To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Last month we saw over $20 billion of leveraged positions wiped out within 24 hours as Bitcoin fell from $117K to $102K and settled around $112K by day’s end. It was a major black swan event. Since then, short orders and downward pressure have dominated, with Bitcoin falling back below $100K and now trading just under $103K.

Yesterday we saw an intraday high of $107.5K on the back of the Tariff Dividend proposal from Trump, which sent all risk-on markets higher. Since that high, Bitcoin has pulled back over 4% as bears defended key liquidation levels. This pullback was entirely crypto-specific, as traditional markets across both risk-on and risk-off assets have risen over the last 24 hours. Bears are now holding critical price levels. If these are lost, we could see major short squeezes that would wipe out billions of dollars in short positions on Binance alone.

The first level that would trigger over $1 billion in short liquidations sits just under $108.5K. Another $1 billion would be wiped out at $112K. Between these two levels, short positions are relatively thin. This means that if bulls can successfully clear $108.5K, we could see a fast and sharp move toward the next challenge at $112K before bears put up resistance again. A clean reclaim of $112K would give structural and momentum control back to the bulls while also inflicting serious damage on the bears.

Once $112K is taken, all momentum shifts to the bulls. Another $2 billion would be wiped out if Bitcoin reclaims $118K, bringing total short liquidations to over $4 billion at current levels on Binance alone. Of course, this number would increase as new short positions are added or as bears sell further into price strength in an attempt to suppress the rally. But we may be setting up for the reverse of last month’s black swan event. While it may not be as violent or as large as the $20 billion collapse, it would still mark a significant shift. Some are already calling it a white swan.

Now for something a bit different — the McRib. Yes, a McDonald’s menu item has made its way into Stormrake’s Morning Note. But for good reason. McDonald’s has announced the return of the McRib, and interestingly, each time it has returned, Bitcoin has gone on to post strong bullish moves. As shown in the chart below:

Historically, Bitcoin has at least doubled following the McRib’s return. Will it do so again? We will have to wait and see.

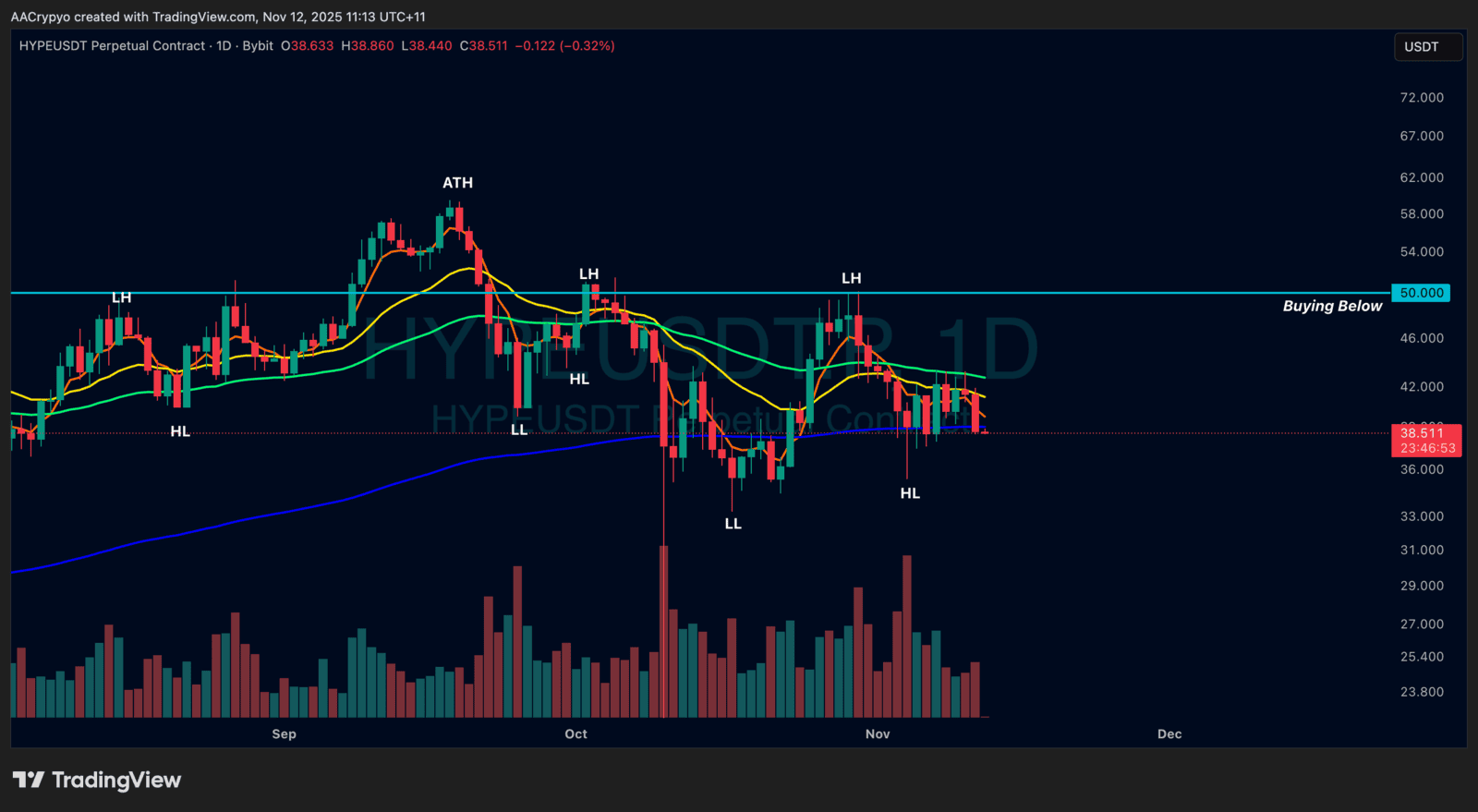

Stormrake Spotlight: Hyperliquid (HYPE) ($38.45)

Stormrake Spotlight: Hyperliquid (HYPE) ($38.45)