To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

A near 5% day of pure volatility for Bitcoin has set the stage for bulls to take another shot at the yearly open. As mentioned yesterday, both Bitcoin and US equity futures began falling following Powell’s speech, and that weakness extended through the Asian session. Bitcoin dropped back to the bottom of its consolidation range, holding just above $89K.

Fast forward to this morning and we have seen another strong US session. In fact, every US session this week has printed bullish price action, a constructive sign as Bitcoin climbs back above $92K. Bulls are once again looking to flip Bitcoin green for 2025.

While Bitcoin remains down close to 30% from its all time high, traditional markets are telling a different story. The S&P 500 recorded its highest ever close overnight, while the Dow Jones also pushed to new all time highs. Risk-on sentiment is clearly present in legacy markets, though not yet enough to trigger a full rotation into crypto.

Sentiment is gradually improving after a prolonged period of extreme fear. Today’s Fear & Greed Index reading came in at 29, still classified as fear. Bitcoin sentiment has been stuck in fear or extreme fear for most of the past month. Historically, extended periods in extreme fear tend to mark local bottoms, or suggest one is approaching. This remains something to watch heading into the final weeks of the year.

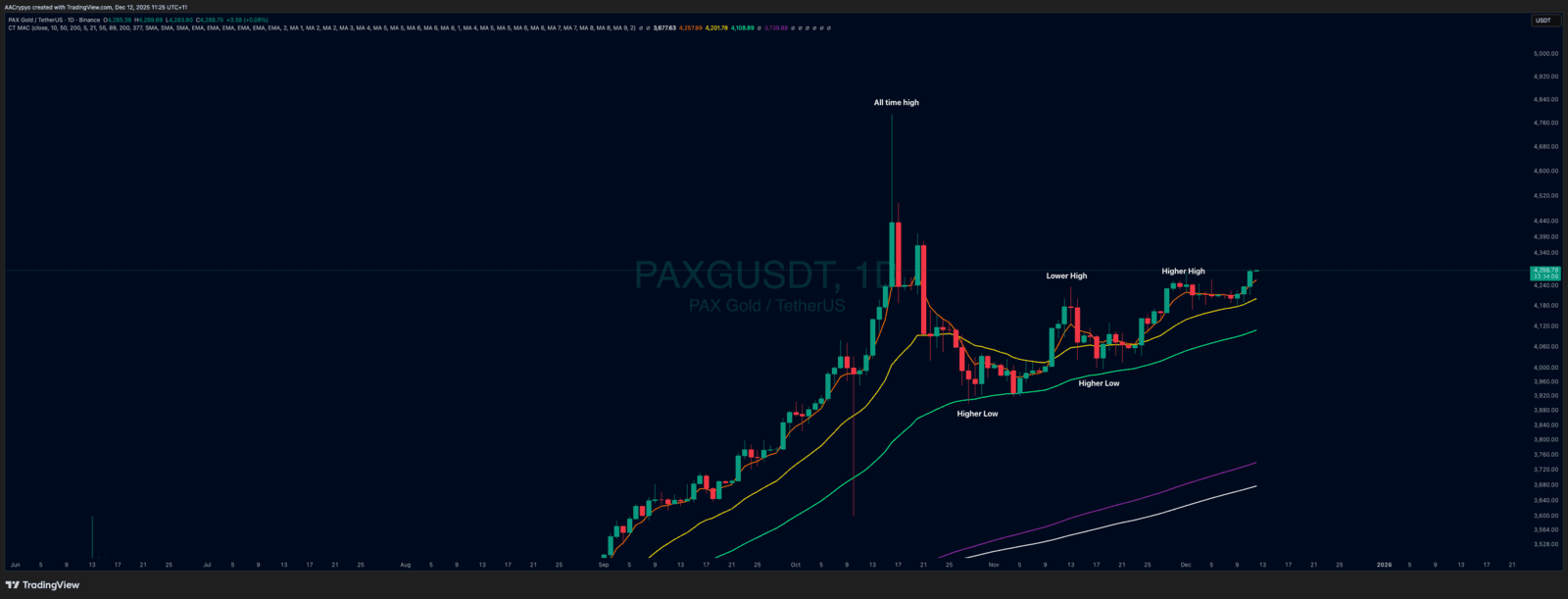

Stormrake Spotlight: Pax Gold (PAXG) ($4,288)

Stormrake Spotlight: Pax Gold (PAXG) ($4,288)