The Rake Review: August 2023

The Rake Review: August 2023

Welcome to another Riveting Rake Review as August delivered on some volatility and news again. From Supply shocks, to Aussie Banking issues, to ETF's, to Russian Billionaires accidentally being blown up, we go around the world as Bitcoin quietly counts down to the next halving in April.

Special Update: Greyscale & SEC

Just as we were sending out the Rake Review huge news came through again. We had to delay the newsletter and add this key development.

Judge Srinivasan & Edwards found that the Securities and Exchange Commission (SEC) was wrong to reject Greyscales ETF application and failed to explain their rejection.

The result can still be challenged but if it stands is enormous for Bitcoin and the whole industry. For Greyscale it means they could turn their current Bitcoin fund into an ETF. Their current fund is the worlds largest holder of Bitcoin (Other than the Satoshi holding).

It also means that there is great hope for the other 7 ETF applications currently before the SEC. As you will read below in the body of this newsletter we already see the ETF applications as the biggest catalyst for the next Bull-run.

Bitcoin has already responded in trading this morning up over 6% to almost $28,000 USD. The wider crypto market has also been dragged up by this news with ETH and SOL up 5%. As the market digests the news further how will this play out?

We will post a full analysis of this news in a separate article today.

Bitcoin Supply Shock Incoming

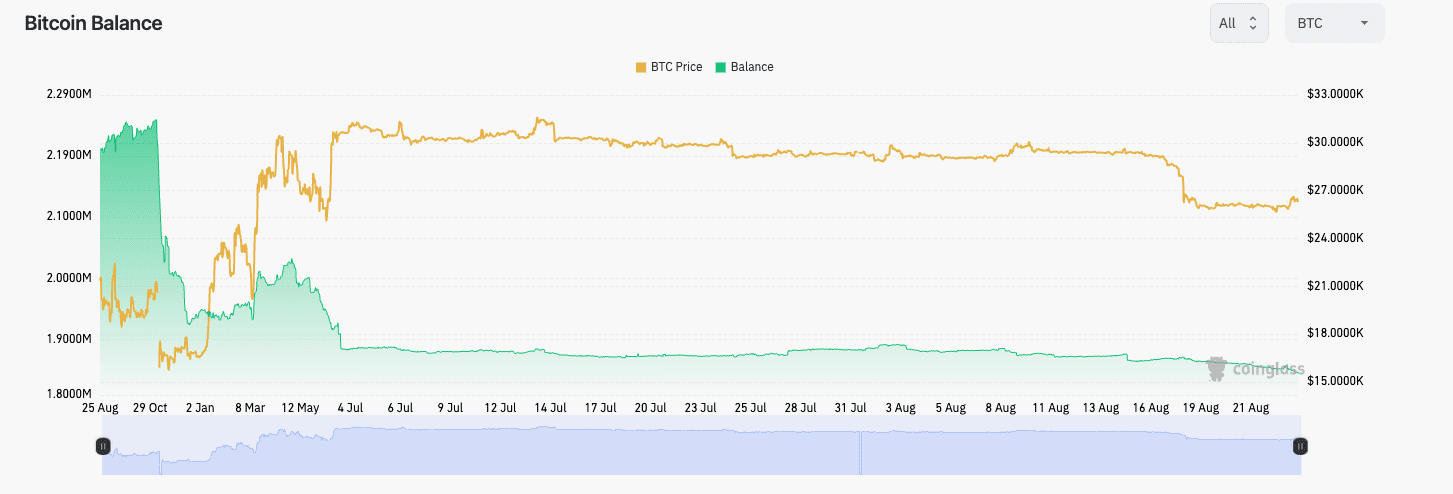

The supply of coins on exchange is historically very low. According to Coinglass, less than 10% of Bitcoin supply is accessible through exchanges. That means the rest is safely put away in cold storage or similar. Available supply is extremely low.

Look at the green line below. Less than 2 Million BTC is on exchange.

Bitcoin on exchange is now at a 5 year low, despite 5 years of mining adding to the supply. There is significant accumulation going on amongst the whales (large holders) and according to some reports Wall St funds are starting to accumulate a position ahead of launching their ETF's. It's an environment where any demand shock could spark a sharp rise.

Banks Behaving Badly

Which Bank has sent a letter to every customer telling them that they can't send any more than $10,000 AUD per month to cryptocurrency exchanges? The Commonwealth Bank.

ANZ and NAB seem to also be looking at similar rules. Its a very concerning development for a western country. All of a sudden the Bank gets to choose what you can spend your "hard earned" on. That's despite the fact that its all legal. They just don't think the industry is a "good fit" or fits within their "risk appetite". With cash disappearing at a rapid rate in Australia its a real concern that we are seeing the future unfold. CBDC's are on the way and you might be looking into a little window of your future where you will be told what you can and can't spend your money on. Meat, fatty foods, coke, fast food, guns, produce of countries we don't approve, etc etc.

The key here is this. While you can buy Bitcoin you really need to because your AUD offramp could be cut at anytime and then you physically won't be able to buy while watching the price rocket and not being able to do anything about it.

We wrote about this in detail in our Thunder Trading update so I won't go into great detail here. However, given that this is key news, what you need to know is that the SEC has filed for an appeal.

The curtain has not yet fallen on the riveting drama between the U.S. Securities and Exchange Commission (SEC) and Ripple Labs. What once was hailed as a pivotal moment with the July 13 ruling is now heating up with an appeal, bringing further uncertainty to the crypto sphere.

Read more here.

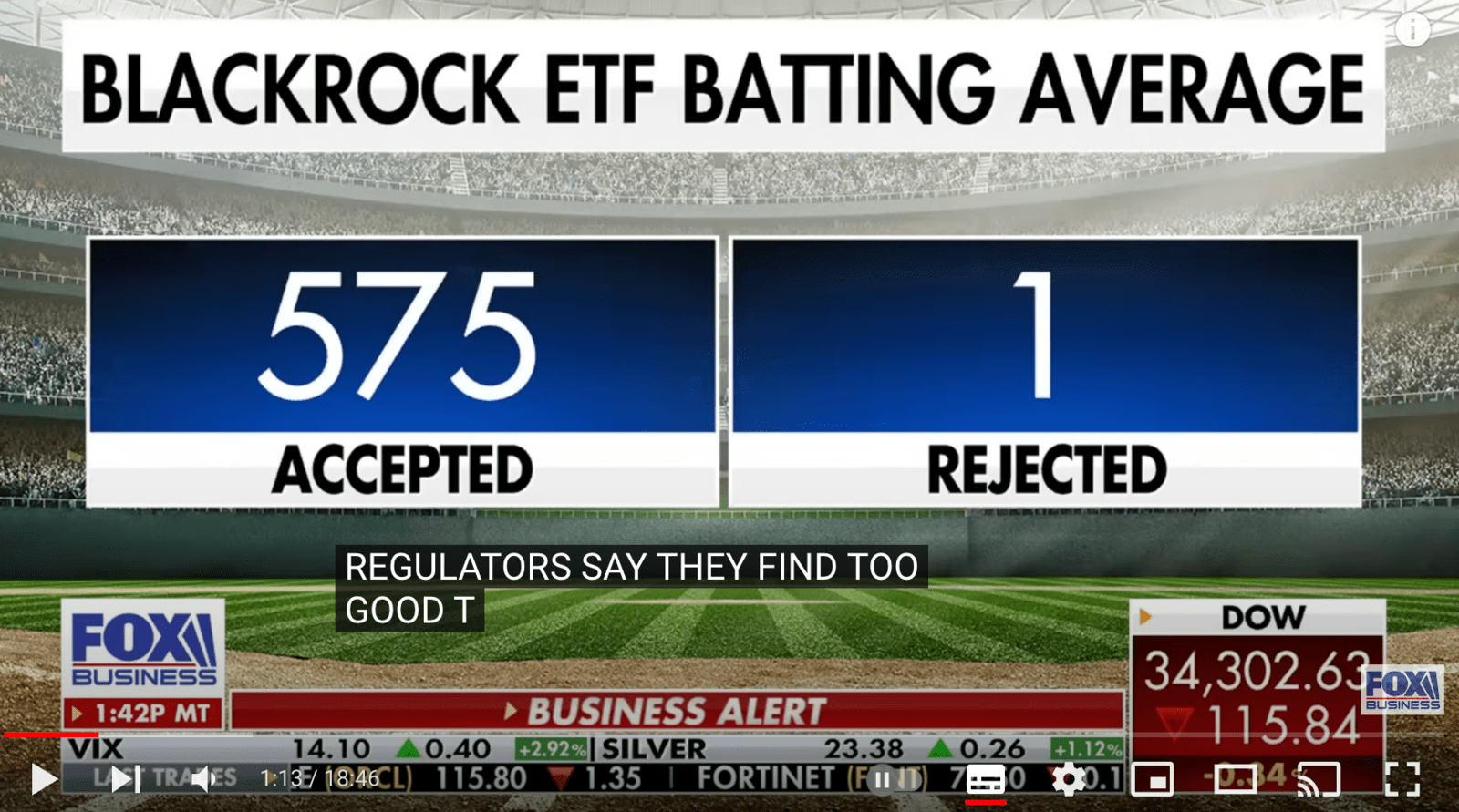

BlackRock ETF

A further demand side shock is expected from any movement on the approval process for US based Exchange Traded Funds (ETF's). While some players have had applications before the SEC for quite some time, the entry of BlackRock has been significant. Other players have quickly filed changes to their applications to be in line with BlackRocks filing. The reasoning is simple, BlackRock has an incredible track record of succeeding so the others want to be as similar as possible so that the SEC has no choice but to accept all of them if they want to approve BlackRock.

So, we are witnessing the single biggest catalyst that could start the next BTC bullrun. If all of these funds are simultaneously approved the demand it brings in is incredible. Given the already low supply and the halving this could ignite the whole market.

ETH is also there with the same players filing for ETH based ETF's also.

BTC Halving Coming Soon

The Bitcoin Halving is under 2/3 of a year away. In April, the amount of BTC released every block will halve lowering supply to hit the market. In the past this has helped put a supply shock into the market and we have seen what can happen to price. Don't get caught short.

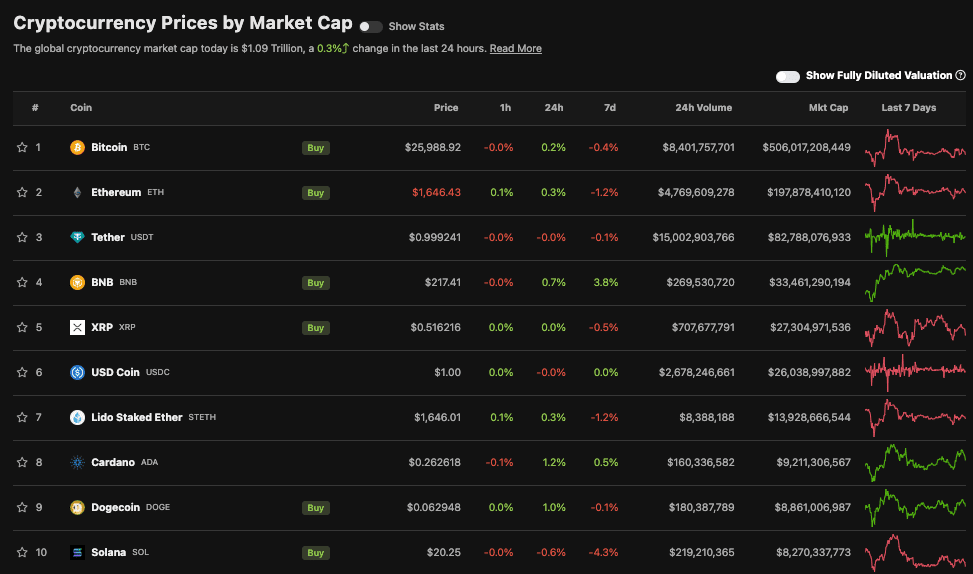

Market Update

Here is the fast five of what you need to know about the market in August 2023:

- A large move this month cut a large chunk out of the total crypto market cap. Bitcoin moved over 10% and has settled at the $26K USD range. Open Interest was cut significantly across all crypto derivatives.

- Volatility remains low despite that move and options reflect this with IV historically low.

- USDC has underperformed with a slight depeg occuring this month. USDT is once again the preferred stablecoin.

- Solana (SOL) has displaced Tron (TRX) in the top10 on the back of a relative recovery.

- DeFi coins continue to underperform with meme coins still attracting silly valuations.

Video of the month

One of our founders Michael Milmeister went on "The Open" show on Ausbiz TV Friday to talk about the market and especially the current supply dynamics.

You can view the full video here with an AusBiz signup. We will soon make this available on our Youtube page also.

In the news

- The Bitcoin HashRate has been widely reported as hitting a record high. Unlike traditional crypto winters where hashrate has dipped, this time around hashrate is flying.

- The Russian Mercenary General and Billionare Prigozhin killed in a recent flight near Moscow has been linked to one of the largest crypto wallets. While you should take this with a grain of salt, it would certainly be interesting if true and would pose the question of whether he passed on his private keys.

- Bitcoin and Ethereum ETF applications in the US reach a record number with Wall St funds lining up to have a crack at the large end of town's demand for crypto.

- Ilya "Dutch" Lichtenstein admitted to being the Bitfinex hacker as part of his guilty plea. That hack was the largest ever and LEO holders are lining up for their piece of the seized funds.

Education

Education

Everyone gets Bitcoin at the Price They Deserve.

In the rapidly evolving world of cryptocurrencies, Bitcoin stands out as a pioneering stalwart. But when it comes to buying Bitcoin, there's an old adage that goes, “Everyone gets the price they deserve."

This phrase may sound philosophical at first, but it carries deep financial wisdom, especially in the context of the dynamic Bitcoin market. So, what does this mean for potential investors and enthusiasts? Let's break it down.

Read the full article HERE.

Memes of the month

Start Your Brokerage Account

If you enjoyed this Rake Review, feel free to open an account and gain access to more proprietary research and work with your very own dedicated crypto broker.

No Advice Warning

Disclaimer

All statements made in this newsletter are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.Copyright © 2022 Stormrake Pty Ltd, All rights reserved