The Rake Review: October 2023

The Rake Review: October 2023

October (Uptober as its come to be known) was an incredible, action-packed month and Bitcoin led the crypto markets to prices not seen for well over a year hitting $35,000 USD. Interest in Bitcoin and crypto more broadly is up and greed is starting to beat fear. So much is happening and we will break it down for you here.

Are Remittance Providers that Charge 12% spreads the Radio Stars of a bygone era?

Spreads are the difference between the buy price an the sell price you get when you convert one currency to another. For years remittance providers and banks have been getting away with huge spreads while telling customers there are "zero fees". How that can be legal is actually mind blowing. Clients have been getting fleeced sending money to their relatives abroad. But is this system going to last and is there a competitor that will force remittance providers down the same path as Radio stars and DVD rentals?

Our cover image shows a shuttered Western Union in a healthy shopping strip in Melbourne. Another closed outpost where people used to waste money and no longer do. But at least Western Union is legitimate you say? Not so, in 2017 Western Union admitted anti-money laundering and consumer fraud violations and forfeited almost $600 Million USD. Last month the US Justice Department sent $40 Million to 25,000 clients of Western Union across the globe. In fact, if you used Western Union to send money to a scammer between January 1, 2004, and January 19, 2017, and you did not already file a claim, its not too late.

WU's full 2022 revenue declined 12% on a reported basis. Results that should worry long term investors. Operating margin was also down by over 10% but still high at 19.8%. That seems high for a business converting one currency to another. There just has to be a better way.

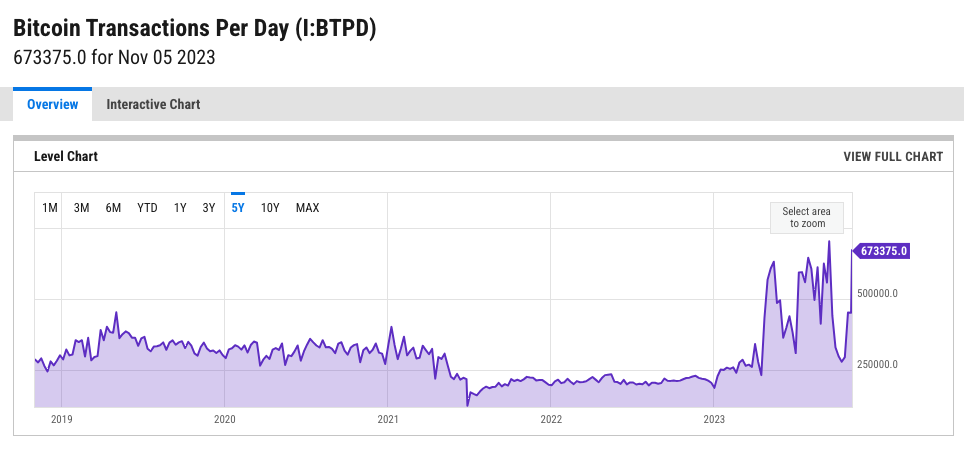

In the last few years the amount of value moved by the Bitcoin network has increased significantly. The graph below shows that the amount of BTC transactions is currently at 5 year highs (Thanks to YCharts). Each one can move significant value to anywhere in the world without the need for a remitter at all. What's more you can send 0.1 BTC just as easily as you can send 100 BTC.

Many Bitcoin naysayers ask about Bitcoin's intrinsic value. The intrinsic value is bitcoins network value. A network that safely and securely moves Billions each day without the need for begging your Bank to release your transaction. If you have BTC - you are truly in control of your funds.

Sam Bankman-Fried - Update

Last month we wrote about SBF's trial finally starting. This month the results are already in. Sam Bankman-Fried (now known as Scam Bankrupt Fraud) has been found guilty on all 7 counts. Sentencing is scheduled for late March 2024 with the once high flying FTX boss facing a maximum sentence of over 100 years.

It's been reported that 78 year old judge Lewis Kaplan was brilliant in cutting through SBF's often convoluted and at times short answers. SBF seemingly tried to confuse the jury of 12 but in the end it did not matter as they found him guilty.

Bankman-Fried was convicted of wire fraud and conspiracy to commit wire fraud against FTX customers and against Alameda Research lenders, conspiracy to commit securities fraud and conspiracy to commit commodities fraud against FTX investors, and conspiracy to commit money laundering.

Unfortunately for SBF's victims this will not help the healing as much as the return of crypto that was sunk into FTX which at current prices is already worth significantly more than it was at the time that FTX declared Bankruptcy. However, this is a positive development in healing and moving on from the darkest chapter of the crypto winter to a new time of growth and building.

ETF's Flare Up

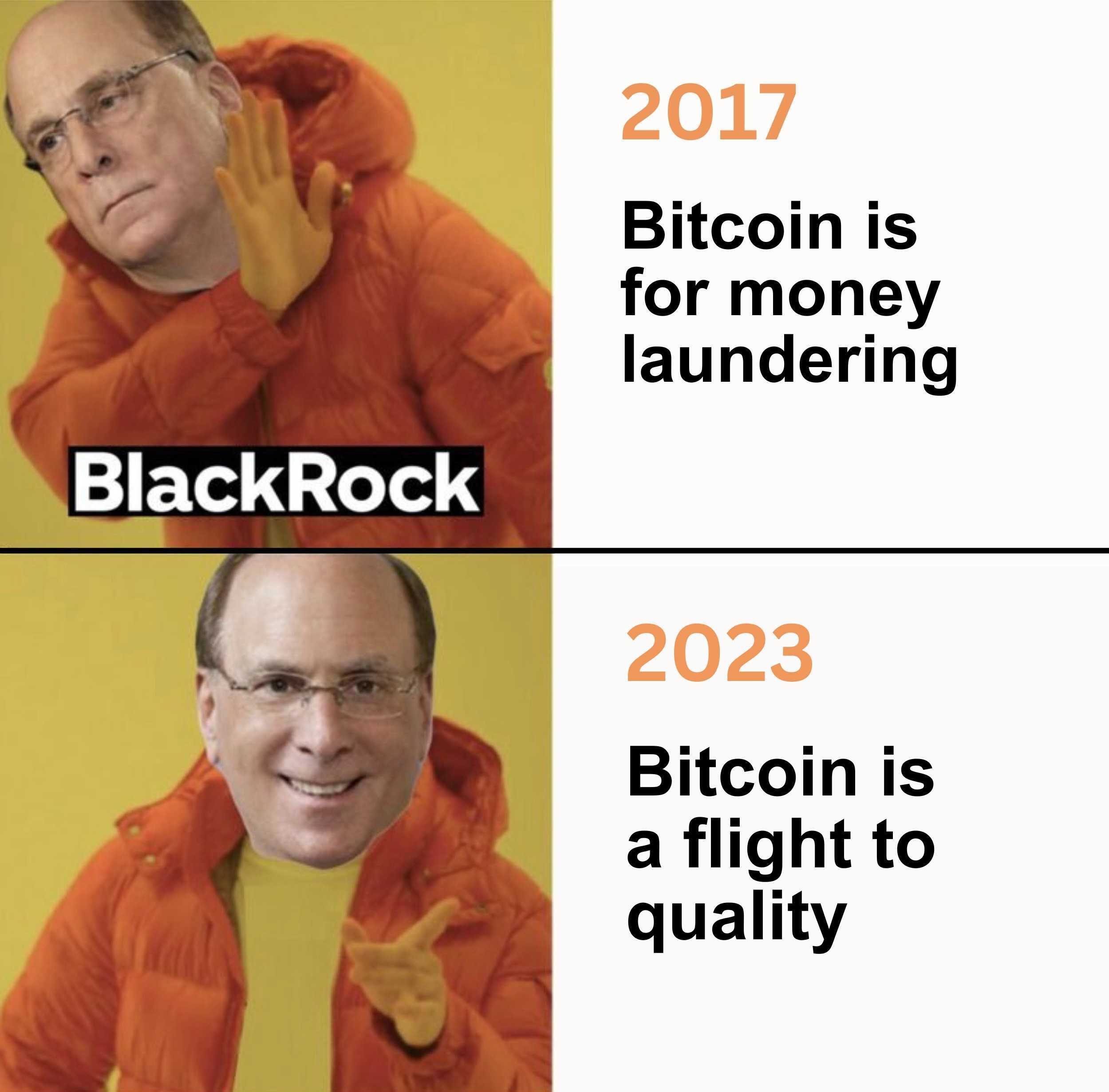

We have flagged over several months that Spot ETF approval in the US as the biggest price catalyst in the market. As it were, this turned out to be accurate as rumours of imminent spot ETF approval gave rise to significant market movement in October.

It all started with a news that BlackRock's spot Bitcoin ETF had been added to the Depository Trust & Clearing Corp's website but later it turned out that this was the case since April and is not uncommon for funds yet to be approved. The price soared and then fall sharply. A pump that made things awkward for Blackrock and the other ETF applicants in front of the SEC.

However it led to Larry Fink of Blackrock coming out to publicly to say that a rally in the price of bitcoin triggered by a false news report about the approval of a spot ETF served as an example of the "pent up interest in crypto." His comments served to pump the price of Bitcoin on a more sustained level and the price rallied around 30% as shown on the chart below.

Bitcoin Turns 15 - October 31

It was 15 years ago when Satoshi Nakamoto released the white paper that would give rise to a new monetary system that was not dependent on any authority or issuer - just Maths. Since then Bitcoin has gone from strength to strength spawning a network worth over $600 Million USD and freeing the flow of money. A new industry was born and now the future is bright.

Interest Rates and The Economy

The world economy appears to be balanced on a knife edge. Will inflation keep pushing interest rates up or will the economy collapse forcing an about turn in rates? Australia has changed governors but rates have remained on hold despite printing high inflation suggesting that the RBA is afraid of pushing the economy over a cliff.

In the US equities are already down significantly. The S&P fell 5% in a fortnight at the end of October as economic fears intensified. There are also fears over the conflict in the Middle-East intensifying. There has been a flight to safety with equities down and Bitcoin up.

All eyes will be on the Fed's next interest rate decision on December 13th.

Market Update

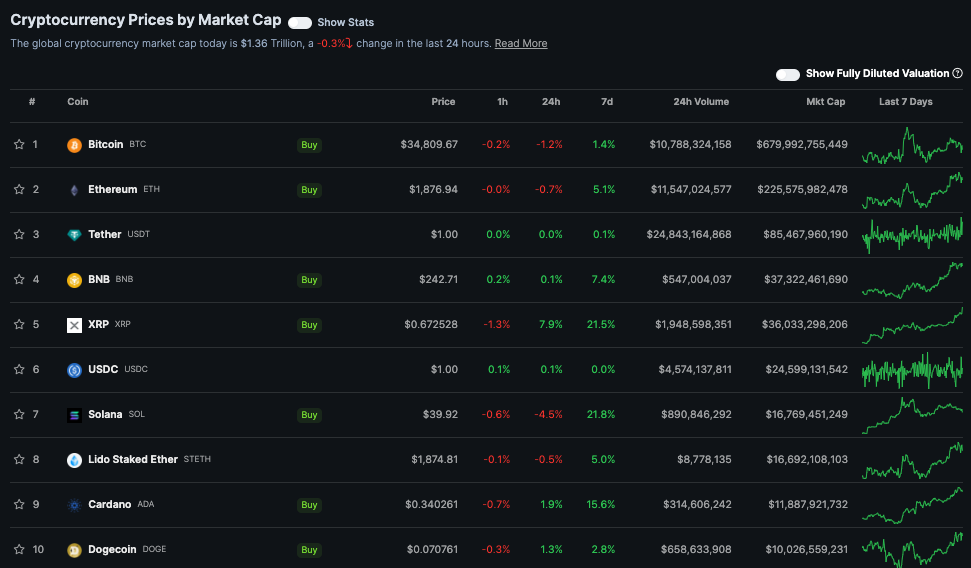

Here is the fast five of what you need to know about the market in October 2023:

- The main change in the Top10 was Solana moving up a spot to 7th after growing 21.5% over the last week. Solana (SOL) may have benefitted from SBF's conviction as there was a strong connection between FTX and Solana.

- BTC was a huge mover adding over 100 Billion to its market cap.

- Altcoins have underperformed, but are catching up over the last few days.

- Calls Options on BTC and ETH have risen substantially thanks to higher spot. Anyone that went long calls in October is laughing.

- Arbitrum (ARB) has breached $1 again currently trading at $1.07

Video of the month

Friedrich August von Hayek (Nobel Prize in Economics 1974) recorded in 1984, saying that monetary policy has never done any good and appearing to predict Bitcoin. Unfortunately Hayek died in 1992 prior to Bitcoin's invention.

In the news

- The Federal Reserve threatened to sue Bitcoin Magazine over apparel that parodies the Fed's "FedNow" system. Bitcoin Magazine issued a brilliant reply. It can (and should) be read in full here

- BlackRock fully behind Bitcoin. Larry Finks comments suggest Bitcoin is undervalued and people are just starting to realise it.

- Sam Bankman-Fried Guilty on all 7 counts. He will likely spend the rest of his adult life in prison ending a dark chapter for the crypto market and giving hope for the future.

- "I don't own any #Bitcoin... but I should." - Stanley Druckenmiller. Legendary investor Stan Druckenmillar appears to support Bitcoin and admits it is being used as a store of value.

Education

Education

Crypto: With Great Power Comes Great Responsibility!

Memes of the month

Start Your Brokerage Account

If you enjoyed this Rake Review, feel free to open an account and gain access to more proprietary research and work with your very own dedicated crypto broker.

No Advice Warning

Disclaimer

All statements made in this newsletter are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.Copyright © 2022 Stormrake Pty Ltd, All rights reserved