The Rake Review: November 2023

The Rake Review: November 2023

Another great month for crypto draws to a close while the world outside makes less and less sense. Bitcoin is more than money, it is personal freedom. Bitcoin doesn't care about who you are and where you come from - It is for all of us so get on the lifeboat

November saw old chapters closing and a feeling that a new Bull run is all but a certainty. It is great to see Bitcoin acting as a flight to safety in an uncertain world hitting 18 month highs as the rest of the crypto market also woke up.

So much is happening and we will break it down for you here.

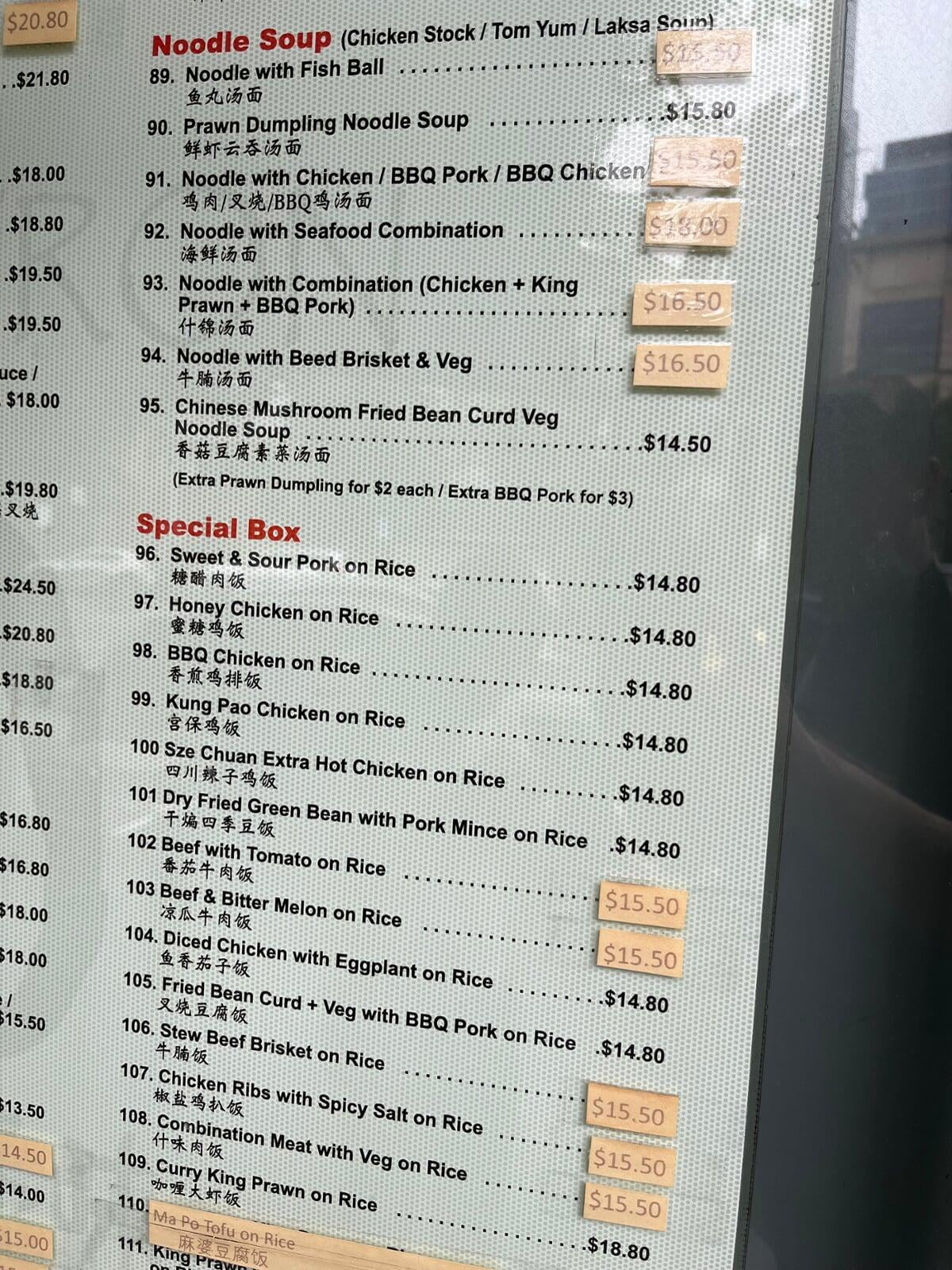

Have you noticed that restaurants can't change prices fast enough?

In the good old days (2 years ago), restaurants would sometimes raise their prices and to do this they would reprint their menu with the new prices. These days restaurants can't keep printing menu's all the time so its faster and cheaper to just put a sticker over the menu. Its a little further evidence that inflation might be an issue. Whether you want the Noodle Soup or the "Special Box" you may have found your cheap local take away is not as cheap as you remember.

Inflation (CPI) numbers out of the US came through lower than expected (3.2%) in October giving investors some hope that the tightening cycle (interest rate rises) may be close to an end. The fastest ever interest rate rises have had a huge impact but have yet to crush the US economy. Inflation has reduced but inflation is still persistently high. Household savings have evaporated and many people are hanging on for dear life, hoping that things improve and interest rates start to reduce again.

Official prices are a whole lot higher than this time last year in the US but importantly most commentators don't give much respect to official CPI. Official inflation is seen as roughly half of the real inflation rate people are experiencing on the street. That would mean real inflation is closer to 6% which is historically very high and would explain why restaurants are changing prices so fast.

In Australia, the new RBA governor raised rates again despite the palpable pain indebted households are feeling. The RBA said inflation "...is still too high and is proving more persistent than expected.....". In April last year the official interest rate was 0.1% and is now 4.35%. We're up 43.5x. It's widely expected that there will be a pause in December even though there was no pause at the same time last year.

The entire economy sits teetering on the edge at the whim of the RBA. The central bank is using the power given to it to try and reduce the inflation caused by all the COVID era money printing. It's not really how monetary policy is designed. But let's see what another country is doing about their Central bank and Monetary Policy.

Argentina

Once one of the world's richest countries, Argentina is a shadow of its former self. As the old Argentine saying goes "Abundance breeds arrogance" and the wealth of the past created arrogance and set in place decades of socialist policies leading to multiple sovereign defaults and a currency that is so mistrusted that people spend it as soon as they get in and save in something a lot more trustworthy.

Argentina is the world record holder of sovereign defaults with a an incredible 9 of them. It is also the largest current borrower from the International Monetary Fund (Egypt is #2, Ukraine #3).

In comes Javier Milei, a former football star and what traditional media describes as a right wing radical. He has swept into power promising to be different and to close the Central Bank of Argentina within a very short period.

How can a country exist without a central Bank? Very easily and prosperously. Little known San Marino has no national currency yet has a higher GDP per capita than Australia, New Zealand, UK or Germany.

There are 14 countries in total that don't have their own legal tender and a further 67 countries that have a pegged currency (Not really a separate currency). Of these countries there are already several South American nations and most notably El Salvador who became the first country in the world to adopt Bitcoin as legal tender. By all accounts El Salvador is experiencing somewhat of a renaissance as a result. Tourism is booming and crime statistics have improved drastically. The nation is prospering and Argentina's Millei will be looking closely at this experiment. Will Argentina become the worlds second nation to adopt Bitcoin?

Binance and Kraken

Binance is still the world's largest centralised exchange by volume. In recent times though, things have not gone to plan with Binance effectively closed to several countries including Australia and Canada due to legal issues in the US. This month Binance finally reached a settlement with US authorities. As part of the settlement, CZ the founder and CEO of Binance will be stepping down and paying a personal fine. Binance will pay an enormous $4.3 Billion USD in fines. There are other undertakings also but from a market perspective what you need to know is this will likely ensure Binance's survival worldwide. It's closing another chapter in crypto and allowing the market to move on. Binance will be weaker for some time but it will now be able to build.

On a related note authorities have gone after Kraken also. Unlike Binance, Kraken is seen as a good player in the crypto space. They were the first major exchange to complete a proof of reserves and don't list questionable coins and projects. However they have not escaped the ire of US regulators which are feeling litigious recently. The SEC has sued Kraken, accusing it of illegally operating a securities exchange without registering.

Kraken intends to fight the charges saying the charges are "incorrect as a matter of law, false as a matter of fact, and disastrous as a matter of policy"

Crypto Heating Up

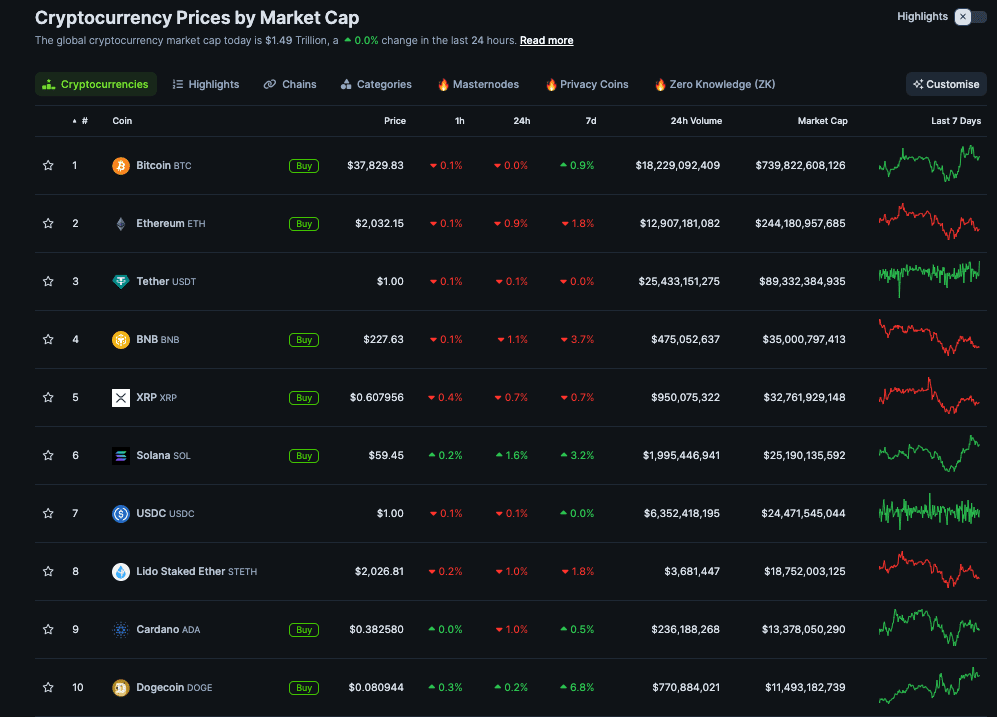

In the wider Crypto market many coins are starting to heat up. RUNE is performing really well. Solana (SOL) in particular has made a nice run reaching levels not seen since May last year. SOL had a tough time during last years FTX debacle as FTX was a large holder and investor. The recent success of Solana is due to several factors including having previously been oversold and heavily shorted. The shorts are now dissipating and Solana's positive aspects are being recognised including several promising projects choosing to build on Solana. Analysts will be watching Solana's progress to see if December can be as good as November.

Market Update

Here is the fast five of what you need to know about the market in November 2023:

- Solana firmly holds 6th spot after gaining more than 77% surge last month.

- Bitcoin has hit an 18month high above $38,000, clearing the path for a rally higher.

- BNB suffered after Binance's CEO Changpeng "CZ" Zhao's guilty plea.

- Despite regulatory action against Binance, a surge in Ethereum network activity and the expectation of a spot ETF approval fuelled a price move above $2,000.

- DOGE's market value has risen 14% to almost $11 billion this month.

Video of the month

In a recent campaign ad, Javier Milei appears receiving the clothes of Capitan Ancap, his superhero counterpart, and destroying the argentine Central Bank with Thor's Hammer. pic.twitter.com/qw1MxSDpEG

— Crazy Ass Moments in LatAm Politics (@AssLatam) November 19, 2023

Javier Millei, Argentina's new leader in his own ad. One of Millei's policies is to disband the Argentine Central Bank and remove the Peso from circulation.

In the news

- Changpeng Zhao has agreed to plead guilty to violating U.S. Anti-Money Laundering requirements and step down as the CEO of the Binance crypto exchange. Settlement is worth $4.3 Billion USD.

- Blackrock has also filed for Ethereum (ETH) spot ETF. This is the a major vote of confidence to the #2 crypto asset.

- The Ethereum (ETH) staking platform Blast witnessed a surge in its total value locked (TVL) metric, surpassing $500 million. As of the latest update, users have deposited more than $570,000,000 into the Blast contract.

- Newly elected Argentine President Javier Milei has affirmed his dedication to closing the country's central bank, Banco Central de la República Argentina (BCRA), dispelling speculations of a potential reversal on this key promise. The government asserts the non-negotiable stance on shutting down Argentina's central bank, emphasizing its pro-Bitcoin position.

- Eric Balchunas, a senior ETF analyst with Bloomberg moved markets by asserting that a Bitcoin Spot ETF was 90% likely to be approved by Jan 2024.

Education

Education

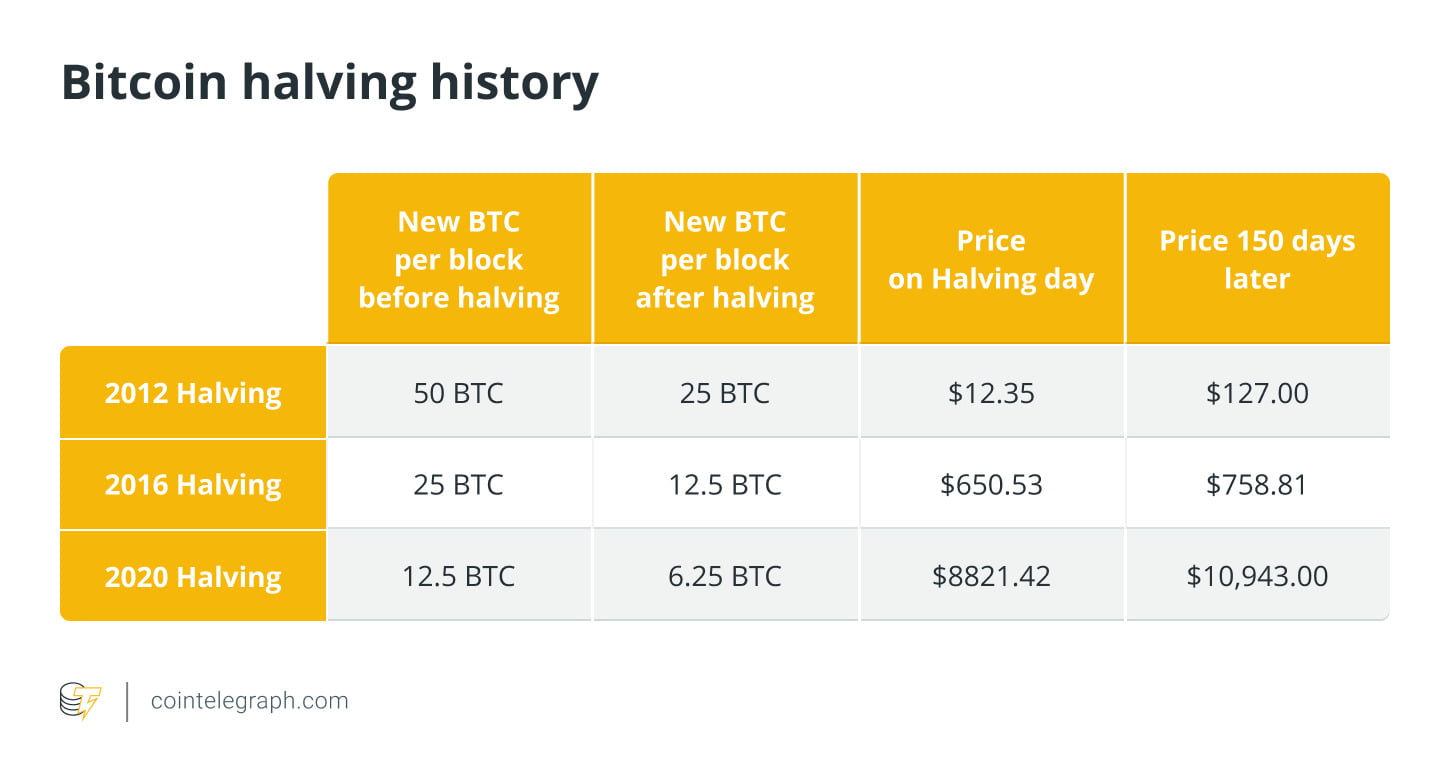

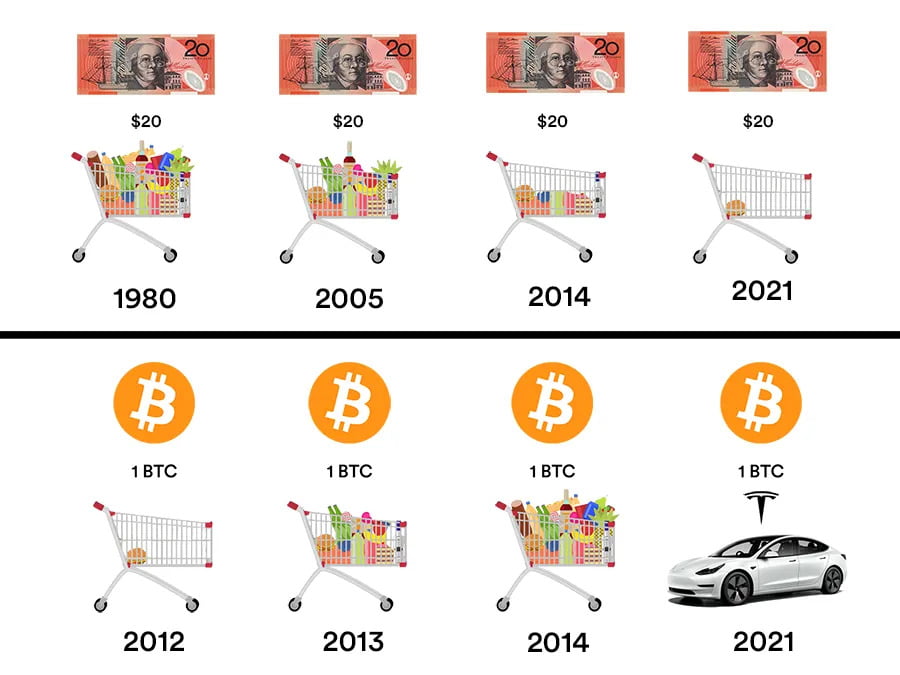

Inflation vs Crypto

Bitcoin purchase power

Meme of the month

Start Your Brokerage Account

If you enjoyed this Rake Review, feel free to open an account and gain access to more proprietary research and work with your very own dedicated crypto broker.

No Advice Warning

Disclaimer

All statements made in this newsletter are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.Copyright © 2022 Stormrake Pty Ltd, All rights reserved