To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Today marks a key moment for the market as over $22 billion in options are set to expire. Yesterday, we flagged $112K as the battleground. While BTC remained above it, the bulls held the upper hand. We also warned that volatility was likely as both sides fought for control.

This morning, Bitcoin opens below $109K, with another $1 billion in long positions liquidated over the past 24 hours. It caps off a brutal few days for the bulls, with more than $3 billion in total liquidations. The bears have clearly regained momentum. Key overnight data in the form of US unemployment figures and GDP supported the dollar, pushing the DXY index up more than 1.25% over the past two days. Meanwhile, traditional markets and hard assets remained mostly flat.

The crypto market, however, took another leg lower. Bitcoin fell nearly 4%, Ethereum dropped almost 7% to below $3,900, and Solana lost close to 9%, falling back under $200. The risk-off rotation ahead of expiry is clear.

Still, despite the recent weakness, Bitcoin remains green on the month. That deserves recognition given September’s historical reputation as a bearish month, often referred to as ‘Rektember’.

The key here is perspective. During periods of pullback or short-term bearishness, zoom out and focus on the bigger picture. Yes, it is frustrating to watch crypto retrace while other markets climb, but Q4 remains poised for a strong start. Uptober is around the corner and it is only a matter of time before flows from traditional finance return to digital assets. Use this period as an opportunity to accumulate Bitcoin and quality altcoins that have pulled back meaningfully.

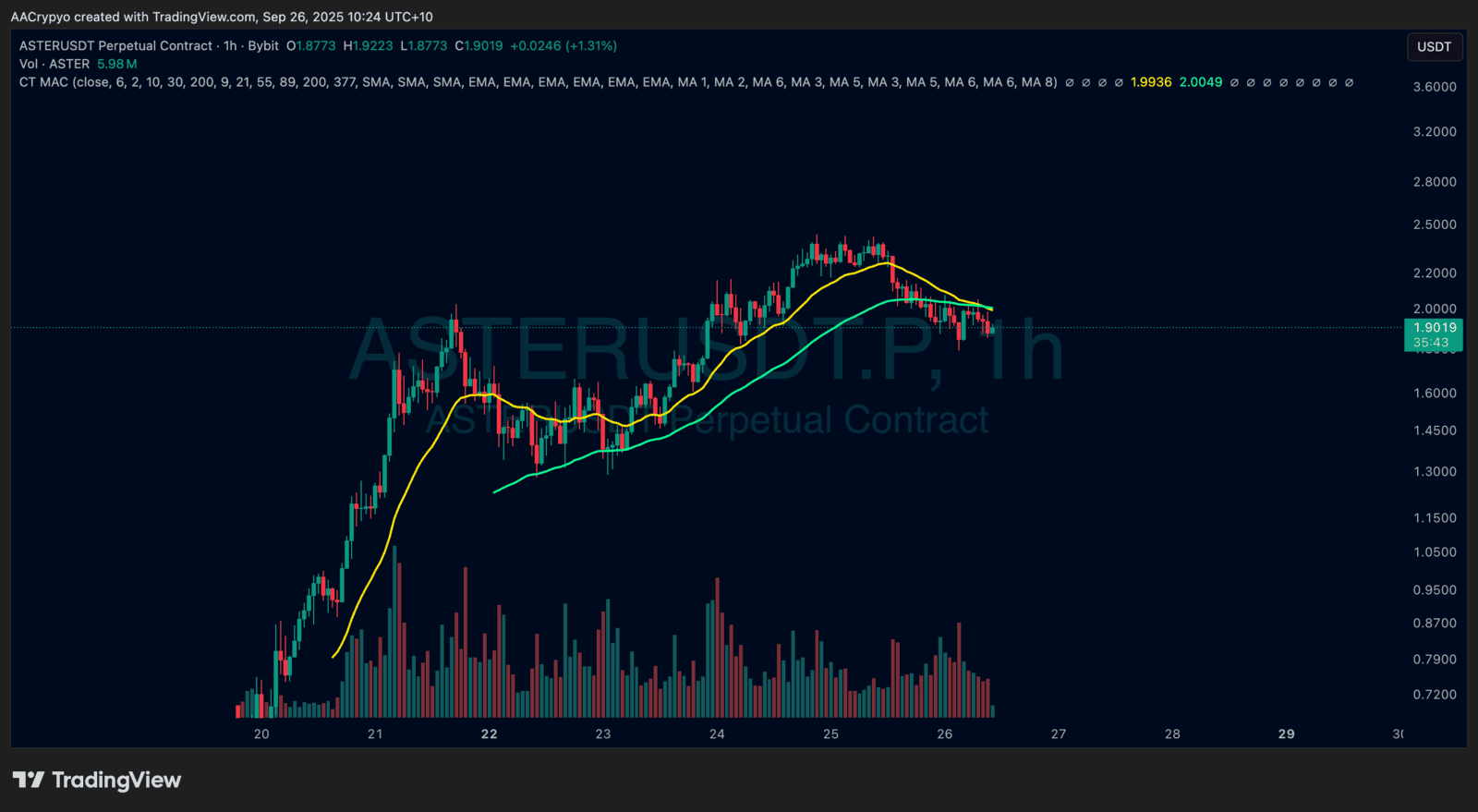

Stormrake Spotlight: Aster (ASTER) ($1.90)

Stormrake Spotlight: Aster (ASTER) ($1.90)