To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Make that five out of the last six days Bitcoin has set a new all-time high, finally breaking the $120k mark that many expected to fall much earlier this year. It is here nonetheless, and more so, Bitcoin did not stop there. It pushed as high as $123.2k, whilst Ethereum has also rallied and now holds above $3,000, continuing to outperform Bitcoin.

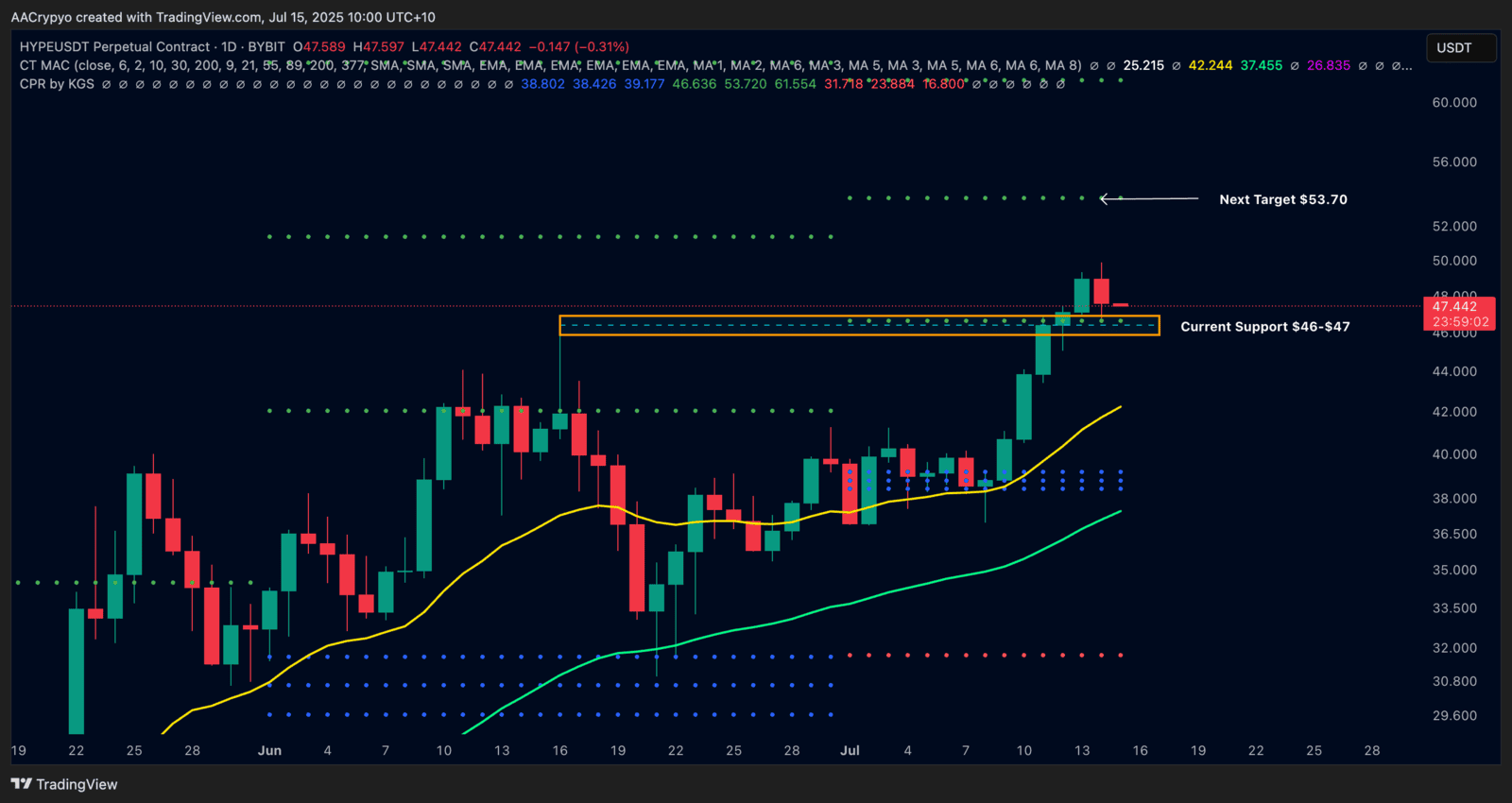

Whilst Bitcoin looks set to close green today, it was a mixed bag for the rest of the market. Sui climbed 11%, XRP and TAO both gained over 4%, and Ondo was up nearly 2%. But plenty of altcoins underperformed Bitcoin and even lost ground over the last 24 hours. Some disappointments amongst the red names were XLM, Sonic and even HYPE, but these coins have all rallied strongly over the past week, so a small red day is nothing to be concerned about.

Bitcoin has slipped out of the extreme greed territory, which is a healthy sign. If price is climbing whilst this sentiment gauge is not in an extreme zone, it signals there is likely more of this move to come. Bitcoin dominance has now entered a bearish structure, which is a big positive for altcoins, whilst the total altcoin market cap has confirmed its bullish structure and breakout. We can start to expect altcoin outperformance, but the challenge is working out which altcoins will lead. The last 24 hours have shown that even when Bitcoin rallies, not every altcoin follows. And even with Bitcoin dominance falling, it is still strong enough to push higher and set new all-time highs. This means it is not yet time to rotate out of Bitcoin — not that one should ever fully rotate out of Bitcoin anyway. The goal should be to accumulate more Bitcoin and use altcoin profits to add to that stack.

However, it might be time to start looking at more altcoin entries, as many still sit well below their all-time highs. For example, Ethereum remains down nearly 40%, and Solana is down 45% from their respective peaks. When retail returns, especially the 2021 crowd, they may see these big names as undervalued compared to Bitcoin and try to play catch up, resulting in strong rallies to fresh highs.

Stormrake Spotlight: Hyperliquid (HYPE) ($47.46)

Stormrake Spotlight: Hyperliquid (HYPE) ($47.46)