To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

The bulls’ window of opportunity may be closing. After more than two weeks of consolidation, Bitcoin looked poised to break higher during the US session last night, approaching $119K following a sharp reversal sparked by Powell’s comments yesterday morning. The recovery suggested the bulls had the upper hand and were pushing towards the top of the range.

Altcoins followed with intraday gains, and a new announcement from Saylor confirming another Bitcoin purchase added to the optimism. A retest of the range highs seemed likely. Instead, Bitcoin failed to sustain the momentum, falling sharply below the range as bears seized control and now threaten to drive prices lower.

This move lower is not isolated to crypto. Traditional risk-on markets also closed in the red despite sitting near all-time highs. Trump is currently live announcing updated tariffs, triggering a risk-off reaction across markets. Investors are selling off as trade tensions escalate, with Canada’s tariffs raised from 25% to 35%. The DXY (US dollar index) has now logged six consecutive green days, while gold, the classic safe-haven asset, has yet to see a meaningful bid.

The ball is now in the bulls’ court. They need to reclaim the range and reverse this breakdown quickly, or the bears may finally win the fortnight-long battle of consolidation and sustain a move lower.

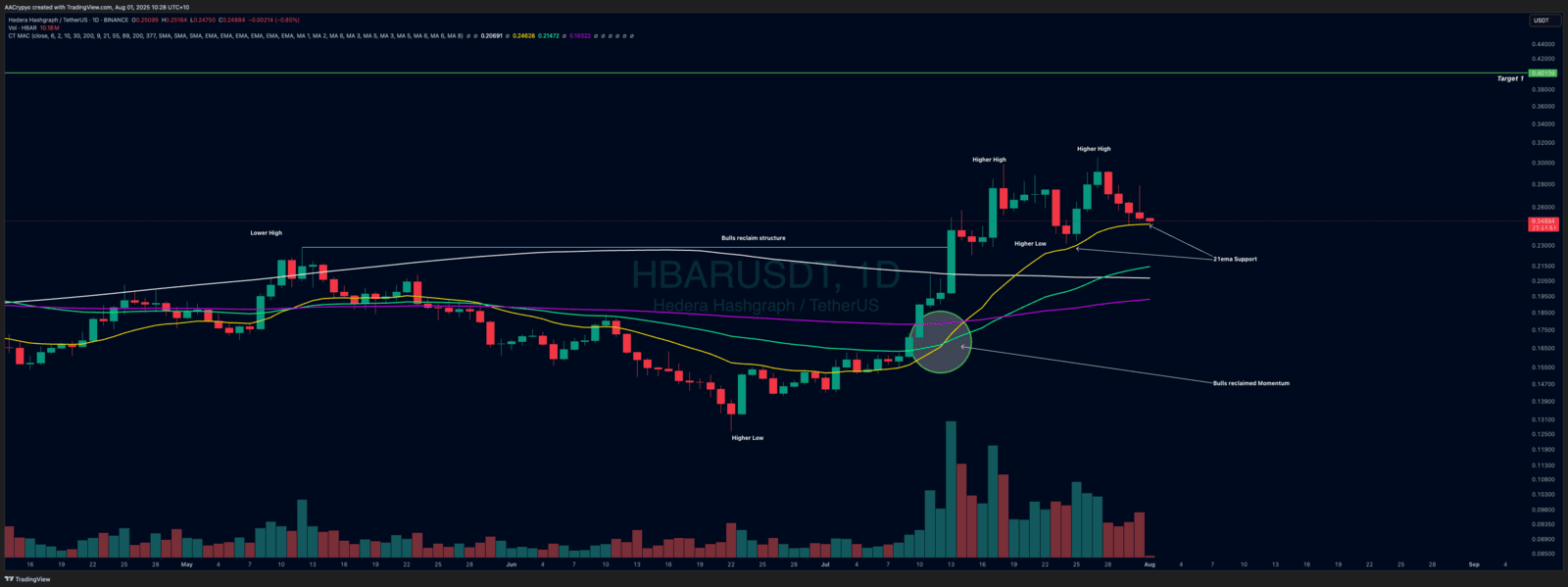

Stormrake Spotlight: Hedera (HBAR) ($0.248)

Stormrake Spotlight: Hedera (HBAR) ($0.248)