To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

We’re two days on from the worst liquidation day in crypto history. While there is still no concrete reasoning behind the cascade and nearly $20 billion in leveraged positions being wiped out, one thing is clear: Bitcoin and the broader crypto market are holding up well.

Most of the market is up over 10% in the last 24 hours, driven by new developments around the US-China tariff saga. It is now being reported that the dramatic standoff may have been a misunderstanding. Trump had threatened a 100% tariff on Chinese goods in response to what was initially seen as China’s aggressive expansion of export restrictions on rare earth minerals. That retaliation triggered the sharp sell-off across risk assets.

This morning, China released a statement clarifying its position. The new export controls on rare earths are not a full ban. Instead, they are conditional, and applications that “meet regulations” will still be approved. This clarification has eased fears of a full-scale trade war, and many now believe the threatened tariffs may not go ahead. The crypto market has reacted positively, rallying on the back of this potential resolution.

Bitcoin is now back above $115K, Ethereum is trading over $4,100, and Solana is approaching $200 once again. Many altcoins are up over 10% on the day. With the US observing a bank holiday, traditional markets are closed, meaning all the focus remains on crypto. Some have questioned whether we have entered the start of a bear market, but this reaction and rebound suggest the opposite. The strong recovery signals that the bull cycle is still be intact and new all-time highs could be just around the corner.

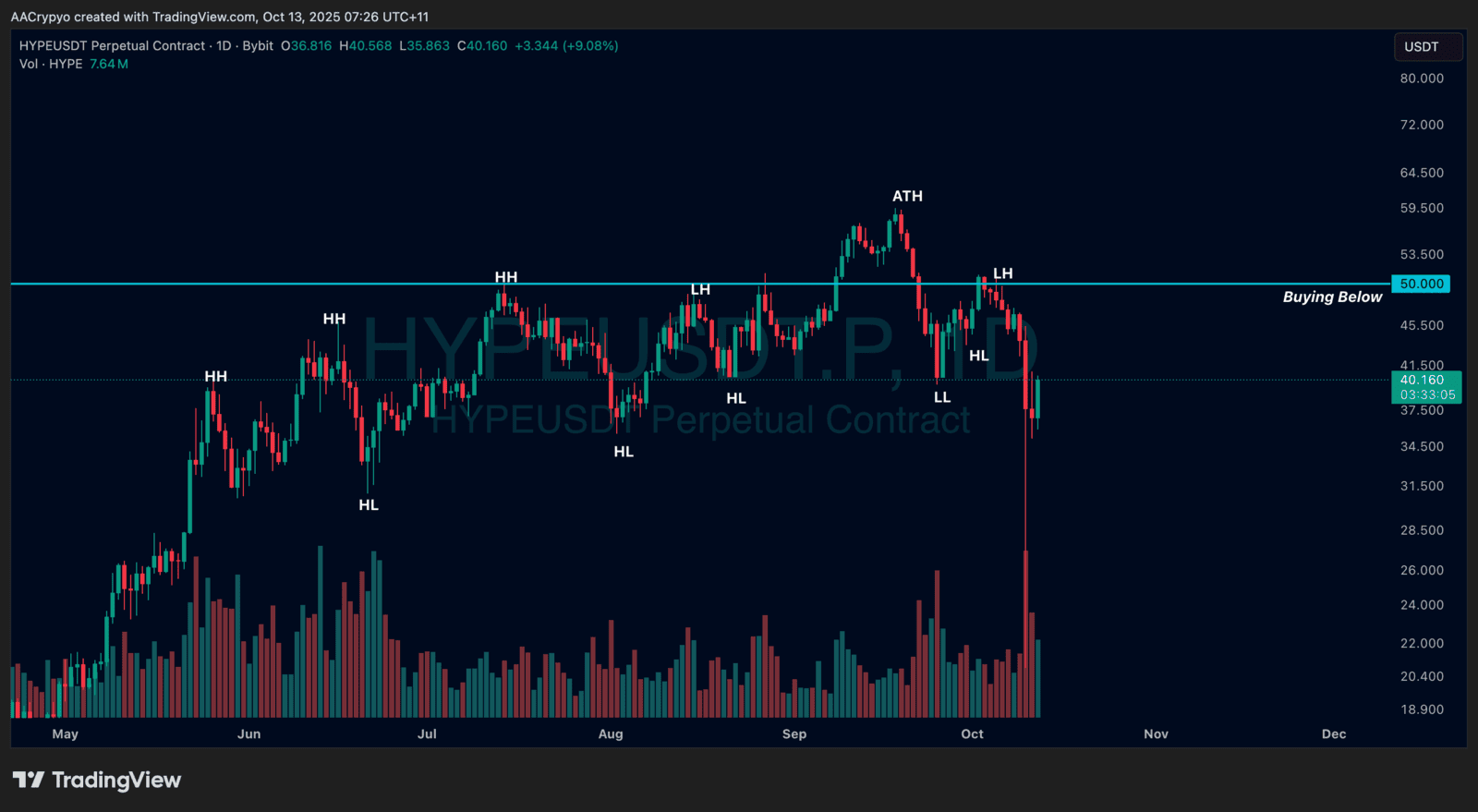

Stormrake Spotlight: Hyperliquid (HYPE) ($40.14)

Stormrake Spotlight: Hyperliquid (HYPE) ($40.14)