To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Yesterday we noted that last week was extremely bullish for Bitcoin and questioned whether the momentum would carry into this event-filled week. It started well, with Bitcoin breaking above $122k and coming within 0.75% of its all-time high of $123.3k, before last night erased all the gains across markets. This morning, Bitcoin is trading back near $118k, down more than 3% in just over 12 hours.

Altcoins were mixed when Bitcoin was pushing higher, but as it began to fall, most turned red. Hyperliquid and XRP initially attempted to buck the trend, remaining among the last altcoins in the green, but they too flipped red once Bitcoin slipped below $120k. It was not just crypto that suffered, traditional risk-on markets fell, and even gold, a traditional haven, declined despite Trump stating that gold will not be tariffed.

As anticipated, there were headlines around US-China tariffs. Trump signed an executive order extending the pause by another 90 days and brokered a unique trade arrangement with NVIDIA and AMD. Under the deal, the companies agreed to provide the US with 15% of revenue from chip sales in China in exchange for the removal of export controls.

Tonight brings the first set of inflation data, with CPI being the key figure influencing Jerome Powell and the Federal Reserve’s interest rate decisions. Readings above forecasts are typically negative for risk-on assets, as they indicate faster-than-expected inflation, while readings below forecasts tend to be bullish. For most of the year, CPI has come in below expectations every month except February.

The probability of a September rate cut currently sits at 88%. Forecasts for tonight put core CPI month-on-month at 0.3% (up 0.1% from last month), headline CPI month-on-month at 0.2% (down from 0.3%), and headline CPI year-on-year at 2.8% (up from 2.7%). A mixed set of figures is expected. Lower-than-forecast inflation would strengthen the case for a September rate cut and could see risk-on assets rally in anticipation. A higher reading would likely trigger a short-term pullback, though the odds of a September cut should remain strong unless there is a significant and unexpected jump in inflation.

The bulls are still in control of Bitcoin. While some volatility is expected around the CPI release, any pullback is likely to be short-lived, with strong buying demand ready to scoop up dips and push prices higher.

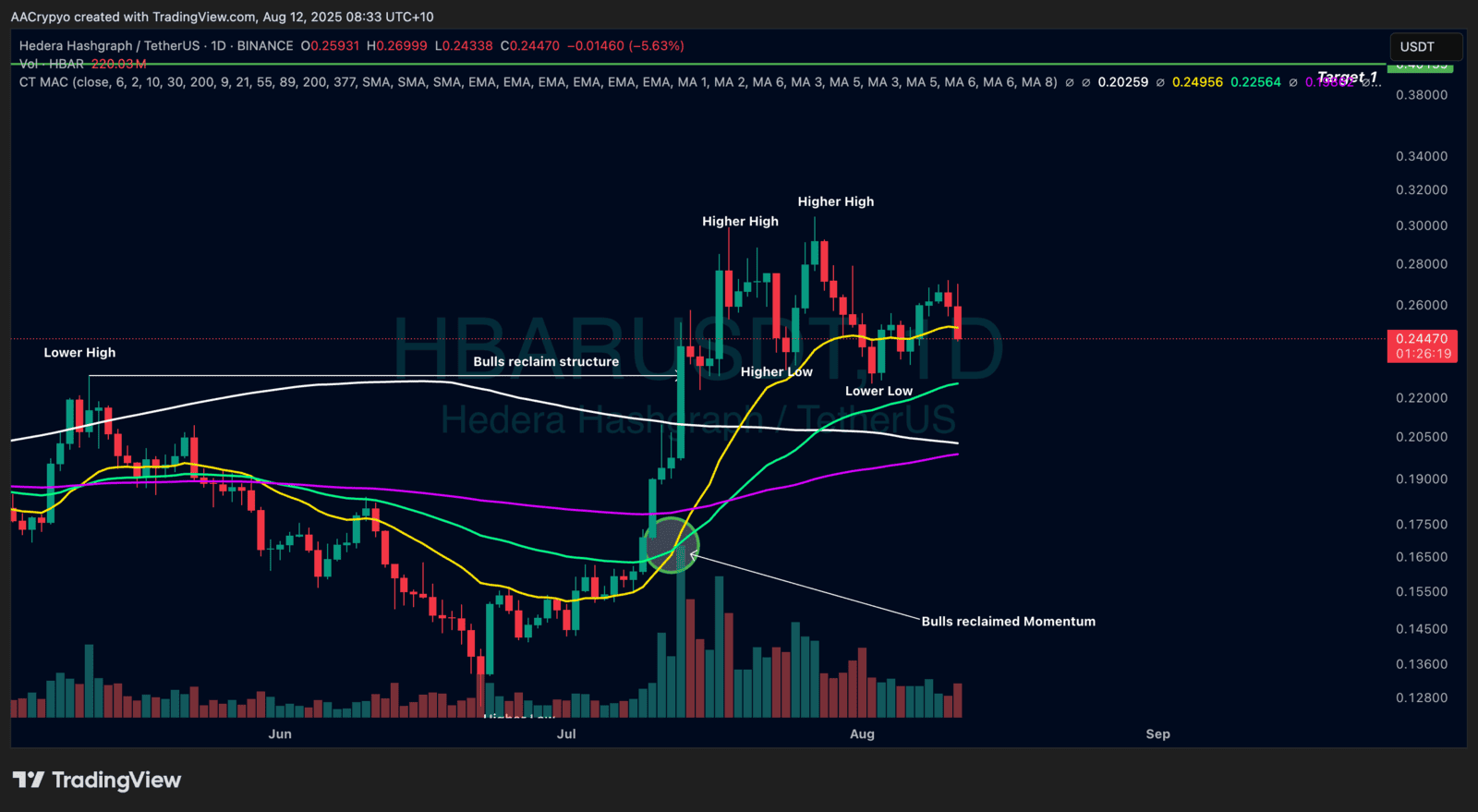

Stormrake Spotlight: Hedera (HBAR) ($0.244)

Stormrake Spotlight: Hedera (HBAR) ($0.244)