To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

The bulls have done well to hold the line and are now building once more on the momentum they’ve carried into October. Bitcoin is back above $123K, less than 2.5% from its all time high, and could very well challenge it in the next few days. To confirm yesterday morning’s low as a proper higher low, we need to see a new high printed. Ideally, this would be a higher high that pushes us through $126K and confirms a fresh all time high.

We also received the FOMC minutes this morning, giving us a recap of last month’s meeting when the first rate cut of the year took place. The committee was in full agreement that a cut was necessary in September. The only disagreement was over how many more cuts to expect before year end. With just two meetings left in 2025, members were split between two 25bps cuts or a total of 75bps across both meetings. The vote landed at 10 to 9 in favour of two 25bps cuts. The more cuts we see, the more bullish it is for risk on assets, but regardless of the split, the overall situation remains bullish.

Meanwhile, the US government shutdown is largely being ignored by markets but it is a clear hindrance for policymakers. While the government is shut down, the Bureau of Labor Statistics (BLS), the agency responsible for publishing monthly jobs data and CPI, halts operations. This means the key data the Fed typically relies on will not be available, leaving them to make decisions without up to date input. Markets expect the shutdown to last at least another 24 days, which would take us past the rate decision on the 29th. Despite this, there is still a 92.5% chance we see a 25bps cut this month, followed by a near 80% chance of another 25bps cut in December.

In other markets, gold has breached $4,000 for the first time in its history, while silver sits at $49.55, less than 1% away from the key $50 level. Traditional indices also bounced, led by tech stocks, with the S&P 500 posting its 33rd all time high of the year and the Nasdaq printing its 32nd.

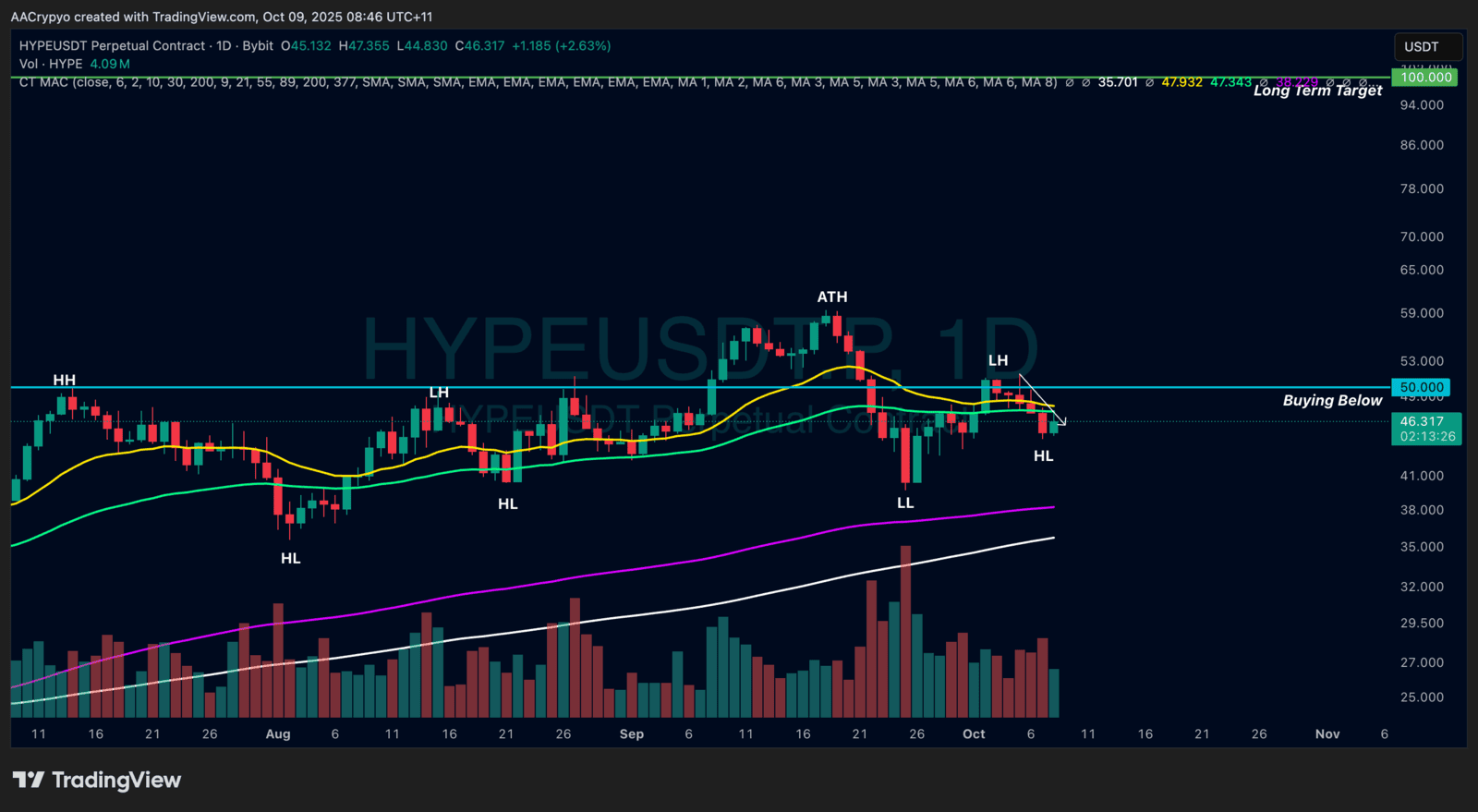

Stormrake Spotlight: Hyperliquid (HYPE) ($46.31)

Stormrake Spotlight: Hyperliquid (HYPE) ($46.31)