Blog tagged as Market

With Japanese bond market turmoil, yields hitting highs not seen since 2008, a possible new Fed chair, and the end of the longest US government shutdown in history, we’re at a key turning point that could set the stage for a massive 2026 and beyond.

2025 was not the year many hoped for, but it was far from a waste. Bitcoin made structural progress, hit key adoption milestones, and may now be undervalued both relative to its own history and within the broader macro environment. The groundwork is set.

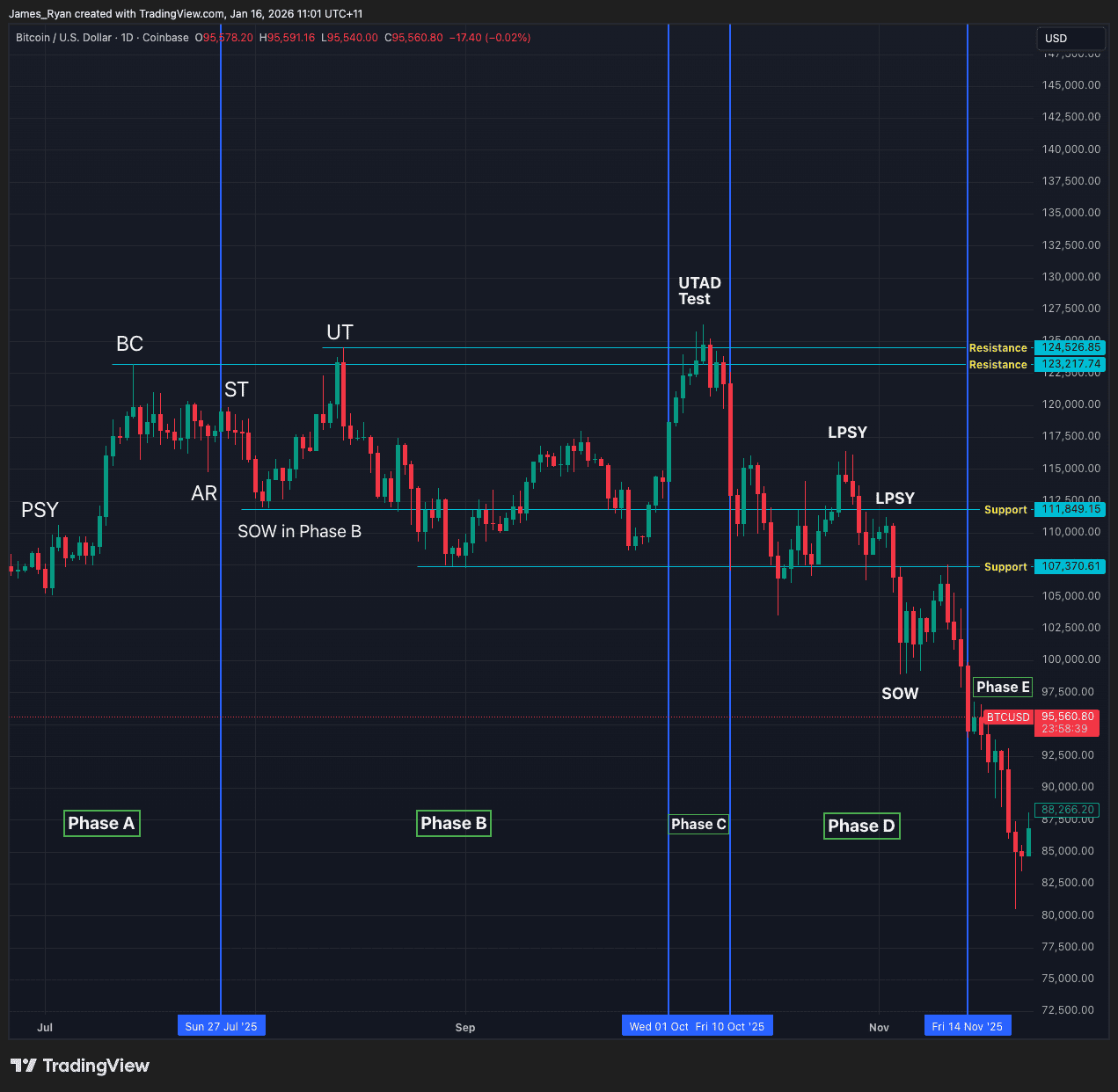

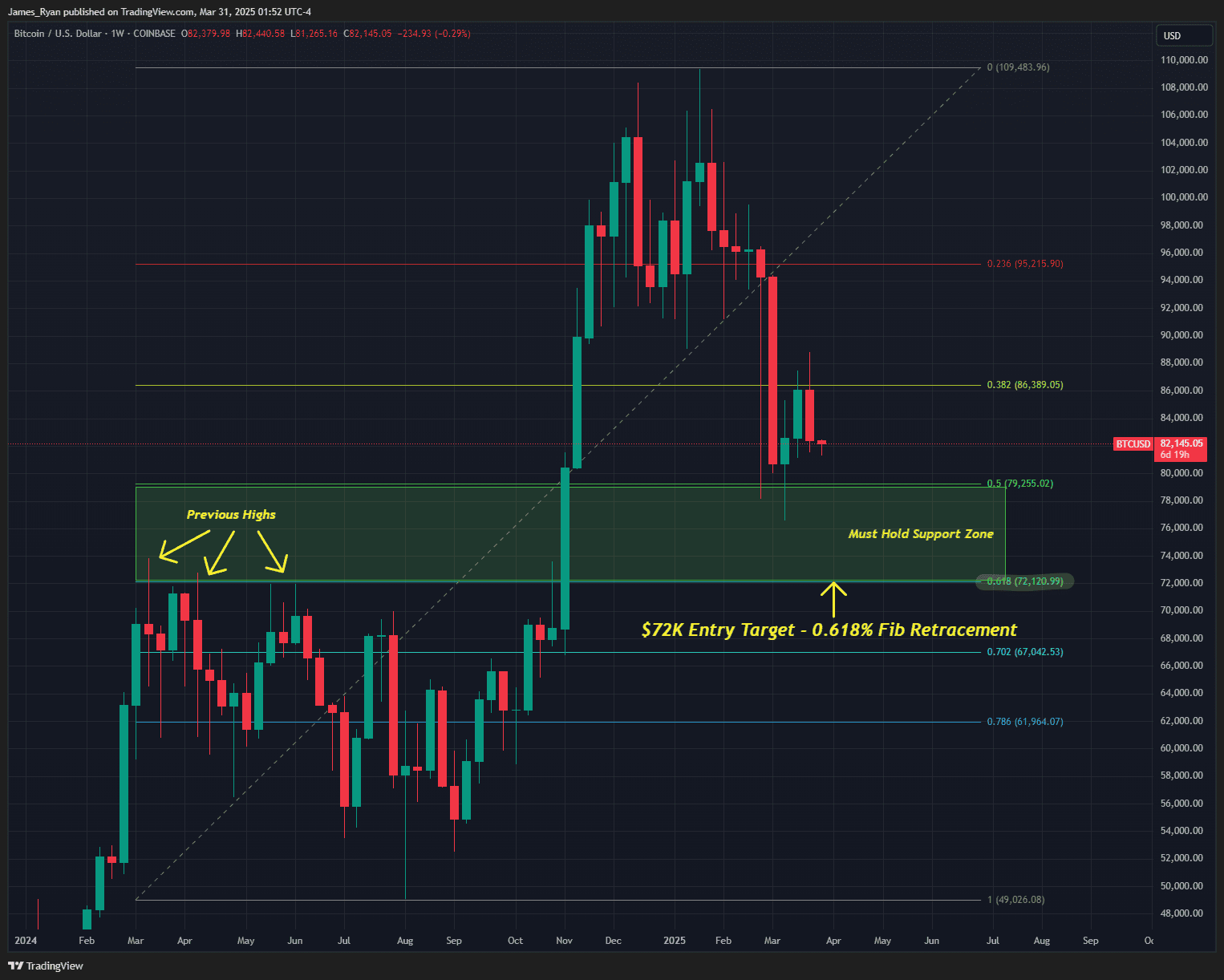

Just last month we saw all time highs. Now, one of Bitcoin’s largest buyers has paused its accumulation, bear market signals have triggered, and sentiment has turned. But despite all of this, several key factors suggest this market may be fundamentally different from those we’ve seen before.

As has been the case throughout this bull market, October delivered both highs and lows in rapid succession, each one offering its own lesson. A new all-time high was quickly followed by some hard truths for those chasing quick gains.

Leverage offers fast gains but often ends in total loss. This weekend’s $20B liquidation proved again that when the market turns, it’s spot holders who survive. Drawdowns hurt, but recovery is possible. Wipeouts are not.

September has wrapped up. It fought through historical stigmas, liquidations, and manipulation to close green. A new narrative dominated headlines and shook the space, while fresh signs of adoption continue to emerge. Through it all, Bitcoin held firm and September has now set the stage for October.

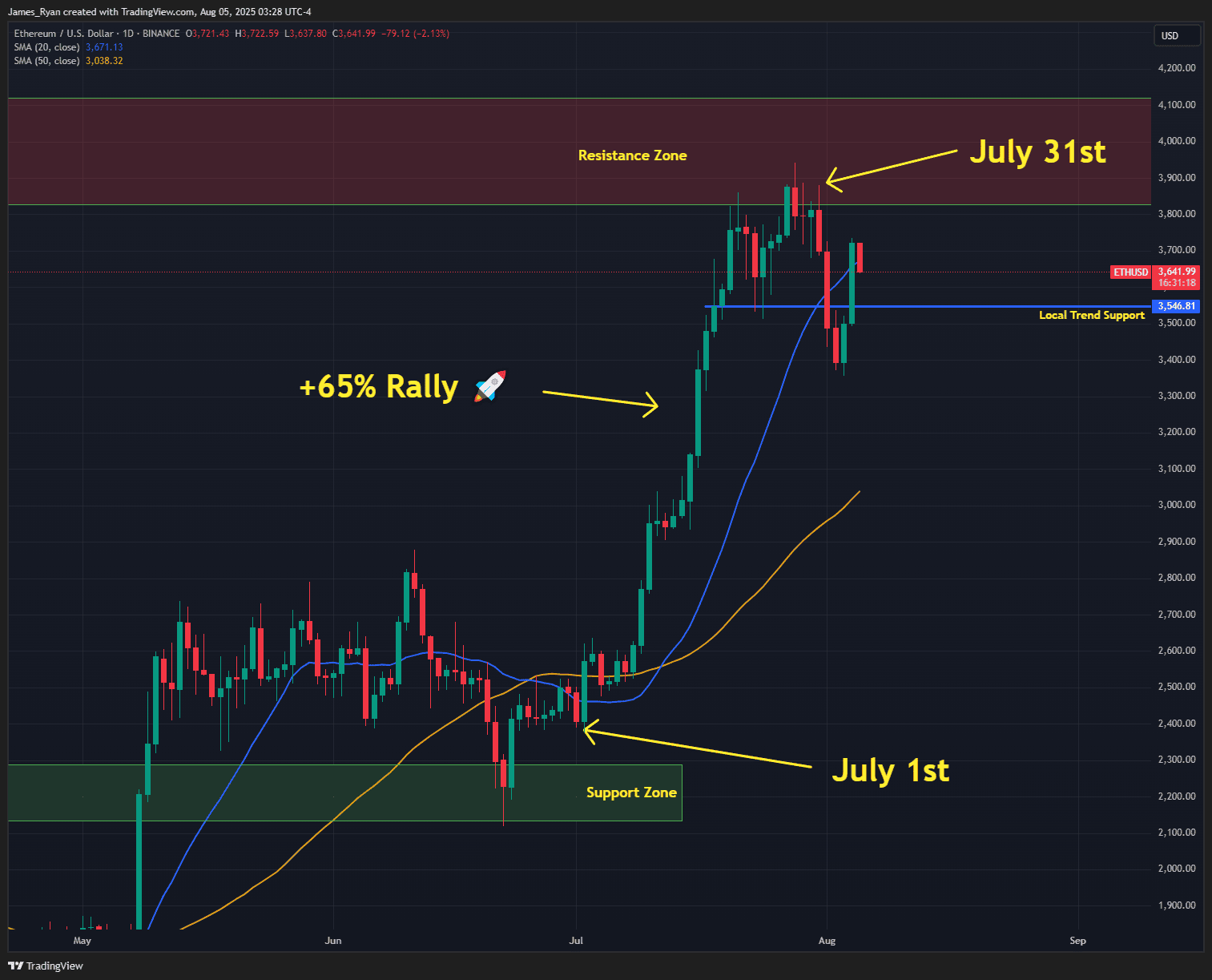

July was a month of contrasts for Bitcoin, with decade-old coins suddenly moving, fresh all-time highs, and the first major crypto regulations landing. The back half of the year has started stronger than expected, but can this momentum carry into a full-fledged altseason?

Since the last bull run in 2021, Ethereum (ETH) has undergone a quiet transformation. It is no longer just a smart contract plaƞorm for DeFi experiments and NFT collectibles – it’s steadily becoming the core infrastructure layer for stablecoins and tokenized real-world assets (RWAs), the...

July was a month of contrasts for Bitcoin, with decade-old coins suddenly moving, fresh all-time highs, and the first major crypto regulations landing. The back half of the year has started stronger than expected, but can this momentum carry into a full-fledged altseason?

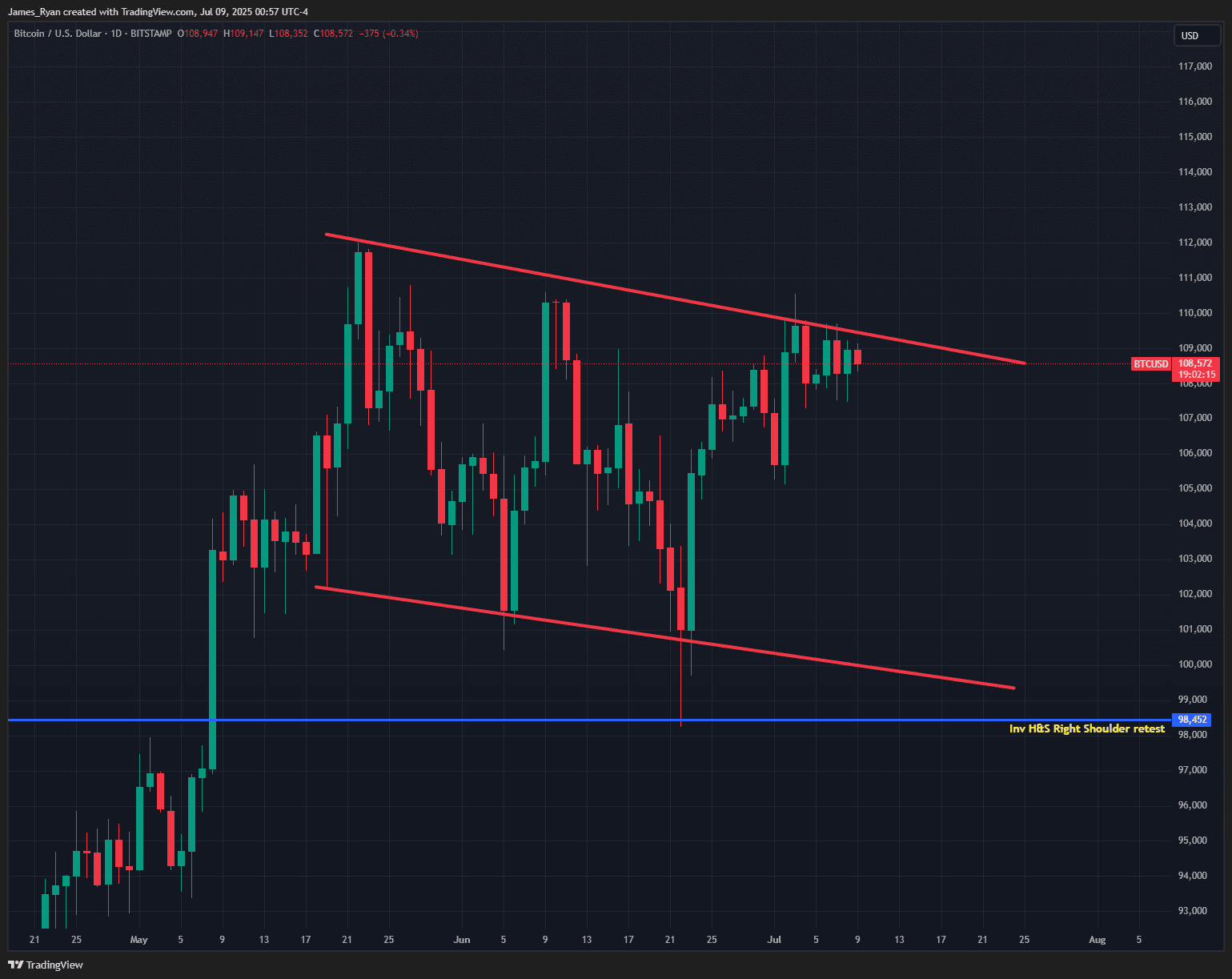

What a wild couple of months we’ve had since our last article. There’s been no shortage of excitement in the market – to say the least! We’ve witnessed Bitcoin not only just break All Time High’s once again since the retail panic of April (well done Tarriff scalpers!) but we’ve now just speedrun a p...

Sonic was a top project last bull run but has disappointed badly this cycle, and now the stage may be set for it to finally outperform and live up to its potential.

As with much of the first half of 2025, June's price action was largely influenced by news and decisions from the White House, alongside ongoing conflicts in the Middle East, but it has set itself up for a potentially bullish second half of the year.

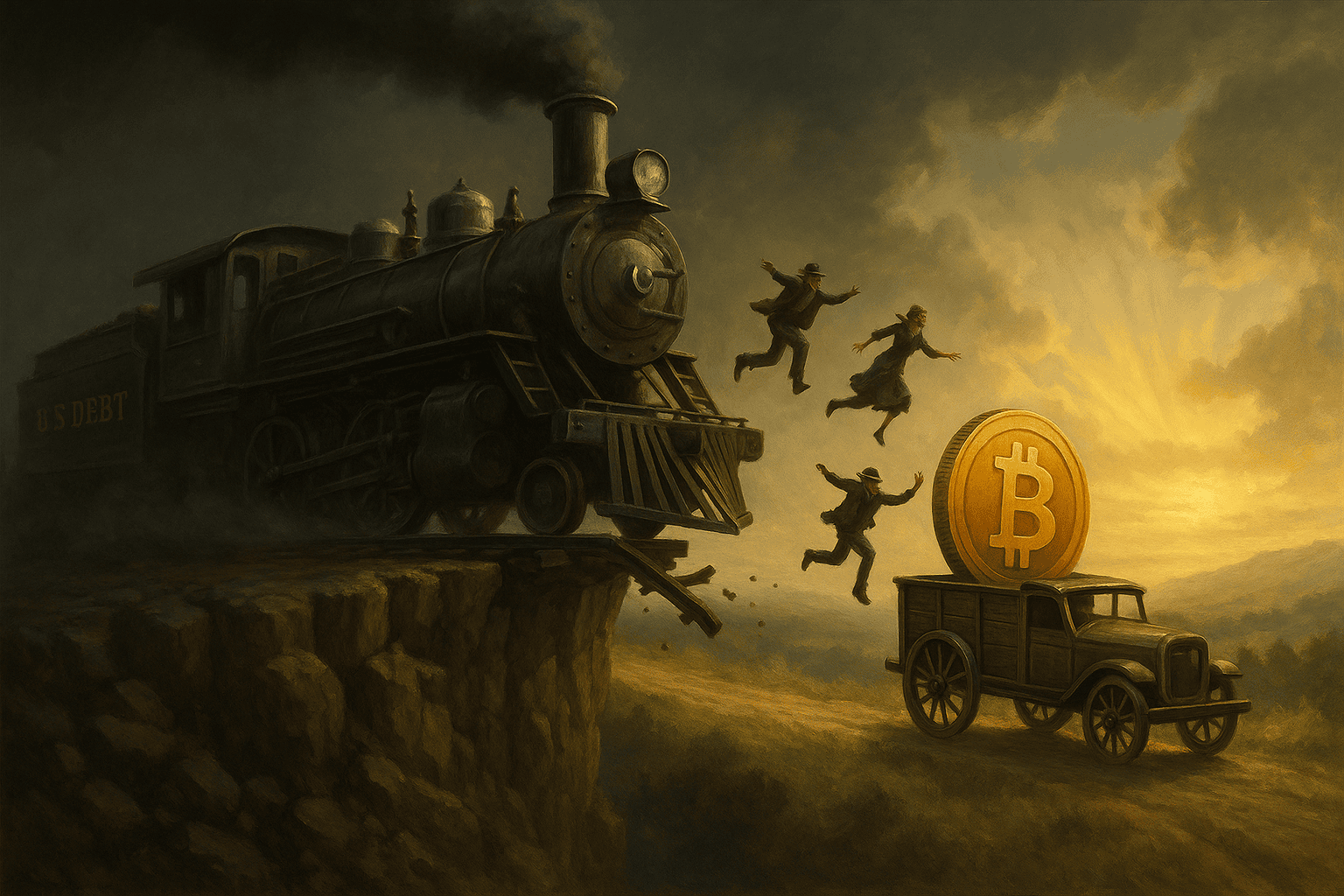

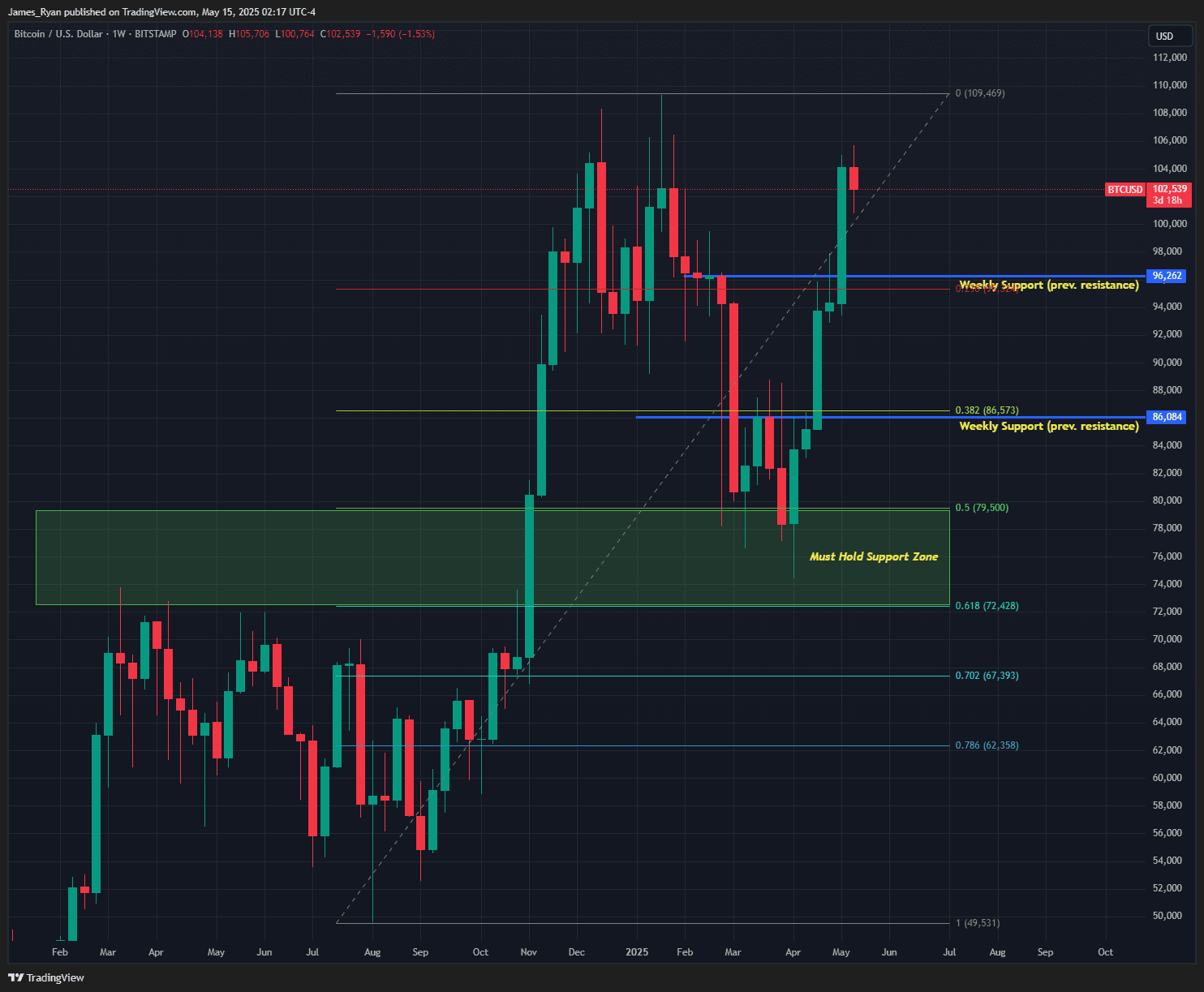

May proved what conviction looks like. As US debt soared past $37T, Bitcoin broke to new highs, reminding markets it’s not just resilient, it’s the alternative. In a system built on debt, Bitcoin isn’t reactionary. It’s the solution.

After all of the Fear, uncertainty and doubt since the beginning of the year, those who saw what we saw and took the necessary action to add to their positions during such a prime market opportunity are being rewarded in spades as we speak! With full market-wide reversals back to the upside, we’re v...

Learn why prime brokerage is critical for serious digital asset investors. Discover how Stormrake delivers secure custody, deep execution, and full-service support.

For the longest time, people have debated whether Bitcoin is a risk-on or risk-off asset. Is it a levered Nasdaq, or is it digital gold? What if I told you neither side is wrong — and that April, one of the wildest months in recent memory, proved Bitcoin is, in fact, both.

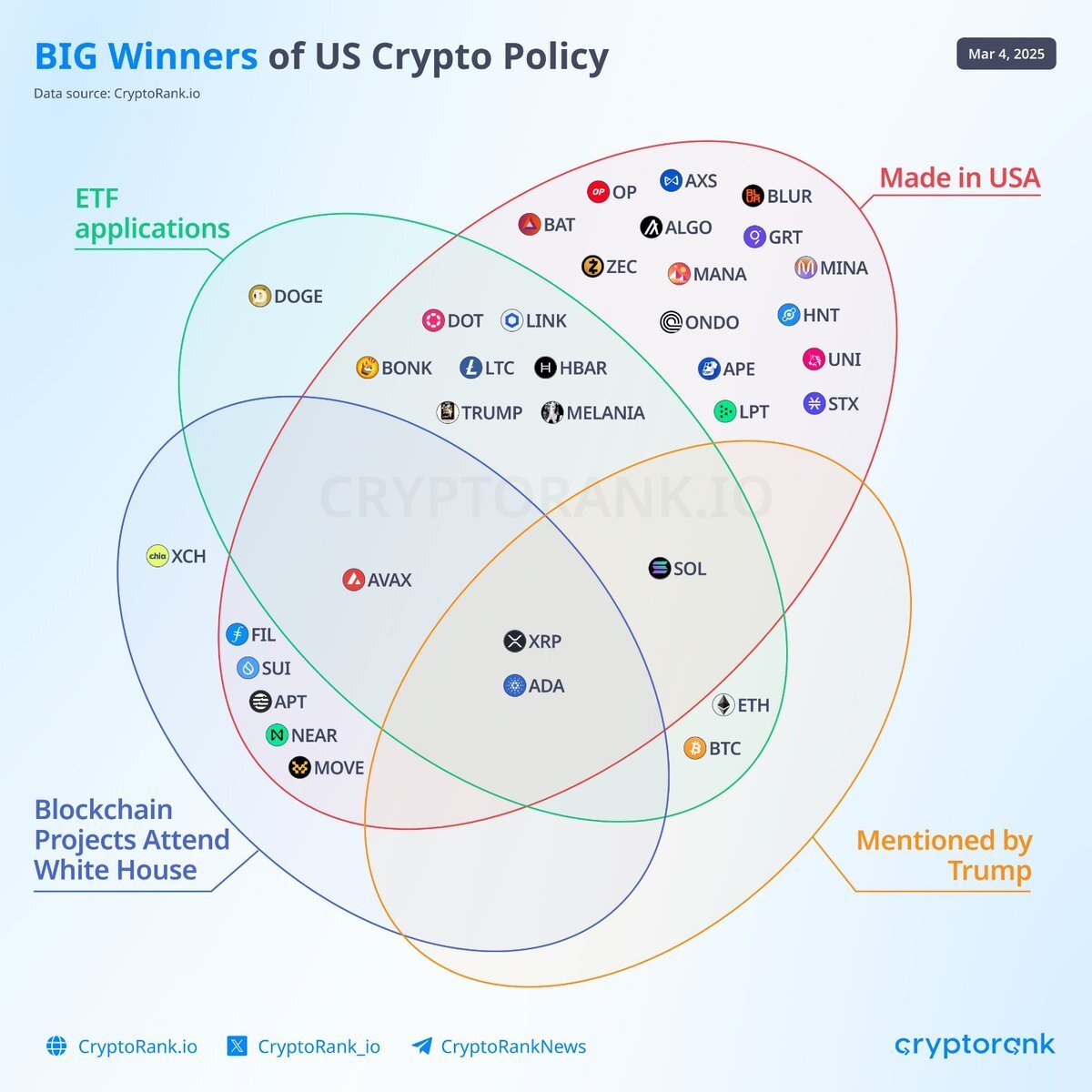

Between the deluge of sensational narratives, extreme retail sentiment swings, and the overall uncertainty of how Trump’s macro-economic policies will affect the US and global markets as a whole, it’s no surprise everyone has their own theories of where things are going from here. One thing is certa...

Bitcoin didn’t just move sideways in March—it moved up the geopolitical ladder. With the US formally designating Bitcoin as a strategic reserve asset, the digital currency took on a new identity: not just a hedge, not just an investment, but a tool of statecraft. Bitcoin became strategic.

With superannuation now a fiscal target and the AUD facing long-term risks, Bitcoin offers an avenue for enhanced financial sovereignty within an SMSF.

Bitcoin has reclaimed $90K as the highly anticipated Crypto Summit approaches in less than 48 hours.