To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Overnight, Trump signed several pro-crypto executive orders, but the most impactful was the one allowing Americans to purchase Bitcoin and crypto assets within their 401(K)s (the US equivalent of Superannuation). This move has just opened another gateway for over 90 million Americans to gain exposure to the crypto market.

The market reacted immediately. Bitcoin rallied over 2%, breaking past resistance with conviction. Bulls are back in control, and most altcoins followed suit with gains of at least 5% on the day. This looks like the end of the recent pullback and could be the bulls' chance to push Bitcoin back to all-time highs, and potentially beyond.

Why is this so significant?

As mentioned, this unlocks access for up to 90 million additional investors. According to a 2024 Vanguard report, the average 401(K) balance sits at around $148,153. When you line that up with Bitcoin’s fixed supply of just 21 million, the numbers don’t stack. As more people gain access and begin to allocate, demand will only continue to rise. Meanwhile, available supply keeps shrinking as long-term holders accumulate. Trump's policy shift has increased demand, and price will likely follow. The takeaway: allocation is key, and accumulating sooner rather than later is crucial, as it will only get more expensive with time.

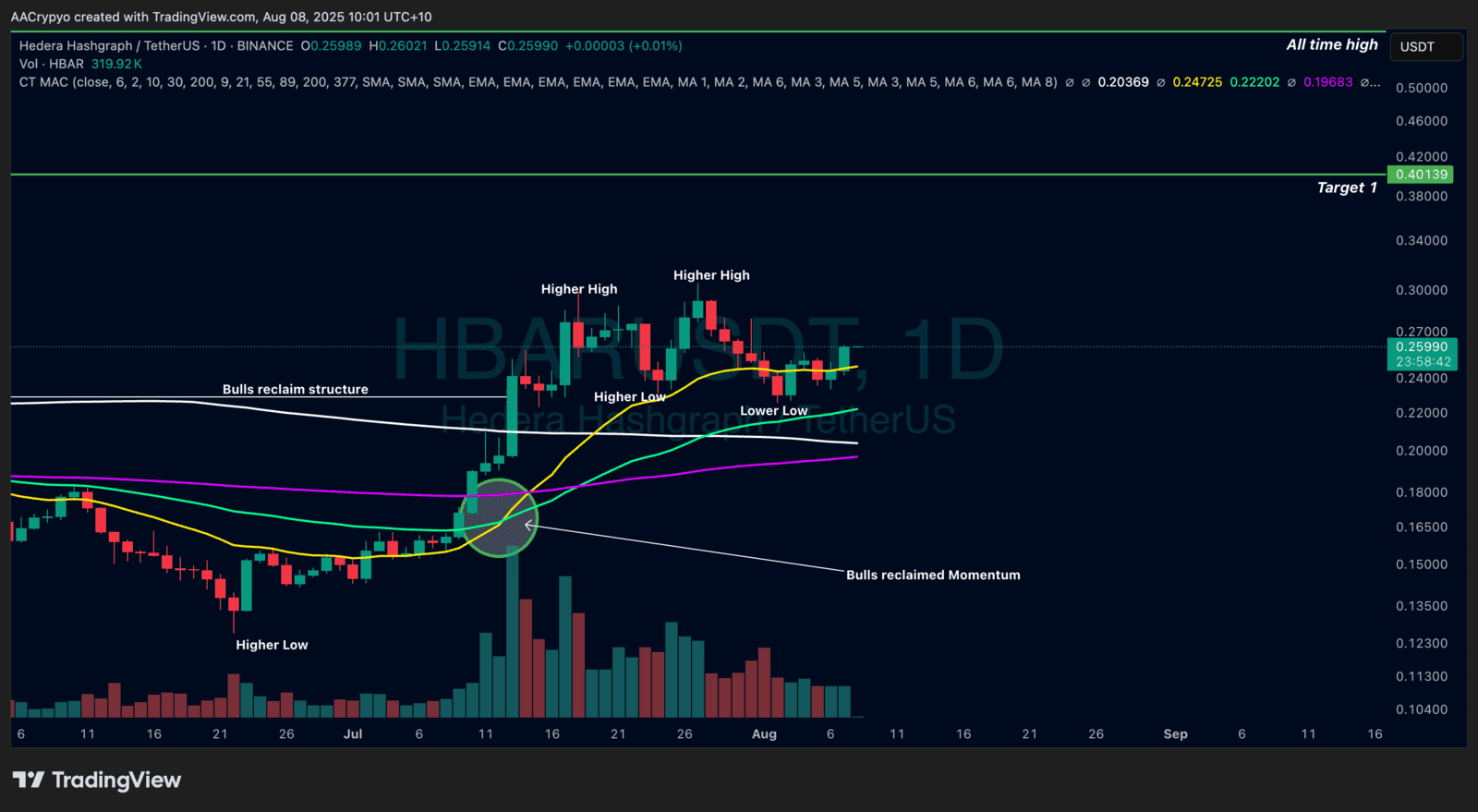

Stormrake Spotlight: Hedera (HBAR) ($0.259)

Stormrake Spotlight: Hedera (HBAR) ($0.259)