To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

It was a slow weekend across most of the crypto market, with Bitcoin stuck in a tight range of less than $1,000 over the past two days, as expected. After a week dominated by macro headlines, including the first rate cut of the year, markets have paused to consolidate and digest.

The reality is, much of the cut was already priced in. That explains the bullish lead-up and the muted reaction once the announcement was made. But the fact remains: rate cuts are here, and that is a long-term bullish signal for risk-on assets. These quieter phases, or even slight pullbacks, are often the most rewarding accumulation windows ahead of major moves.

While most majors remained quiet, with Ethereum and Solana each moving less than 2%, BNB continued its dominance and pushed higher. It is up another 6.5% since the start of the weekend. But why?

Many of you will be familiar with Hyperliquid, a regular in the Stormrake Spotlight this year. For those unfamiliar, it is the leading on-chain perpetuals trading platform, now home to high-value traders and crypto whales. Over the weekend, a new competitor emerged. ASTER, built on the Binance Smart Chain, has seen a strong inflow of users migrating from Hyperliquid. Its token has posted a huge run in recent days and, in doing so, has also driven renewed activity on BSC, pushing BNB higher as users shift to the new decentralised exchange.

We are in the heart of altseason. Ethereum had its moment. Solana surged from $180 to $250 in two weeks. Now, it is BNB’s turn and its ecosystem is starting to lead the market. Even if the broader action remains quiet, the bias is still bullish.

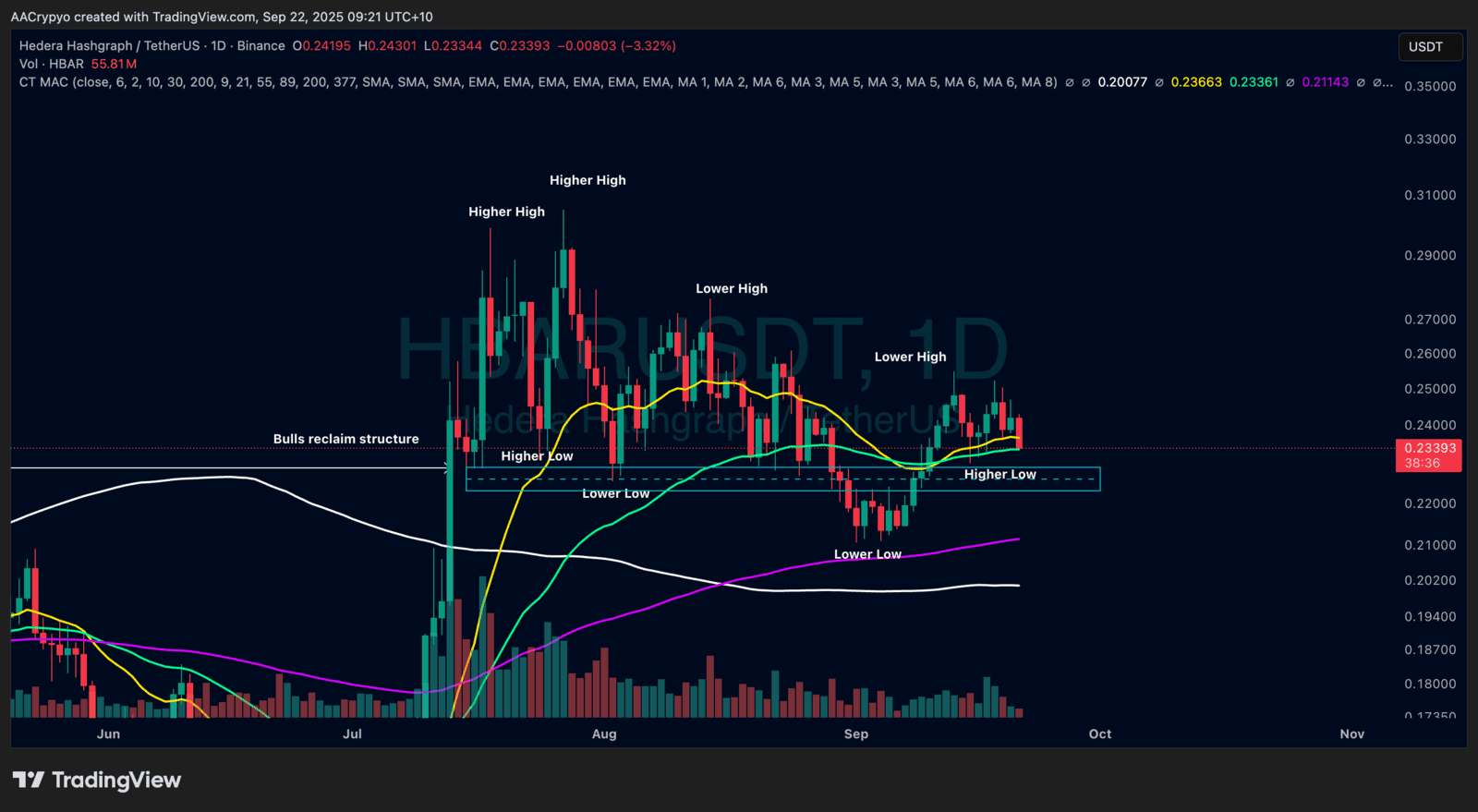

Stormrake Spotlight: Hedera (HBAR) ($0.233)

Stormrake Spotlight: Hedera (HBAR) ($0.233)