conclusion:

Conclusion:

Market Update

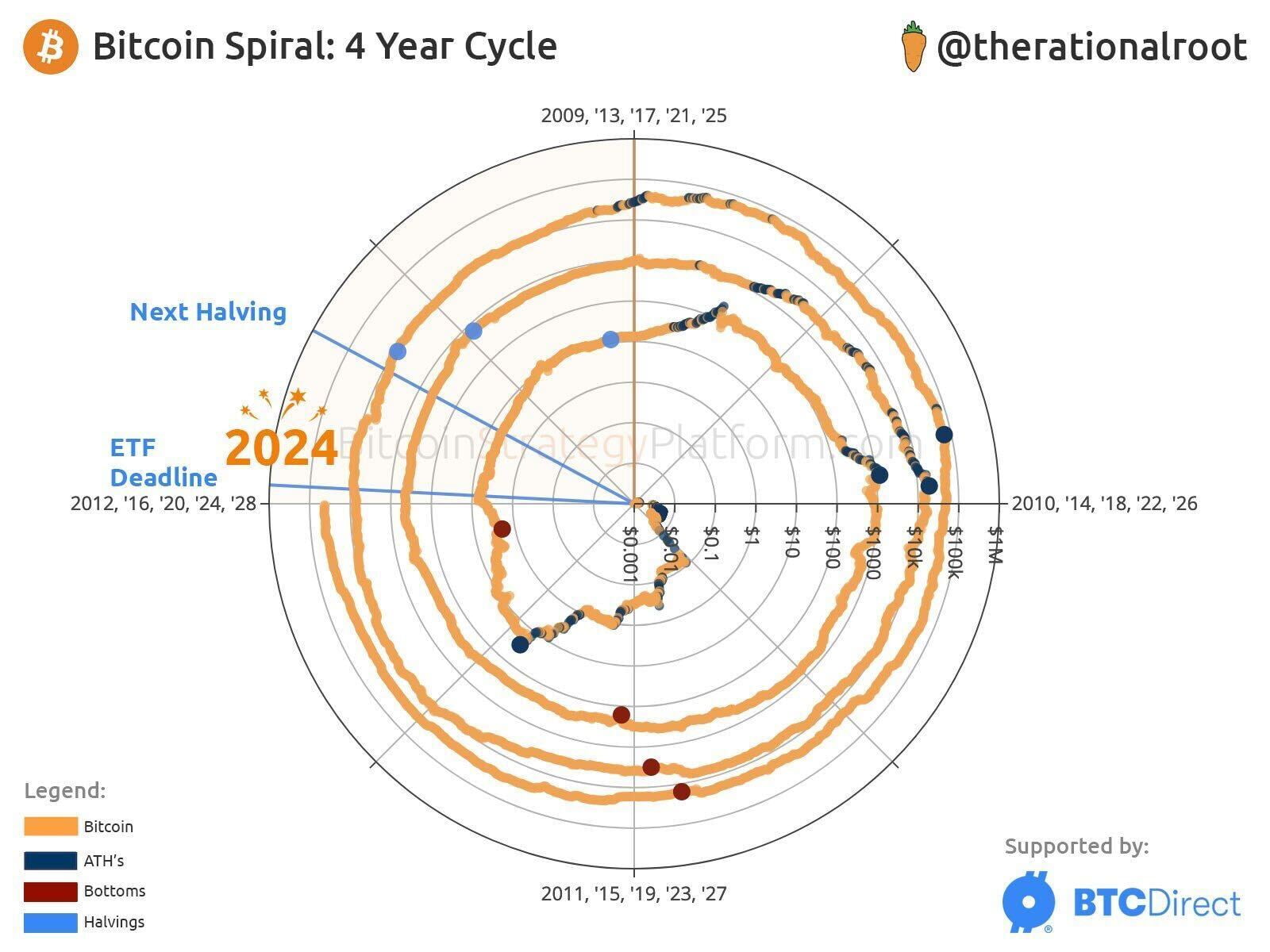

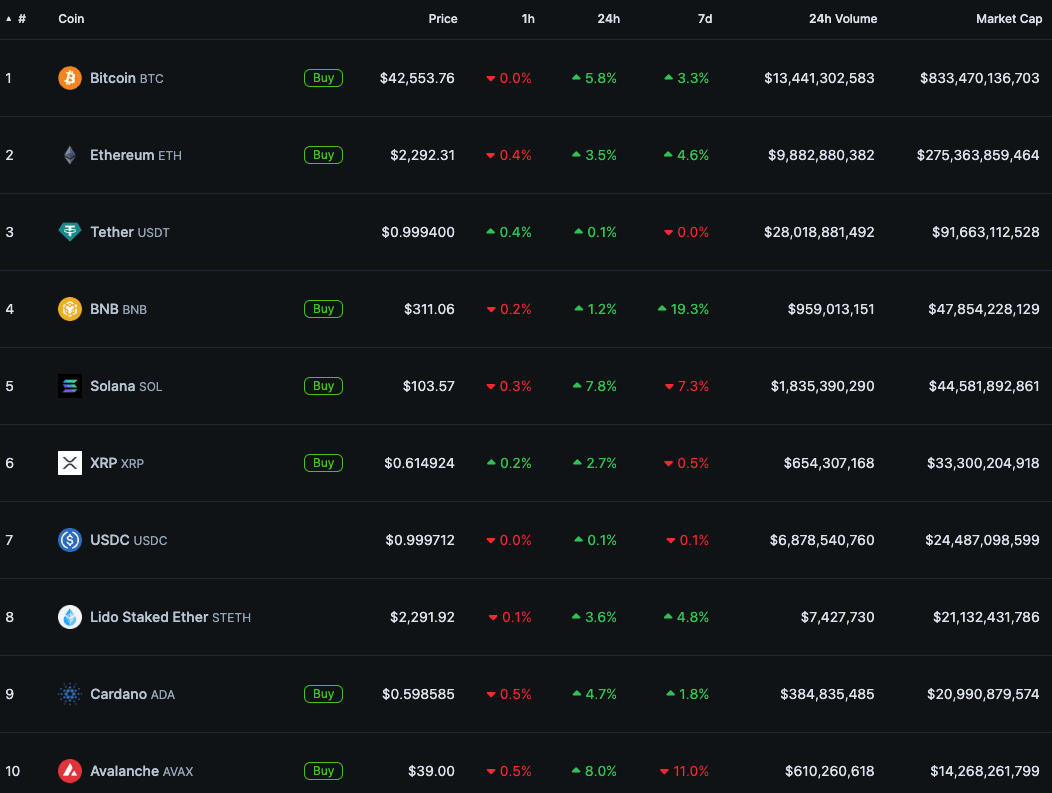

- Bitcoin hit an annual high of $44,700 USD through relentless buying off increasing confidence.

- Ethereum continued to grind higher but has massively underperformed against BTC in 2023.

- Solana surges to 5th place in market capitalization having cracked the $100 USD handle.

- Avalanche has surged in to the top 10 with an impressive triple digit % growth in Dec 2023.

- The entire crypto market has risen by $235 Billion USD in the month.

Video of the month

Vibes heading into 2024

In the news

- El Salvador's Bitcoin investments are in the black. El Presidente has shown he has diamond hands.

- Hardware wallet provider Ledger had experienced a pretty malicious hack.

- Bitcoin price breaks through $45k, days ahead of ETF approval.

- These 3 coins came back from the dead in 2023.

- Michael Saylor's Microstrategy buys 14,620 Bitcoin for $615 Million USD.

- Spot Bitcoin ETF decision by the SEC could be out by January 3

Education

Education

Click HERE for a clearer image

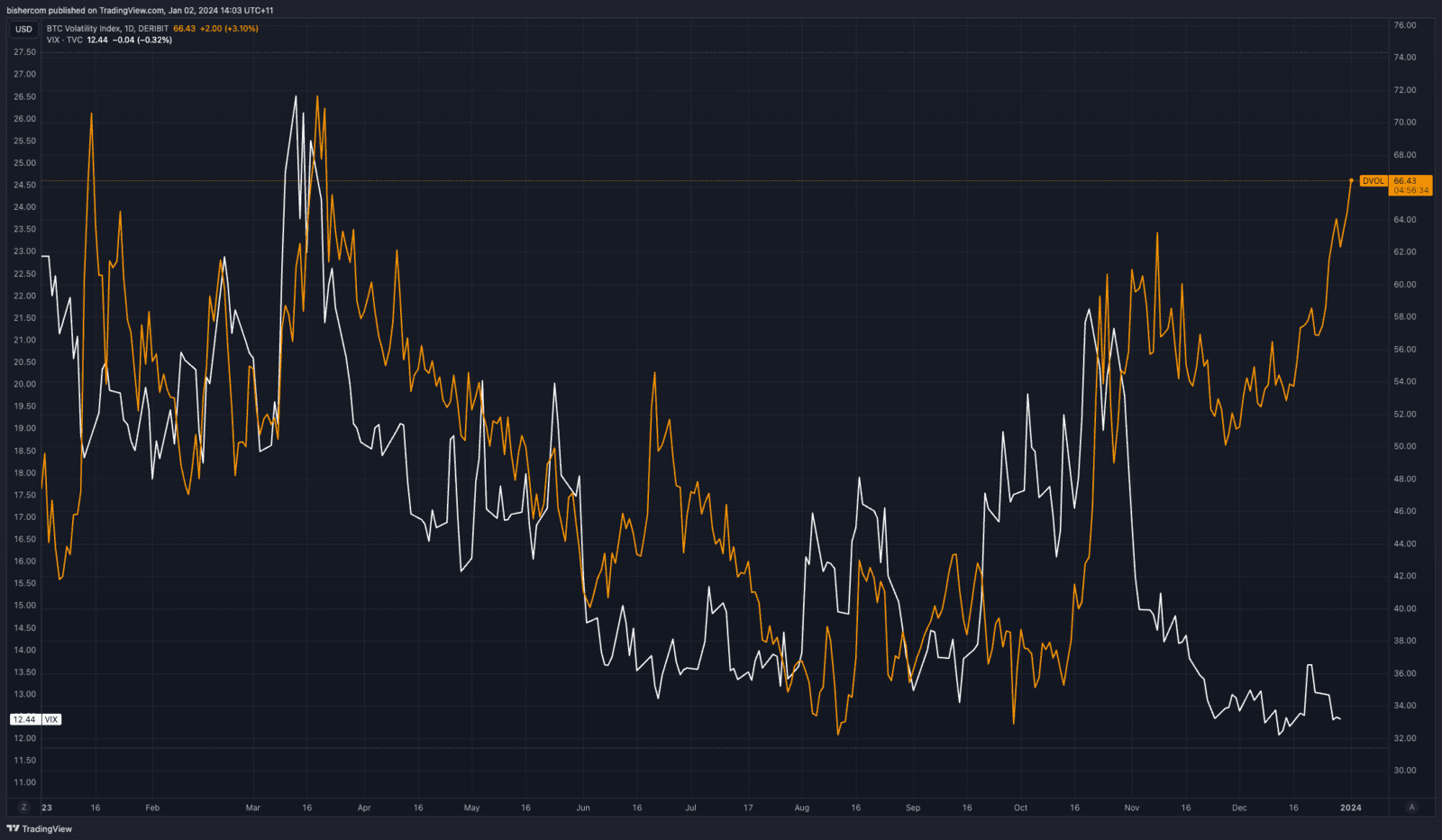

Demystifying Crypto Volatility: A Comprehensive Guide to Understanding and Navigating Market Fluctuations

Defining Crypto Volatility

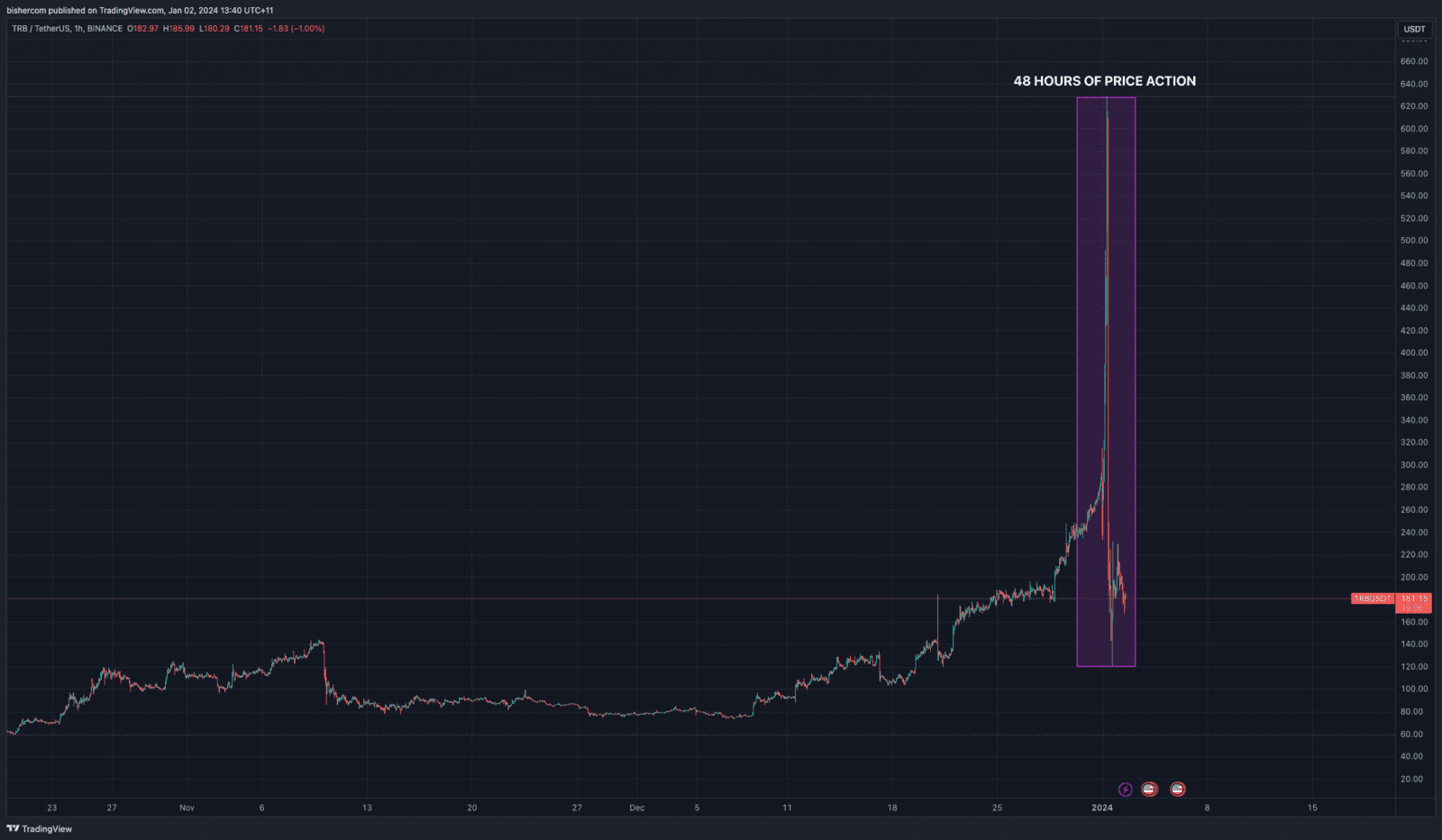

Volatility in the cryptocurrency market refers to the degree of variation in the prices of digital assets over a specific period. Unlike traditional financial markets, cryptocurrencies are known for their wild price swings, often experiencing double-digit percentage changes within short time frames.

Factors Influencing Crypto Volatility

How To Navigate Volatility

More importantly, CALL YOUR STORMRAKE CRYPTO BROKER!

Conclusion

Memes of the month

Start Your Brokerage Account

If you enjoyed this Rake Review, feel free to open an account and gain access to more proprietary research and work with your very own dedicated crypto broker.

No Advice Warning

Disclaimer

All statements made in this newsletter are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.Copyright © 2022 Stormrake Pty Ltd, All rights reserved