To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

In this mini series of Morning Notes, we will be breaking down the realistic reasons why many believe Bitcoin could reach $1 million in the future. From Michael Saylor’s conviction, to comparisons with gold’s market capitalisation, to Bitcoin’s potential role as a global reserve asset. Today, we focus on BIP-110.

So, what is BIP-110?

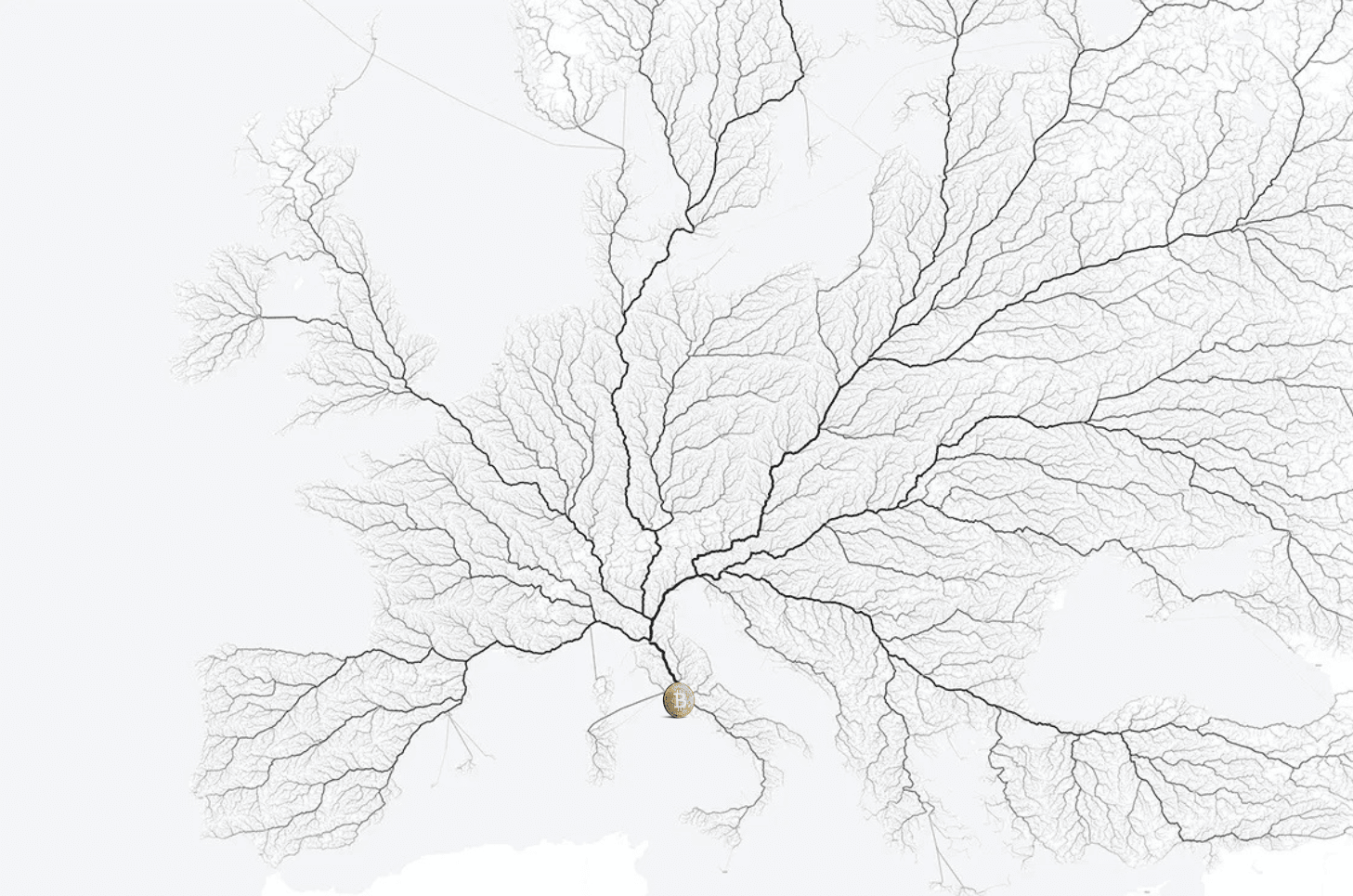

BIP stands for Bitcoin Improvement Proposal. Despite the technical name, BIP-110 is a proposal for a temporary soft fork, lasting one year, designed to limit how much non financial data can be included in Bitcoin transactions. Its aim is to reduce network spam from data heavy uses such as inscriptions. In simple terms, it prioritises Bitcoin as money rather than as a place to store data.

Bitcoin operates through different software versions called node implementations. Bitcoin Core v30 is the latest major version. After the launch of Bitcoin Ordinals in 2023, which allowed non monetary data to be stored on Bitcoin by using features such as SegWit and Taproot, a wider debate began. Many argued this shifted Bitcoin away from its original purpose. BIP-110 emerged from this debate.

At the moment, around 2% of node operators have signalled support for BIP-110. It is still in draft form and has not been activated.

Under the current Core v30 rules, the network propagation rules for OP_RETURN were relaxed, but Bitcoin’s fundamental consensus rules were not changed. OP_RETURN is a feature in Bitcoin that allows users to attach small amounts of data to transactions. Ordinals use a different approach, relying mainly on witness data to create unique digital items on Bitcoin, similar to NFTs. By contrast, BIP-110 proposes changes to the consensus rules themselves.

While these uses are technically valid, it is worth remembering Bitcoin’s original purpose. In the opening line of the Bitcoin white paper, Satoshi Nakamoto described Bitcoin as a “peer to peer electronic cash system”. It was not designed to be an information database or a platform for building additional protocols.