To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

After Bitcoin spent most of July in a consolidation phase, it’s now caught in another range to kick off August. The zone between $112K and $115K has become a battleground for bulls and bears alike.

The bears have had the upper hand since the start of the month, largely due to escalating tensions between the US and Russia. However, the bigger story, and the primary market mover, came from within the US. Last week's unemployment numbers, their subsequent revisions, and the political fallout triggered heavy volatility. Trump claimed the figures had been manipulated to damage his reputation and even fired Dr. Erika McEntarfer, the commissioner of the Bureau of Labor Statistics, as a result. That said, no evidence has been presented to support these claims.

Markets pulled back across the board, but risk assets have since begun clawing their way back. Bitcoin is slowly tilting short-term momentum back to the bulls, with the Nasdaq and S&P 500 also trading higher since the weekend drama.

Overnight, further tariff headlines have kept markets on edge. Trump signed an executive order imposing a 25% tariff increase on India for continuing to purchase Russian oil. In response, the BRICS bloc has announced an emergency summit to discuss a coordinated response. In addition, the US has introduced a 100% tariff on imported semiconductors. While NVIDIA remained largely unaffected, other major players like TSMC (Taiwan) and ARM (UK) ended the session in the red.

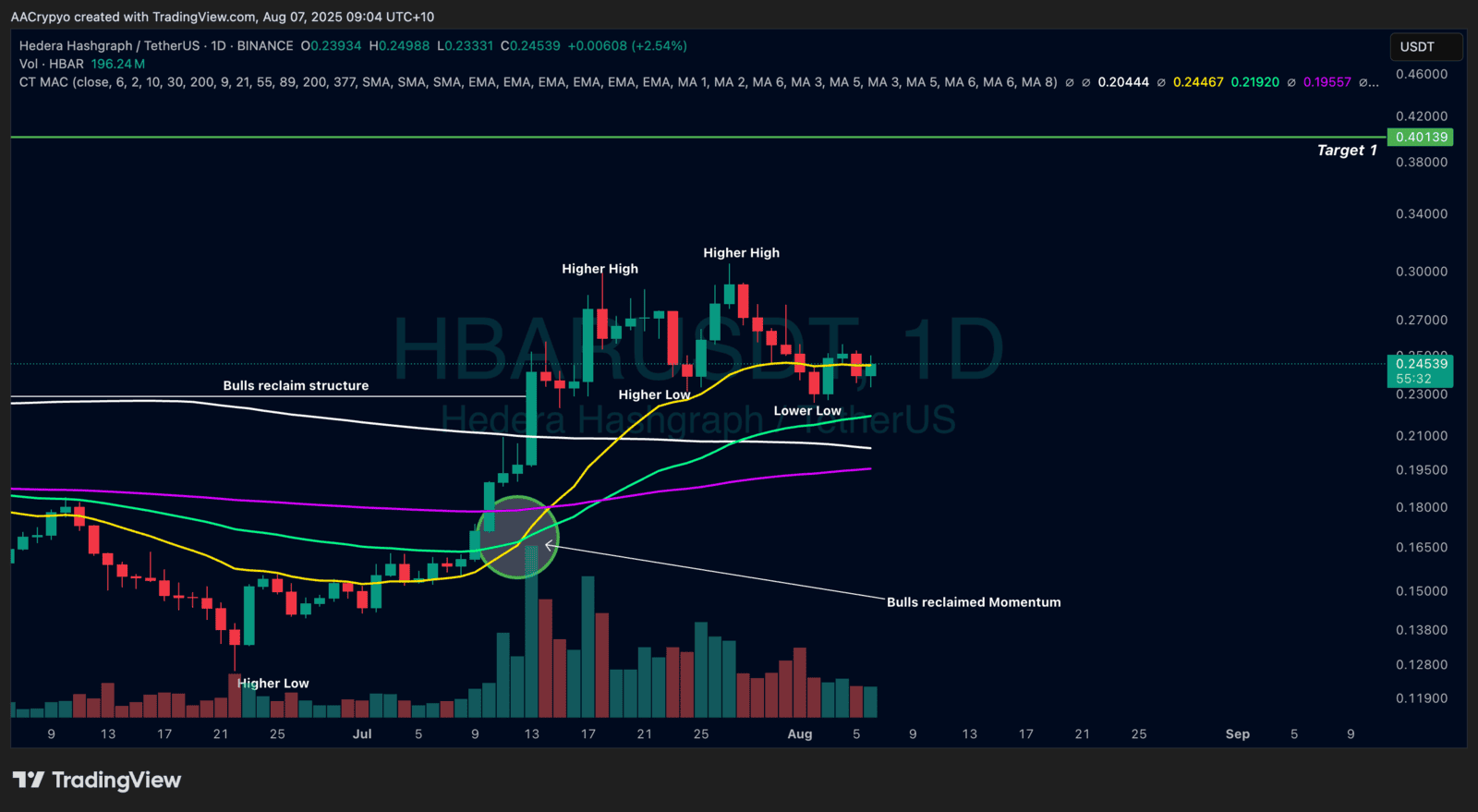

Stormrake Spotlight: Hedera (HBAR) ($0.245)

Stormrake Spotlight: Hedera (HBAR) ($0.245)