To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

If you’re checking the charts for the first time since Friday, you might assume Bitcoin had a quiet weekend. It’s only 0.5% higher than Friday’s close. But those following closely yesterday or watching the news will know Bitcoin finally set a new all time high.

Bitcoin broke out to hit $125.7K, setting a new all time high Sunday afternoon. The move triggered strong momentum across the market, with altcoins also enjoying short-lived rallies. However, the celebration was brief. Most major coins are now either in the red or struggling to stay in the green as Bitcoin pulled back almost immediately after the peak, with investors taking profits at the milestone. Despite the retrace, Bitcoin remains in a strong technical position and looks set to push higher later this week.

Altcoins are mixed over the past 24 hours. HYPE was nearly up 5% at its intraday peak but is now down 2%, a swing of more than 6%. Ethereum and Solana are both marginally green, currently up less than 0.45%, despite intraday highs of over 3% and 4% respectively.

Key Macro Events This Week

The second half of the week is shaping up to be eventful. FOMC minutes are set to be released Thursday morning and should provide more insight into the Fed’s thinking at the last meeting, with potential signals about future decisions. Thursday night brings US unemployment data, followed by a speech from Fed Chair Jerome Powell. Additional labour data is expected on Friday. These events could influence broader markets, including crypto.

Seasonal Tailwinds in Play

October has started strongly and the new all time high could be just the beginning of what is historically a bullish time of year. Keep in mind, anything less than $131K would be considered underperformance for Bitcoin in October.

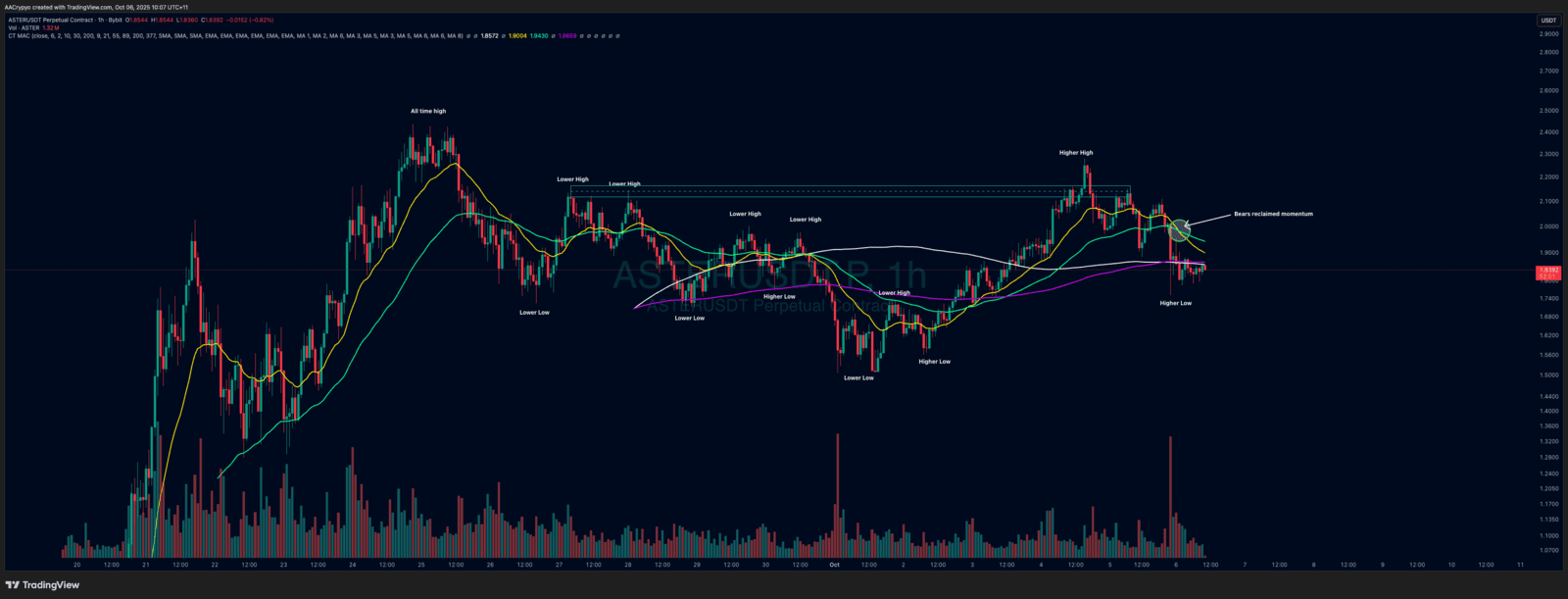

Stormrake Spotlight: Aster (ASTER) ($1.83)

Stormrake Spotlight: Aster (ASTER) ($1.83)