The Story

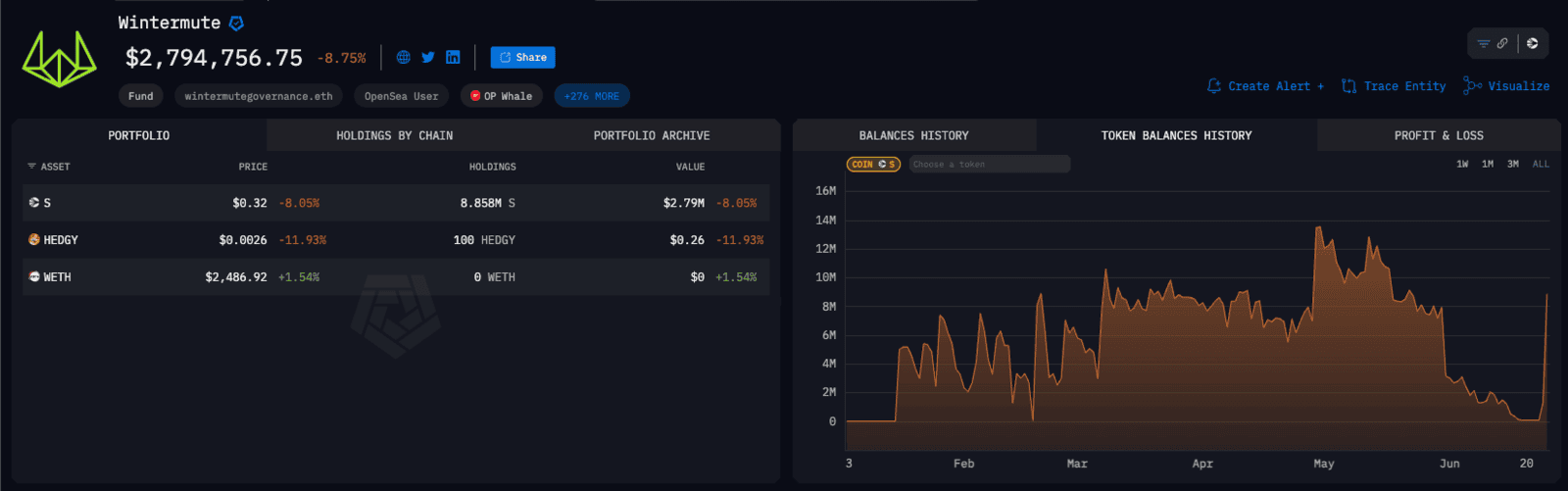

What’s Happening Under the Surface

Where Sonic Stands

What to Watch Next

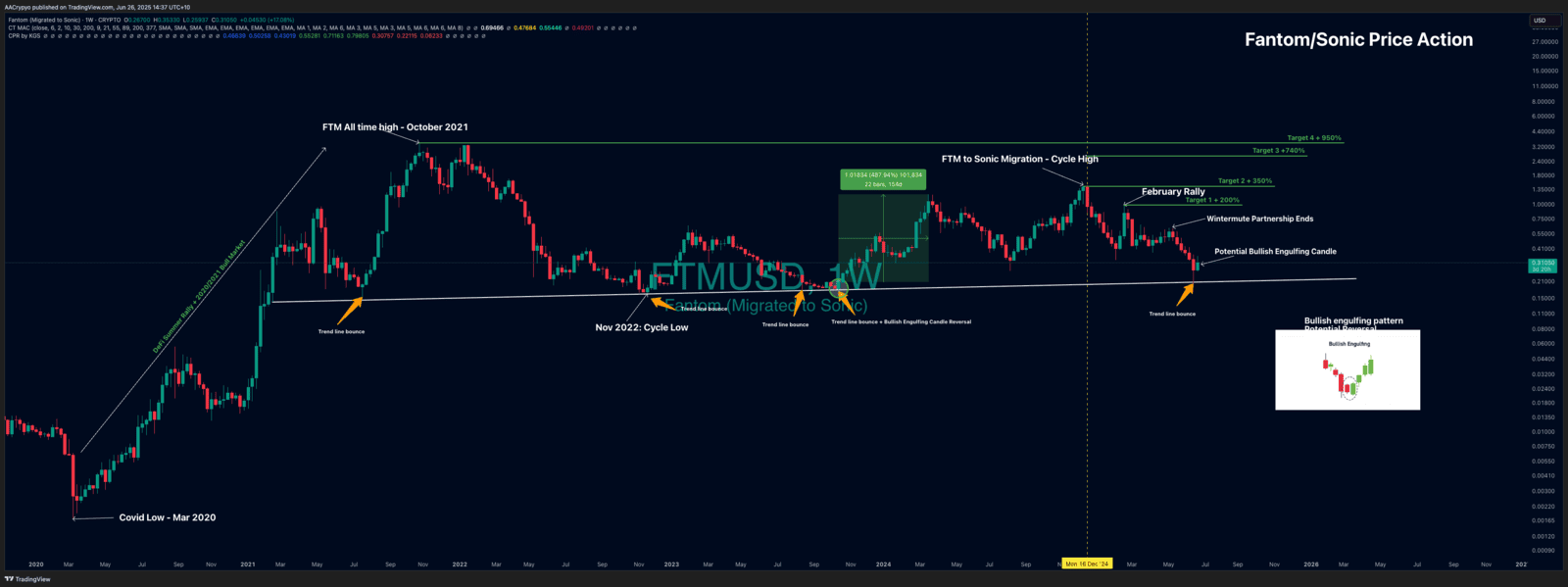

Sonic’s story has been a rollercoaster. From huge gains to massive losses, and now a slow rebuild. The big reasons it struggled — from poor communication to unexpected big sell-offs — seem to have been addressed. On-chain activity remains strong, developers are building, and the new airdrop system encourages users to stick around and actually use the network.

Combined with its impressive transaction speed, Coinbase listing and key players buying in again, Sonic has a mix of factors that could help it turn the corner. This is not financial advice, but for everyday investors, it’s one to keep on the watchlist if you’re interested in blockchains with strong communities and lots of development.

Patience and good research are key, as always. The next six to twelve months will show whether Sonic can tap into its full potential and reclaim its place among the top projects in decentralised finance.

Written by Alexandar Artis

Create a brokerage account today

Reach out to us at Stormrake for further market insight and allow us to help you navigate the sea of mania and laser-eye memes, so that you can realise your goals in the market!

No Advice Warning

Disclaimer

All statements made in this newsletter are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.Copyright © 2024 Stormrake Pty Ltd, All rights reserved