To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

For the first time since May 22nd, Bitcoin has printed a new all-time high at $112K, just $20 above the previous peak. The rest of the crypto market is reaping the spoils of this long-awaited breakout, with bulls firmly back in control and Ethereum outperforming as it leads the broader rally.

Markets have rallied off the back of the FOMC meeting minutes released overnight, which revealed that most Fed officials expect rate cuts ahead, though they remain divided on the timing and magnitude. A couple of members see the first cut coming as soon as the next meeting later this month, while others think no cuts would be appropriate this year. Analysts and investors are still expecting to see two cuts this year with more to come in 2026. Traditional markets stayed green, with the S&P500 and Nasdaq pushing higher, and a massive milestone was hit: NVIDIA became the first company to reach a $4 trillion USD market cap.

The FOMC minutes have overshadowed further tariff announcements by Trump, who has imposed one-way tariffs on another seven countries, bringing the total to 21 nations facing these tariffs from August 1st. Brazil was a surprise inclusion, slapped with a 50% tariff, despite the US running a trade surplus with them — exporting more goods than it imports, unlike the other targeted countries.

There are no more excuses for Bitcoin. This is the breakout the market has been waiting for, with bulls now controlling momentum and structure across all timeframes. Rate cuts are just around the corner, global money supply keeps rising, and the market has moved on from tariff fears, no longer phased by trade spats. This strong start to H2 is exactly what Bitcoin needed to keep 2025’s lofty expectations alive.

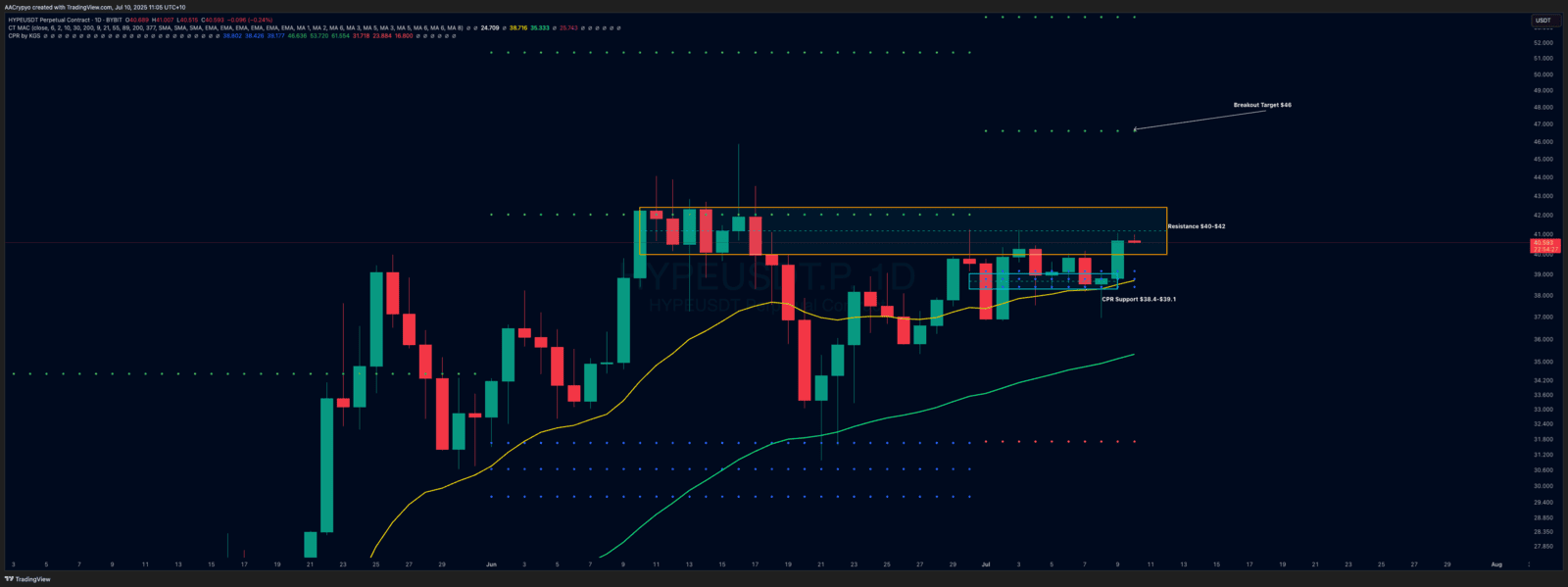

Stormrake Spotlight: Hyperliquid (HYPE) ($40.59)

Stormrake Spotlight: Hyperliquid (HYPE) ($40.59)