To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

After a bullish week in markets, particularly crypto, sentiment was boosted by a string of major developments. Trump signed pro-crypto executive orders, the SEC officially ended its legal battle with Ripple, and regulators confirmed that crypto liquid staking activities are not considered securities. This was exactly the kind of momentum the market needed, especially after weeks of escalating trade tariffs and rising geopolitical tensions with Russia. Bitcoin surged back above $119K and Ethereum climbed past $4,300 for the first time since 2021. Bulls are firmly back in control, with Bitcoin edging ever closer to an all-time high breakout.

This week is shaping up to be just as eventful. The first key focus will be tariffs, with the US-China tariff pause set to expire on August 12. This particular trade standoff has been the most closely watched, defined by a constant back and forth of steep tariff impositions, followed by temporary truces and deadline extensions. If no extension is agreed upon in the coming days, we could see a fresh wave of tariff talk with China, adding volatility to the market. Headlines on this front are almost certain and price swings may follow.

The second and arguably most important event will be the release of US inflation data. CPI and PPI figures are due on Tuesday and Thursday night (AEST), marking the first of two inflation readings before September’s US interest rate decision. Markets are currently pricing in the first rate cut of the year, but recent data has sent mixed signals about the Fed’s intentions. This week’s readings could be pivotal in providing the clarity markets are looking for.

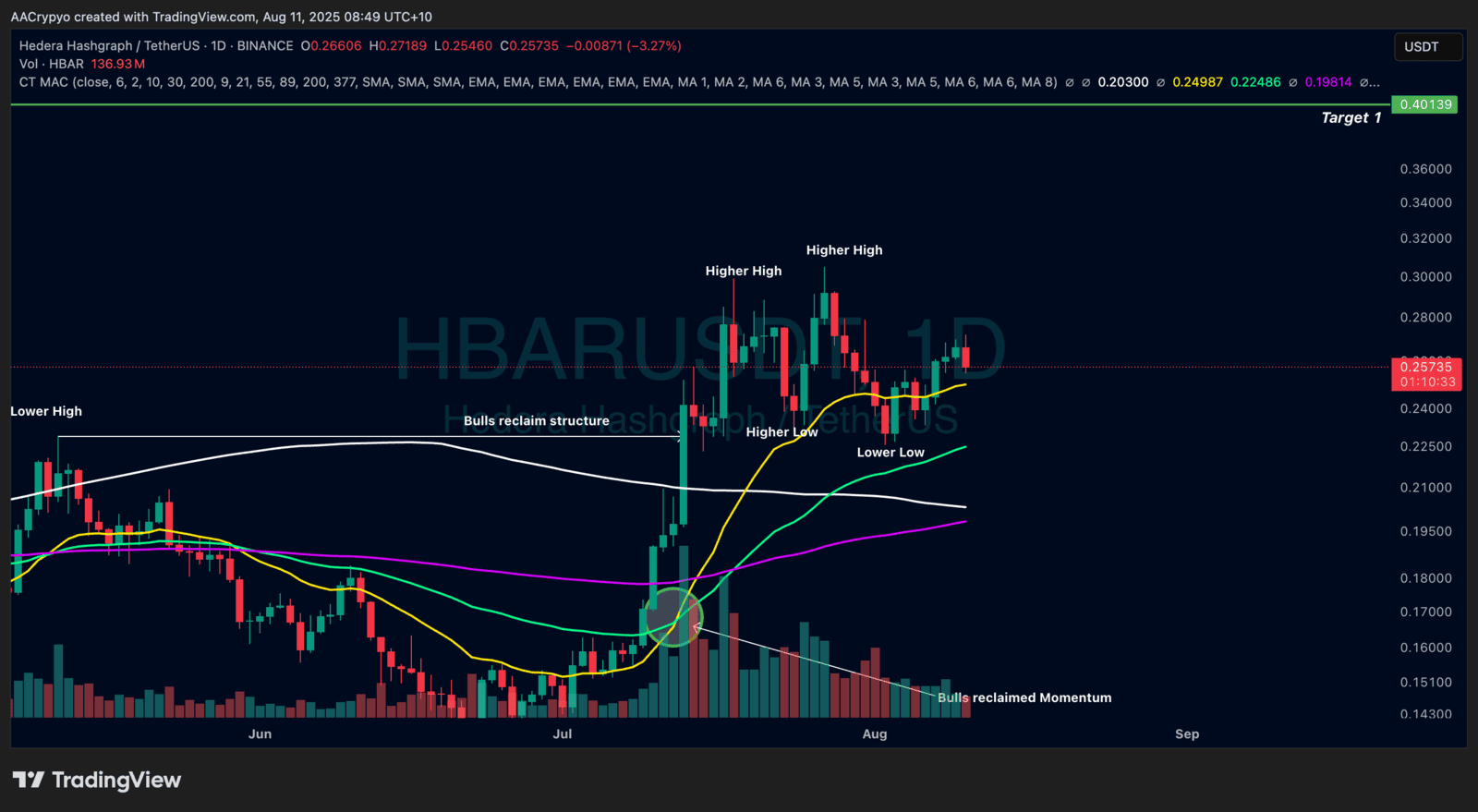

Stormrake Spotlight: Hedera (HBAR) ($0.257)

Stormrake Spotlight: Hedera (HBAR) ($0.257)