To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Japanese monetary policy continues to steal the spotlight as one of the most influential forces on global markets. Yesterday, we highlighted that Bank of Japan Governor Ueda was due to speak and that his comments would likely move markets. That is exactly what happened, with Bitcoin starting to fall almost immediately after he began.

Ueda said the BOJ would consider the pros and cons of a rate hike at this month’s meeting, describing a hike as easing off the accelerator rather than applying the brakes. This triggered a rally in the yen against major currencies, but more importantly, Japanese government bond yields surged. The 10-year yield jumped nearly 4% to its highest level since June 2022, while the 30-year yield climbed to a new all-time high.

This move is bearish for risk assets. There is a strong short-term inverse correlation between yields and Bitcoin. When yields spike, Bitcoin typically falls, which is exactly what we have seen over the past couple of weeks.

There is also a strong inverse correlation between BOJ interest rates and Bitcoin. If the BOJ does raise rates this month, it would likely be bearish for Bitcoin, as higher borrowing costs make the yen carry trade more expensive. This forces institutions running the carry trade to unwind their risk-on positions, with Bitcoin often the first asset sold due to its liquidity. Markets are now pricing in an 80% chance of a rate hike, sharp jump from what was virtually a coinflip just last week.

Technically, Bitcoin has failed to hold key support and has now handed full control back to the bears. After starting the day above $90K, it has dropped below $84K and is now down 4% on the day, currently hovering around $86K.

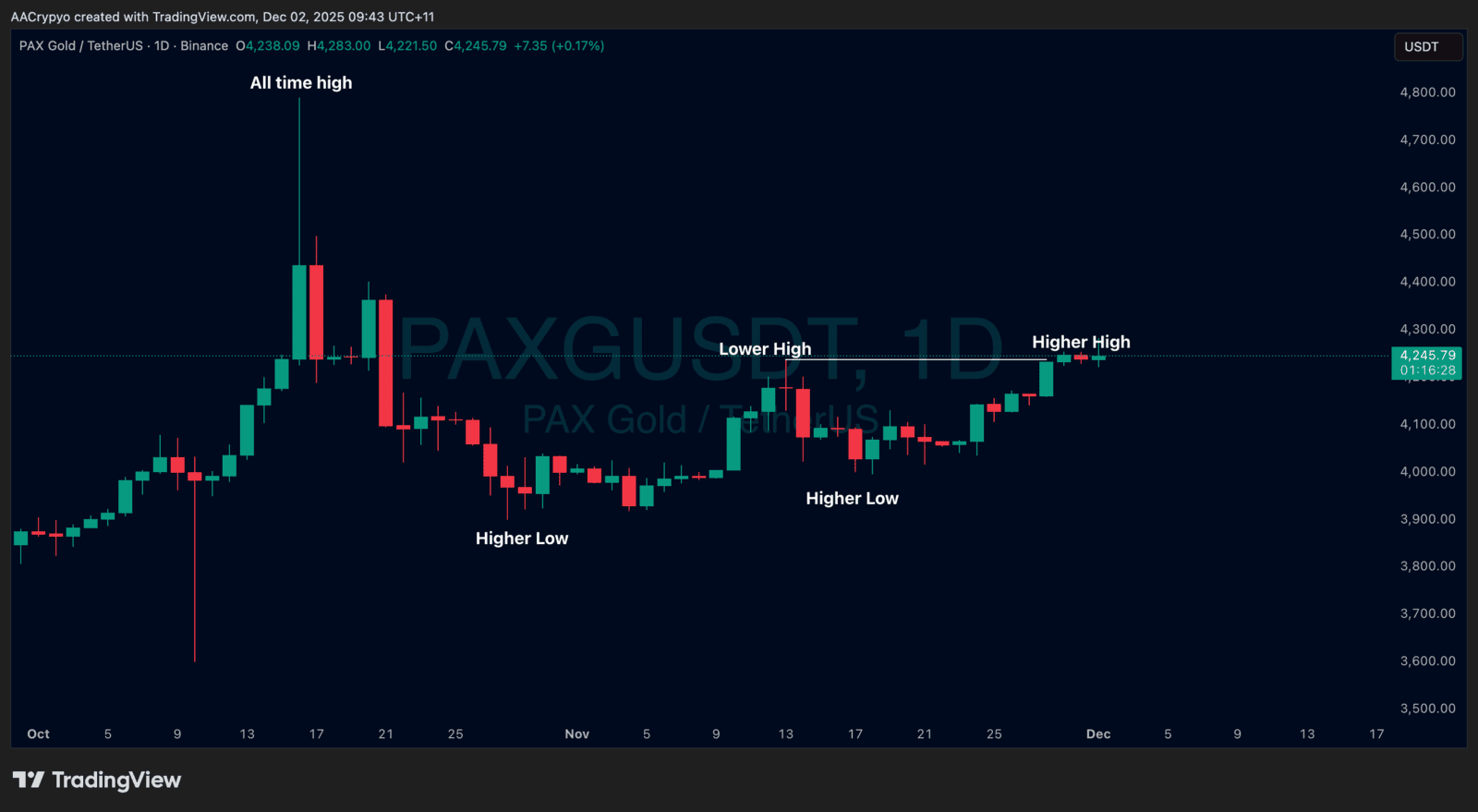

Stormrake Spotlight: Pax Gold (PAXG) ($4,245)

Stormrake Spotlight: Pax Gold (PAXG) ($4,245)