To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

After a week of bearish price action and widespread long liquidations, the crypto market is finally flashing some green across the charts.

Now that options have expired, the bears seem to have taken a breather. Their recent push was likely aimed at keeping pressure on the market so their positions would print, but with expiry behind us, they have eased off slightly. That shift is showing clearly in the altcoins.

Bitcoin spent the day consolidating around $109K, while altcoins have taken the spotlight over the past 24 hours following a rough week. Ethereum is up nearly 4% and back above $4,000, Solana has reclaimed $200 with a 5% move, and the standout performer is Hyperliquid.

It has been a turbulent week for HYPE, falling over 30% since ASTER launched. The new competitor triggered a wave of users shifting platforms, dragging sentiment and price down. But in the last 24 hours, HYPE has finally seen some relief, rallying 10% after Bitwise filed for a Hyperliquid ETF. It is the first green day in over a week and a key moment not just for price but for long-term positioning. The current correction stemmed from short-term hype around a new narrative, but this ETF filing is a long-term catalyst that could open the door to institutional exposure and broader adoption.

Sentiment over the past week has clearly turned bearish. Social media is full of cycle-top calls, and the Fear & Greed Index has dropped 16 points in just 24 hours, now sitting at 28. That is approaching extreme fear territory. Yet Bitcoin is only 12% off its all-time high and is holding key support. The disconnect between sentiment and price suggests we may have already seen the bottom, or are very close to it.

Long-time readers of the Morning Note will recognise this setup. We saw a similar pullback in May before fresh all-time highs, a correction in Q1 after the tariff narrative before fresh all time highs, and again in December before fresh all time highs. Each time, fear surged, the market turned bearish, and shortly after, Bitcoin broke out to new highs. These pullbacks are part of bull markets. Sentiment turns sour, price wobbles, and social media screams panic, but the constant that follows is opportunity.

Pullbacks in a bull market often lead to strong recoveries. These are the moments smart money steps in to accumulate Bitcoin and high-conviction altcoins. This past week has already offered a few of those windows, and there may still be more ahead.

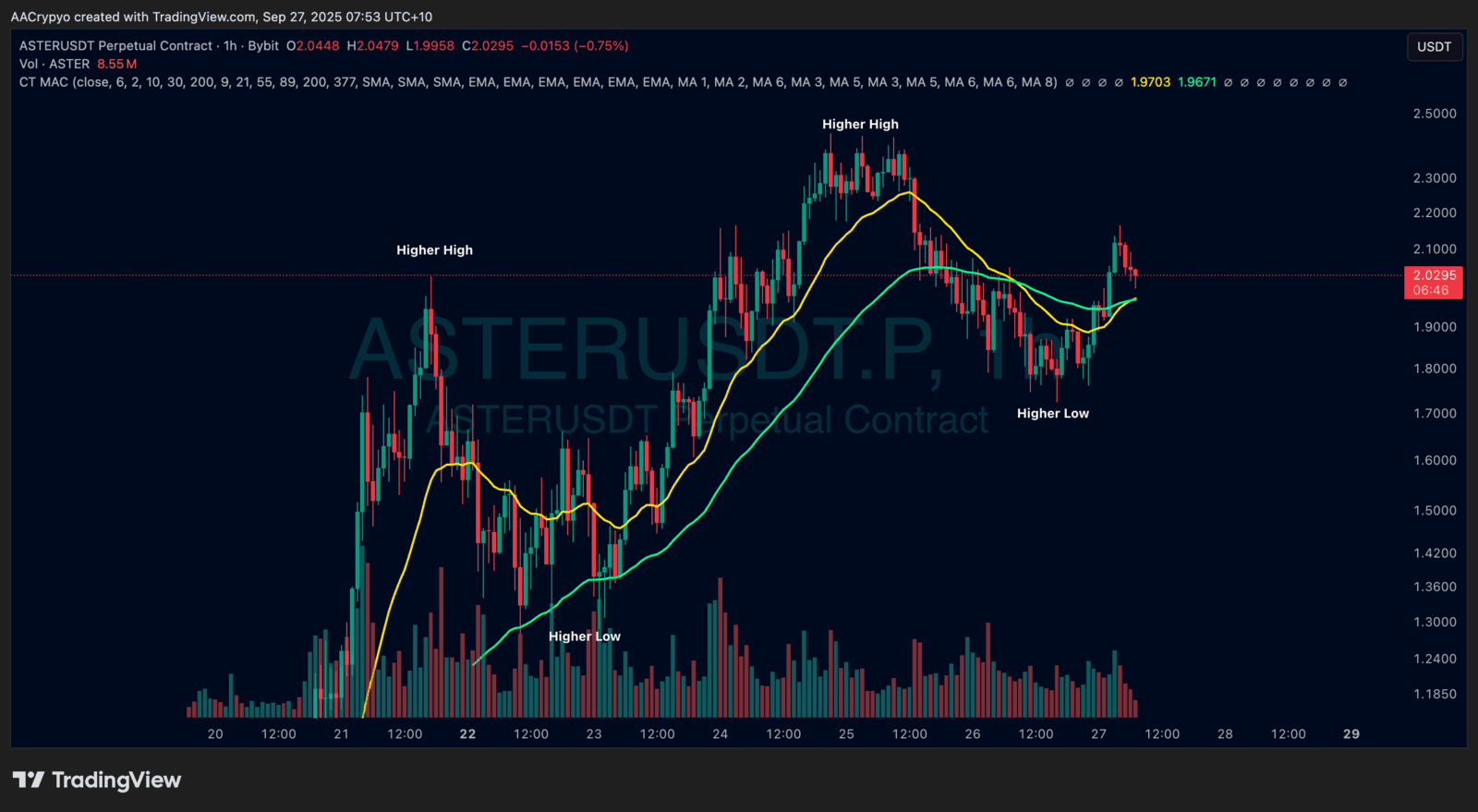

Stormrake Spotlight: Aster (ASTER) ($2.02)

Stormrake Spotlight: Aster (ASTER) ($2.02)