To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Cycle after cycle, we move into the altseason phase once Bitcoin begins to lose steam. As Bitcoin shows signs of exhaustion, funds rotate into large-cap altcoins and kick off a familiar shift in market leadership. There were questions in recent weeks about which stage of the cycle we were in, but it’s now clear we are in altseason. Bitcoin has had its moment leading the charge, but that dominance is fading as the bull run continues and attention turns to the majors.

The last week should have cleared any remaining doubts. Bitcoin dropped from $118K back below $109K, entering a bearish structure, while Ethereum and Solana remain bullish and continue to outperform. This rotation is textbook altseason behaviour. Solana and newer majors like Hyperliquid have now joined Ethereum at the front of the market. Hyperliquid is up more than 13%, Ethereum and Solana both gained 5%, while Bitcoin managed just 1.5% and is still struggling to shake off bearish momentum.

On the macro side, Trump has reignited tensions with the US Federal Reserve. He is attempting to fire Fed Governor and board member Lisa Cook, something that has never happened in the Fed’s 111-year history. Trump wants to replace her with an ally in an attempt to tilt the board in his favour and push for rate cuts. Cook has responded by suing Trump to prevent her removal. This only adds more pressure to an already volatile mix of inflation, political posturing and questions around Fed independence.

Historically, altseasons tend to happen towards the later stages of a bull cycle. They often run for a few months before the broader market enters a bearish phase. While it may not be the message most want to hear, the idea that we are moving closer to the end of the bull run is something that needs to be considered.

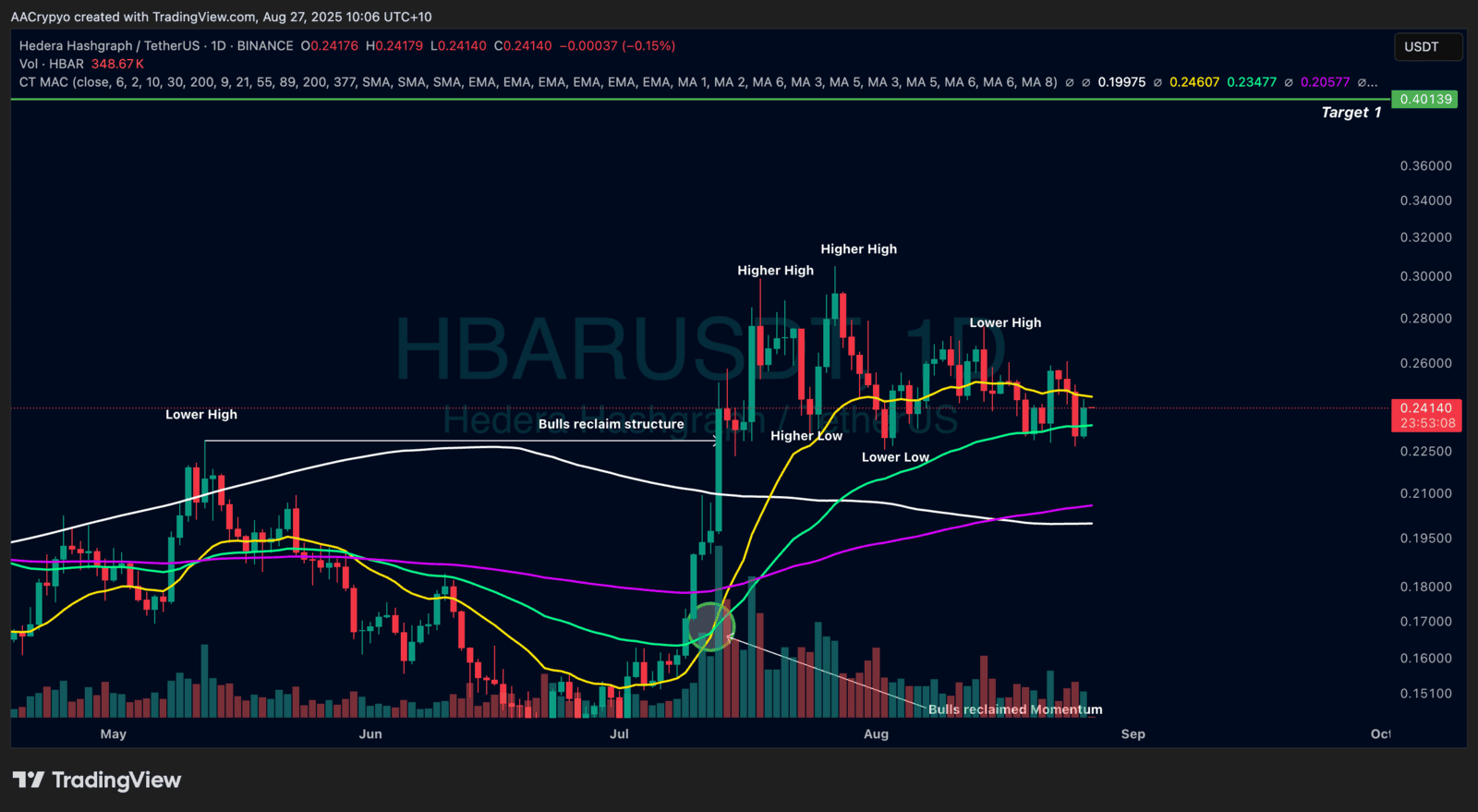

Stormrake Spotlight: Hedera (HBAR) ($0.241)

Stormrake Spotlight: Hedera (HBAR) ($0.241)