To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

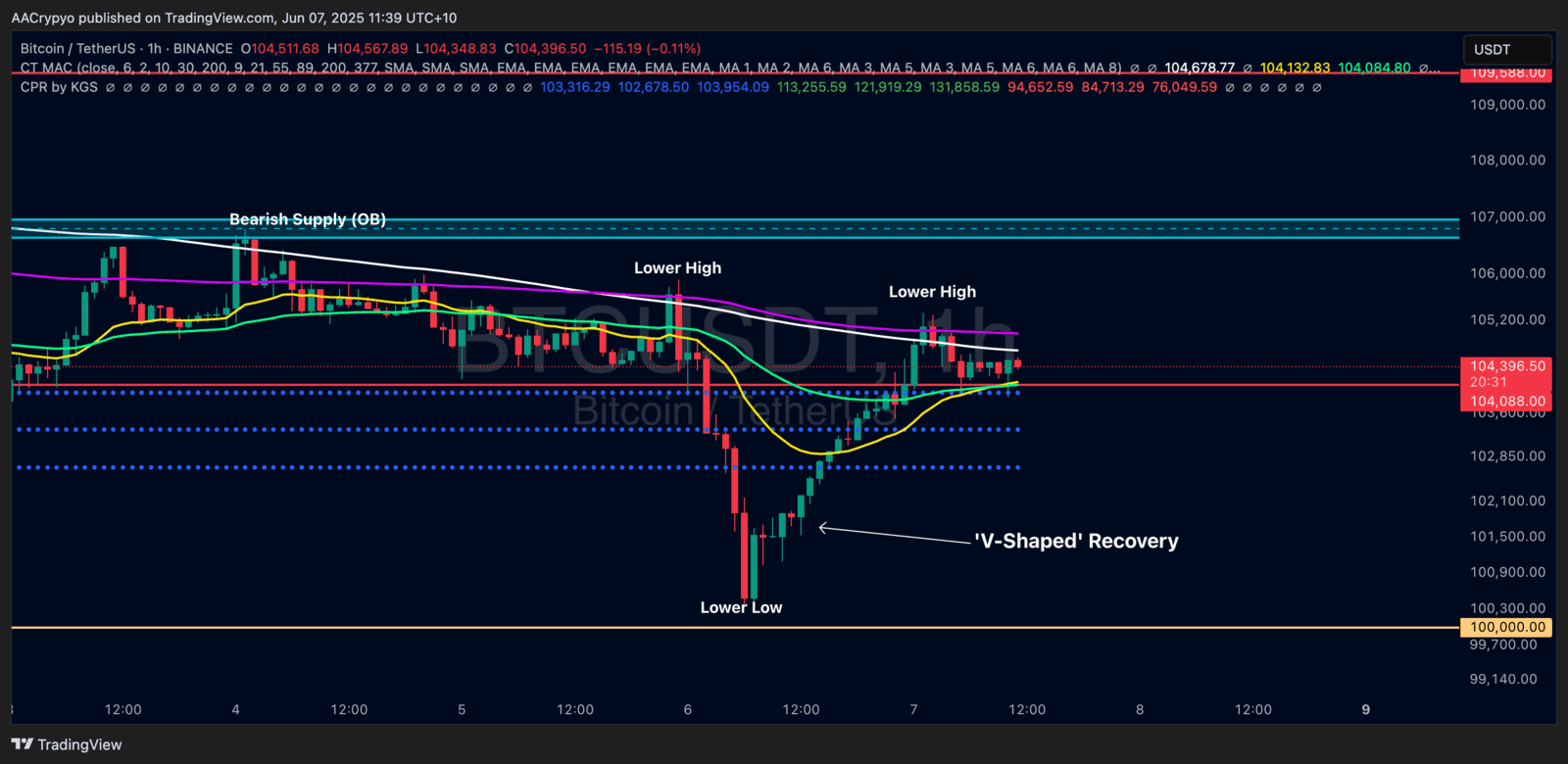

After the public fallout between Donald Trump and Elon Musk, Bitcoin tumbled back to $100K, dragging sentiment into fear territory. However, over the past 24 hours, BTC has staged a sharp rebound—ripping back above $104K with a textbook ‘V-shaped’ recovery that nearly erases the entire pullback. As a result, sentiment has shifted back into neutral territory, with the Fear & Greed Index now reading 52, up from yesterday’s fear levels.

Altcoins joined the bounce, but unlike Bitcoin, most remain below their pre-fallout levels. The exception was Sui, which surged nearly 10% and is now trading above where it stood before the political disruption.

Trump Refocuses on Powell

The White House swiftly shut down rumours of a Trump–Musk phone call, signalling no progress on that front. Instead, Trump has pivoted back to Jerome Powell, posting repeatedly on Truth Social. He called Powell “Mr Too Late” and urged a 100bps rate cut at the next FOMC meeting—suggesting that even if inflation ticks back up, rates could be raised again. Trump also teased that he’s ready to announce his pick for the next Fed Chair.

All this sets the stage for Thursday night’s CPI print, a key data point that will shape expectations ahead of the Fed’s interest rate decision the following week.

Weekend Watch: Bitcoin at a Crossroads

This weekend is critical. The momentum BTC reclaimed must hold to set the tone for what’s likely to be a volatile week. If strength continues, bulls could be gearing up for a push to new all-time highs. But a rejection could drag BTC back below the $100K mark.

Stormrake Spotlight: Bittensor (TAO) ($367)

Stormrake Spotlight: Bittensor (TAO) ($367)

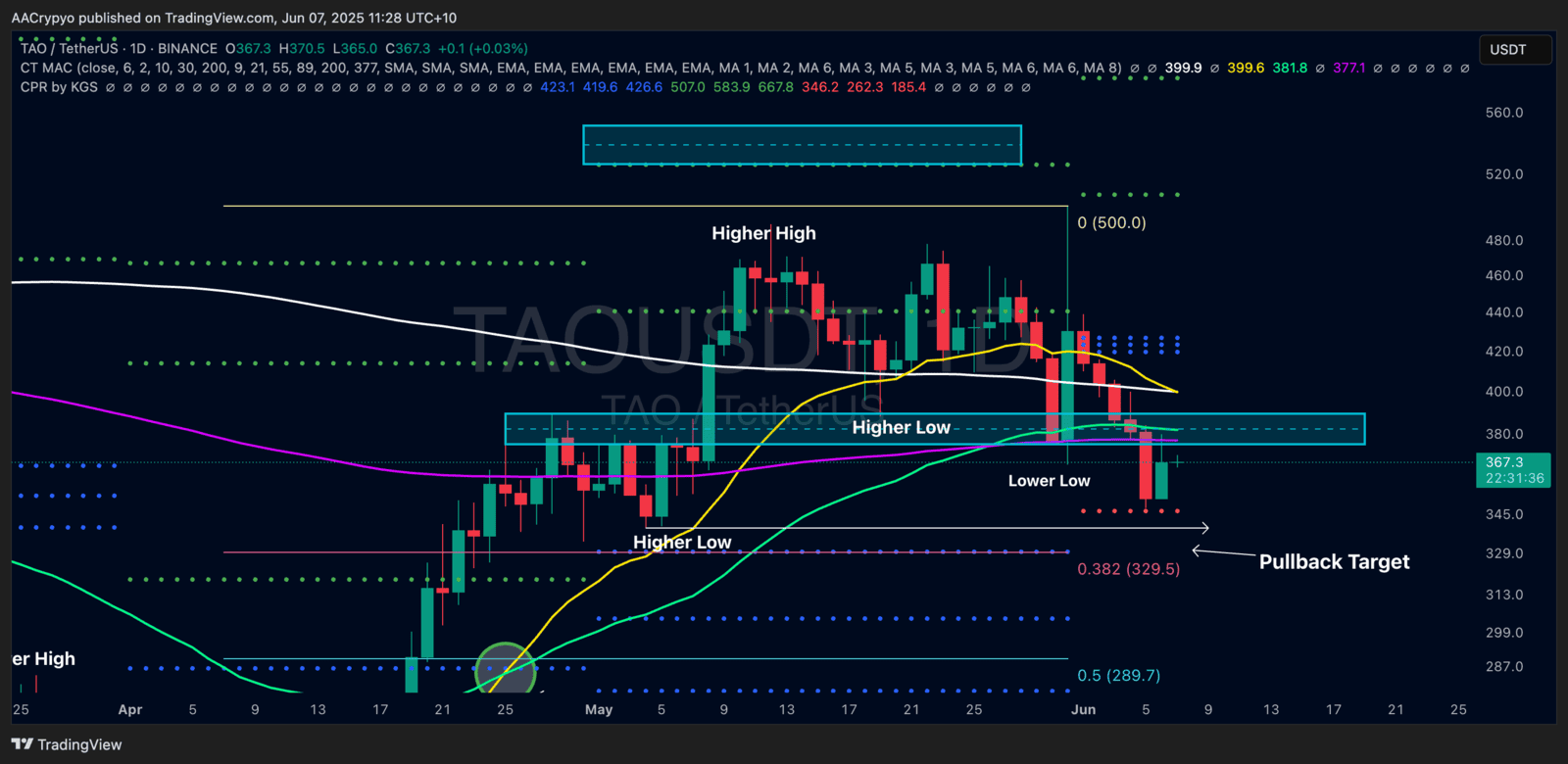

TAO mirrored the broader altcoin market—bouncing 4.5% on the day—but still trades below pre-fallout levels. Price respected CPR support at $347, which now acts as the key short-term level. The bears are pressing, attempting to stall the recovery.

As noted yesterday, TAO will follow BTC’s lead, so the path of least resistance still lies with Bitcoin’s next move.

BTC/USD Key Levels and Price Action:

BTC/USD Key Levels and Price Action: