To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

The bulls’ last stand appears to have failed as Bitcoin falls back below $100K once again

This marks the first daily close under $100K since 7 May, over six months ago, and confirms we are now in a correction phase, with Bitcoin more than 20% down from its all time high in early October. Is it over?

The bears are firmly in control. Structurally, technically, and in terms of momentum, there is no hiding from that fact. Every rally over the past month has failed. Each attempt by the bulls has been sold into, as bears continue to apply pressure and force prices lower. Most altcoins are significantly down over the last few weeks, and sentiment is deeply buried in extreme fear. We are currently seeing a sentiment reading of 16, just one point above yesterday.

That said, sentiment is still slightly more constructive than earlier this year, when Trump was announcing tariffs and Bitcoin was tumbling from $100K. Price wise, we are at similar levels to 12 months ago, but sentiment has completely flipped. From extreme greed in November last year to extreme fear today.

It has been extremely frustrating to see Bitcoin fail to make any meaningful progress throughout 2025. Especially when you consider that gold has dominated and up over 60%, and the S&P 500 has constantly hit the headlines with fresh all time highs. Over the same period, the S&P is only up around 13% but it is the consistency and strength of those moves that matter. It simply has not been the right environment for Bitcoin or risk on assets to thrive.

Yes, we have seen pockets of outperformance throughout the year, but overall 2025 has been dominated by uncertainty. That is the kind of backdrop where gold and risk off assets perform best.

Despite the lacklustre price action, the groundwork for Bitcoin has been laid. We have seen major adoption across both the political and institutional space, not just for Bitcoin but for the entire crypto ecosystem. It is becoming more accepted, more integrated, and more widely utilised.

The macro uncertainty that defined most of this year is now fading. Trade deals are being finalised, ceasefires are being agreed, and major wars that impacted investor sentiment appear to be winding down. Quantitative easing is on the horizon and interest rates continue to be cut. So while Bitcoin’s price has been underwhelming, the broader environment has quietly improved as the year has gone on. This may well set the stage for a stronger 2026.

If Bitcoin does enter a prolonged correction over the coming months, it should be seen as an opportunity. A chance to accumulate at lower prices and position for what may come as macro conditions shift. Now that $100K has been lost, all eyes turn to the yearly open at $93.5K.

Historically, Bitcoin has at least doubled following the McRib’s return. Will it do so again? We will have to wait and see.

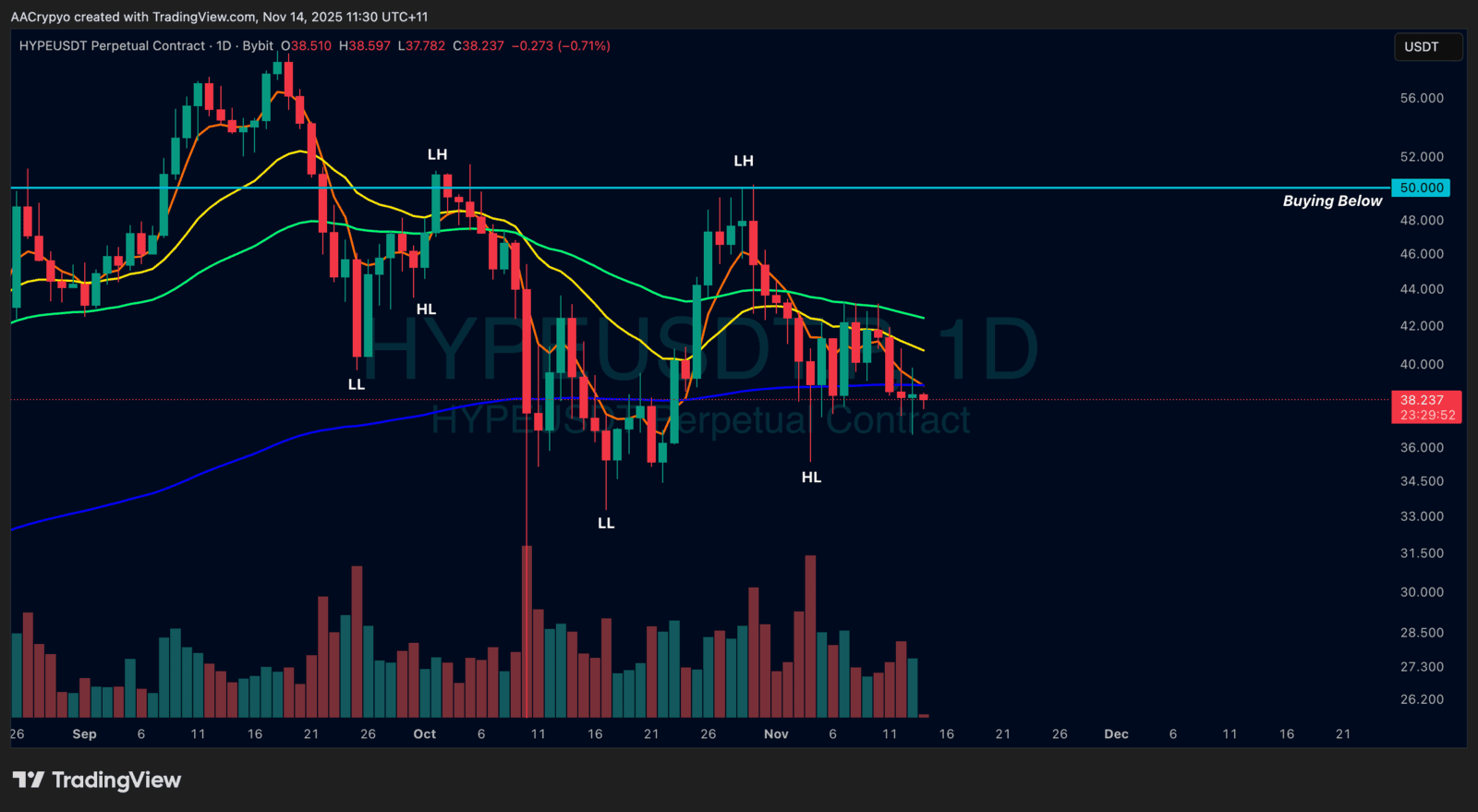

Stormrake Spotlight: Hyperliquid (HYPE) ($38.22)

Stormrake Spotlight: Hyperliquid (HYPE) ($38.22)