To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

The highly anticipated interest rate decision has arrived and the result came as expected: a 25 basis point cut. This is a very positive sign for risk on assets, though the impact has not been felt overnight. Markets had priced in the cut well in advance, which explains the lack of immediate movement across risk assets.

Bitcoin failed to sustain a breakout yesterday, seeing some volatility around the time of the announcement but still trading just above $116K. Despite the pullback, BTC remains in the bulls' control. Traditional risk on markets also experienced some volatility, but ultimately closed flat. The S&P 500 lost just 0.10%, and the Nasdaq finished marginally lower, down 0.21% on the session.

Gold and silver both pulled back over the past day, though both remain in strong uptrends. Gold is still hovering around its all time highs, while silver sits just below its highest level in 14 years. These are healthy corrections from strength, not signs of weakness. Interestingly, the DXY (US dollar index) looks set to close green on the day despite the rate cut. It has caught a slight bid but still remains in a broader breakdown, now sitting at its lowest levels since February 2022.

So while the cut was fully priced in and did not move markets overnight, this is the first step towards what could become a more prolonged and powerful bull run. Liquidity is starting to return and that is a bullish macro tailwind. Markets are still pricing in another 50 basis points in cuts by year end. The question is whether that comes as one 50 basis point move or two 25 basis point cuts. Either way, the catalyst is now in place. Historically, Q4 is a strong period for risk assets and with rate cuts finally underway, that seasonal trend could be amplified.

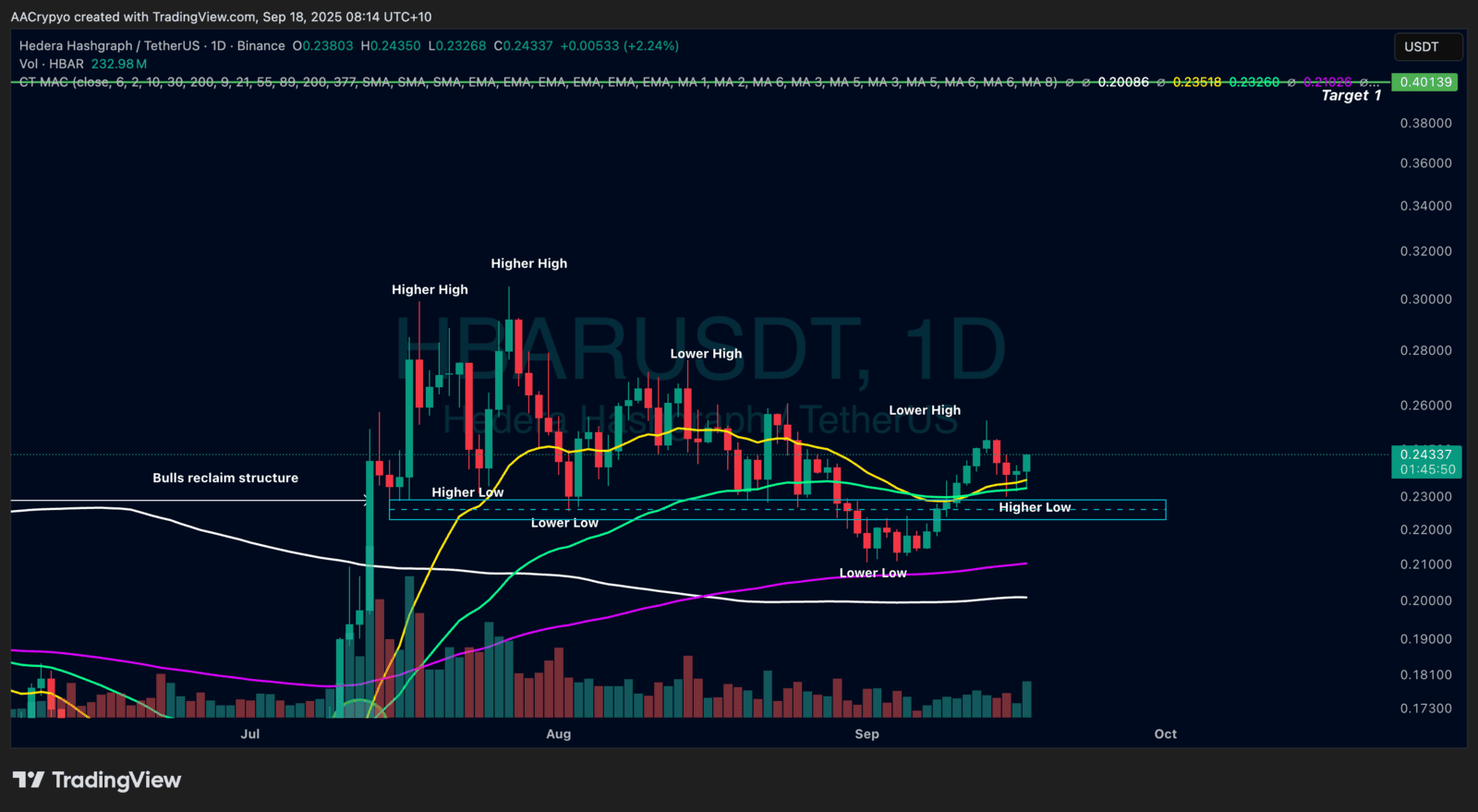

Stormrake Spotlight: Hedera (HBAR) ($0.243)

Stormrake Spotlight: Hedera (HBAR) ($0.243)