To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

After the bearish day that was Friday, Bitcoin has enjoyed a quiet yet bullish weekend, almost reclaiming the entire pullback it suffered on Friday. With no major news or announcements moving Bitcoin over the weekend, the crypto space remained fixated on the mega whale transfers that took place on Friday night and Saturday morning. Arkham Intelligence confirmed that the movement of 80,009 BTC was for wallet upgrades rather than liquidations. The funds were moved from a legacy address to a more modern one, boosting transaction efficiency and reducing network fees. Whilst the mystery still lingers over who was behind the transfer, some raised suspicions of a potential quantum hack. However, many believe it was Roger Ver, the early Bitcoin investor who was jailed in Spain back in 2011 and was recently released this June. It all remains speculation though, and we may never know for certain who moved it.

Bitcoin has also set another record, posting its highest weekly close in history at $109.2k.

Meanwhile, it was reported that ‘The Open Network’ (TON) had partnered with the UAE to offer a golden visa, whereby investors could stake $100,000 worth of TON tokens for three years plus an additional $35,000 fee. Conventional UAE golden visa routes usually require a minimum $540,000 investment in illiquid assets, making the TON route seem far cheaper. This news sent TON rallying 13% in an hour before many began to question it. Binance founder ‘CZ’ queried the legitimacy of the announcement, saying, ‘It would be awesome if true,’ but noted there was nothing on any official government website to back it up — adding that if it were real, he would ‘definitely try to get it on BNB too’. A recent press release confirmed by UAE regulators has since denied the claims that golden visas were being offered to crypto investors. TON has since fallen 8% from its high following the denial, but this does open the door to the potential idea of golden visas linked to crypto investments, which could incentivise investors to relocate and help countries become crypto hubs.

Over on X, ‘TACO’ is trending — for those unfamiliar, it stands for ‘Trump Always Chickens Out’. It’s trending because the 90-day pause on Liberation Day tariffs was initially due to expire on 9 July. Trump said last week that an extension was unlikely, but the July 9 deadline has now been pushed back to 1 August. Trump claims new trade deals have been made and that tariffs on other countries will increase by August 1.

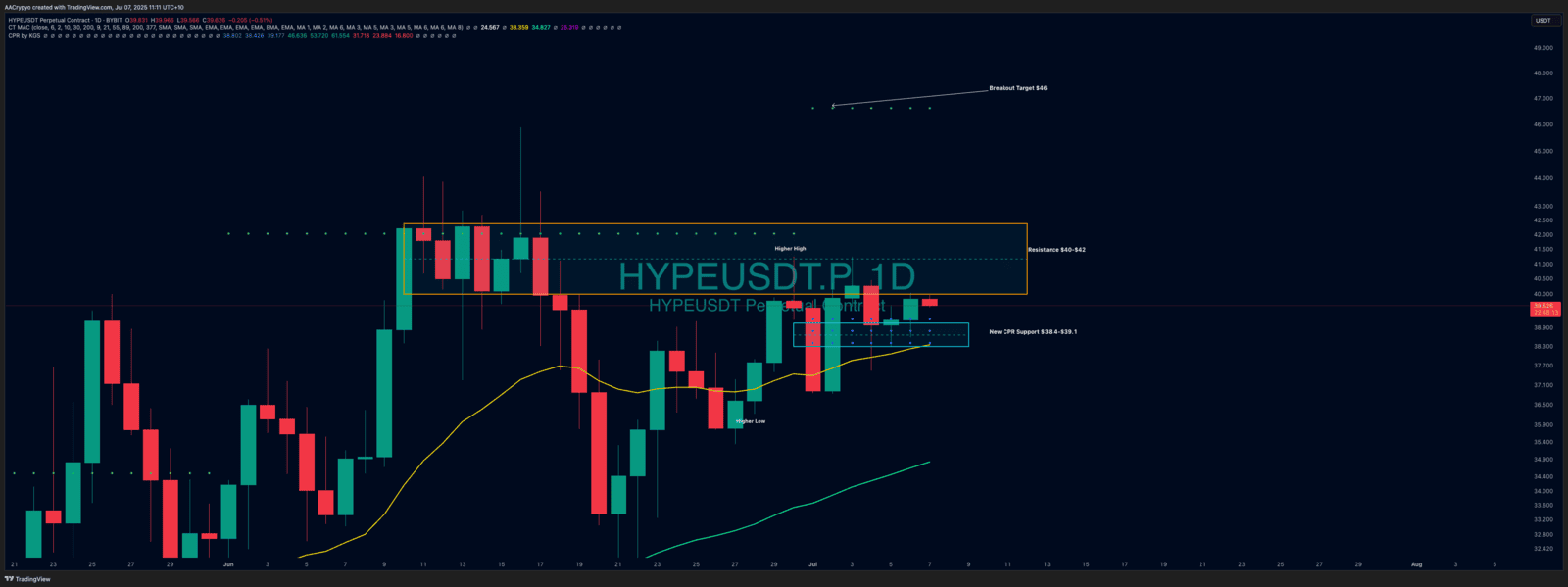

Stormrake Spotlight: Hyperliquid (HYPE) ($39.59)

Stormrake Spotlight: Hyperliquid (HYPE) ($39.59)