To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

The Big Beautiful Bill (BBB) has just passed the Senate with a narrow vote of 51-50, with Vice President JD Vance casting the deciding vote. Despite controlling the Senate, the outcome was tense. Three Republicans joined the Democrats in voting against the bill, while several others, including Elon Musk, voiced their disapproval.

Musk and Trump are once again feuding, with Trump threatening to send DOGE (previously Musk’s own department) to investigate him following further criticism. The BBB will solidify Trump’s 2017 tax cuts and add a projected $5 trillion to the US debt ceiling. This has sparked significant criticism, as many believe it will disproportionately favour the wealthy while burdening low-income Americans.

Markets have taken a step back. Traditional indices have experienced a slight pullback but remain well within all-time-high territory. Bitcoin has lost another 1.35% over the past 24 hours, confirming the longer-term bullish structure with yet another lower high. Gold closed green for a second consecutive day, up over 1%. Bitcoin’s fear and greed sentiment remains in the “greed” zone, with a reading of 63, down just one point in the last 24 hours. This suggests investors are still bullish and waiting for the risk-on flow to re-enter the space. However, this patience continues to weigh on altcoins, with the altcoin market losing 2.61% over the past day. Ethereum is down over 3%, Solana has fallen more than 5%, and XRP is down 2.9%.

The upcoming 90-day pause deadline is fast approaching, set for July 9th. Trump is firm in his stance of not extending the pause, and doubts are growing about a deal with Japan. On tariffs, Federal Reserve Chair Jerome Powell remarked earlier today that the central bank would likely have already cut interest rates this year had it not been for the economic shock caused by Trump’s tariff policies. Assuming no further surprises, we can still expect two rate cuts in the second half of the year.

In the Middle East, further developments have emerged, with Trump confirming that Israel has agreed to the necessary conditions for a 60-day ceasefire in Gaza. He is now urging Hamas to agree to the terms.

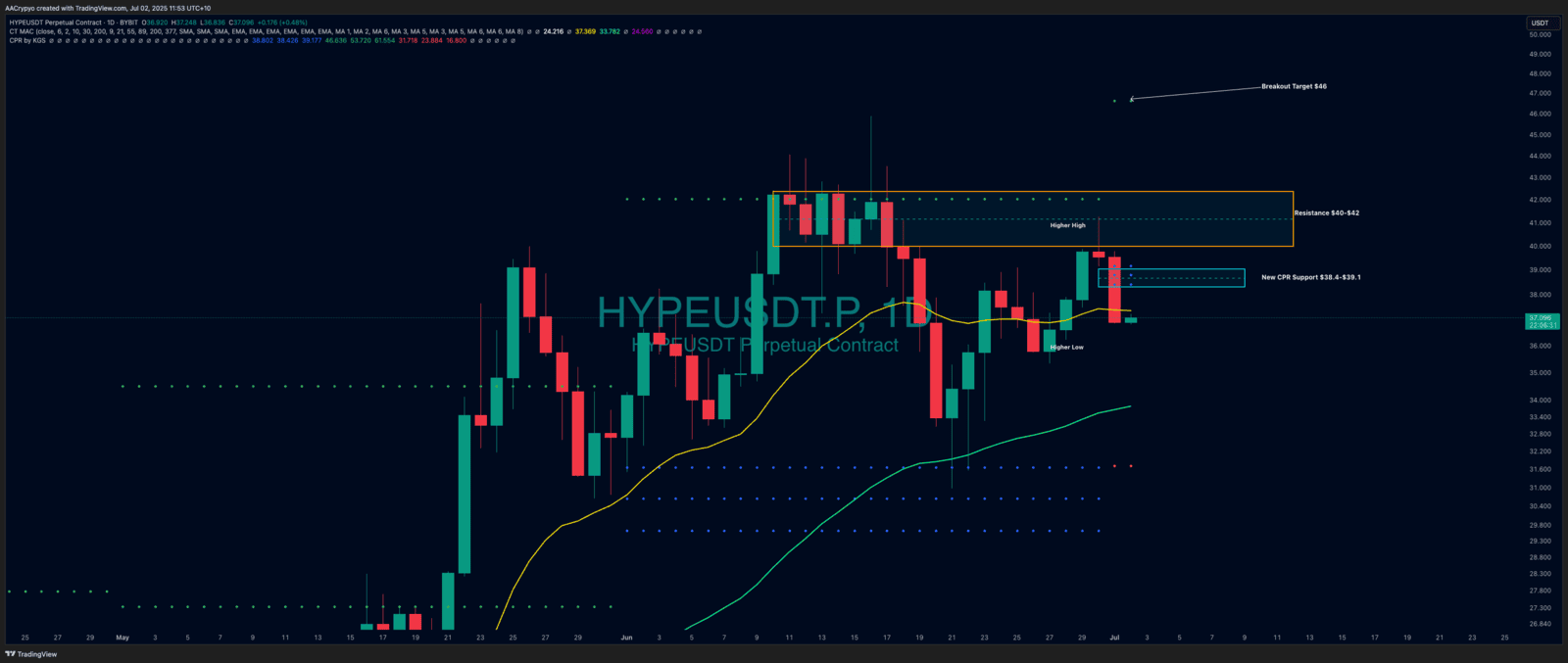

Stormrake Spotlight: Hyperliquid (HYPE) ($37.10)

Stormrake Spotlight: Hyperliquid (HYPE) ($37.10)