To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

This feels like déjà vu. We have almost mirrored Wednesday night’s rally. Bitcoin dipped below $100K yesterday, but this morning we are retesting $104K. As expected, the bulls held $100K, preventing the bears from making any sustained move lower. The range is well defined. Bulls are defending $100K like the bull run depends on it, while bears are using momentum to keep price capped just below $104K.

Altcoins have followed a similar pattern, with many posting over 10% gains and trading higher than they were a few days ago. That may be a sign that risk appetite is returning to the market.

In the broader market, we saw a strong risk-on bounce. The S&P 500 looked set for another 1% pullback, but an intraday reversal off the 55 EMA saw it close green. Gold finally pushed back above $4,000 but remains in a consolidation phase for now.

Bitcoin Consolidation Range: $100K to $104K

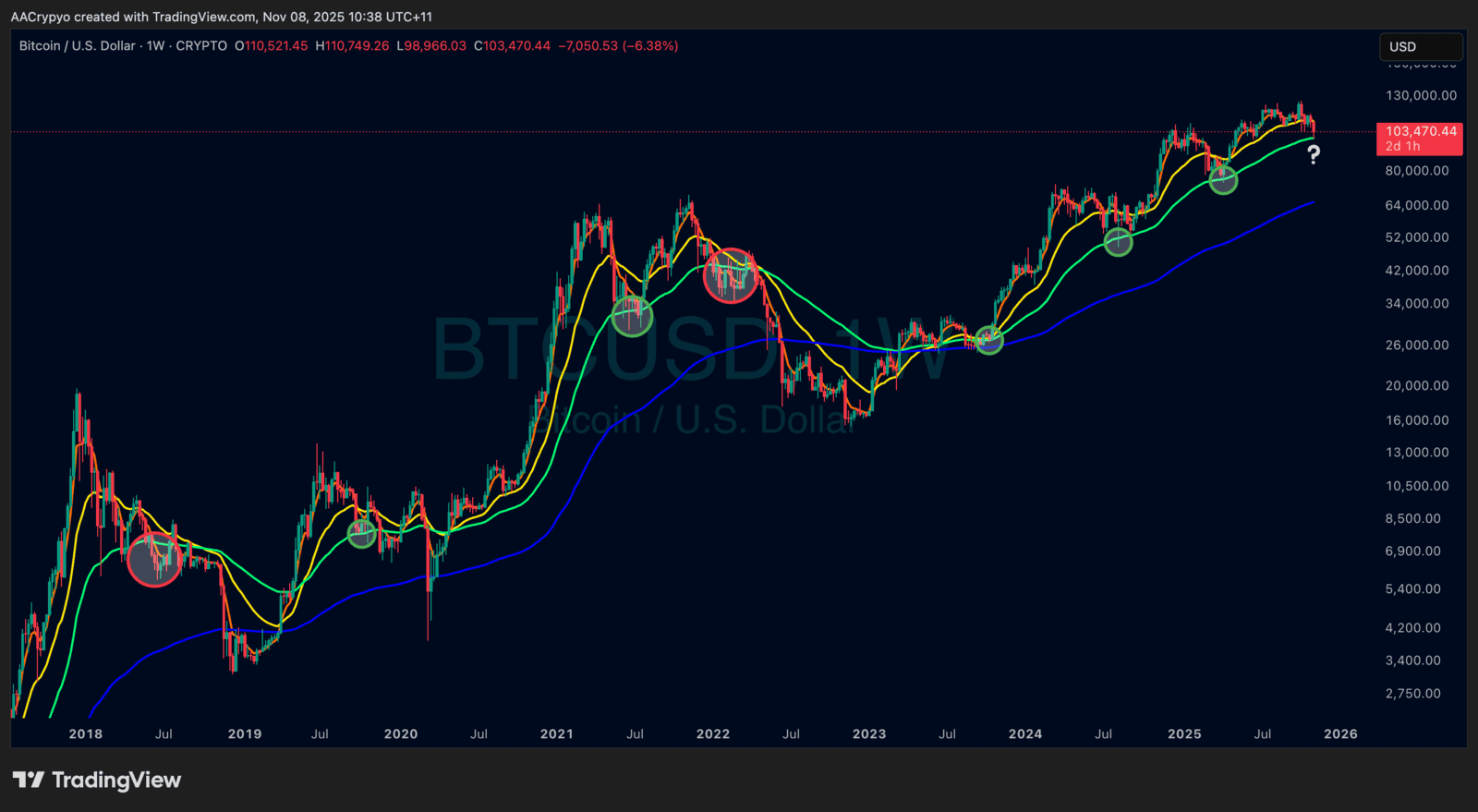

The $100K level has strong technical support. Zooming out, we are now testing the weekly 55 EMA, which has historically been a key trend-defining level for Bitcoin.