To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

A weekend dominated by tariff headlines and statements from key global figures saw tensions flare further between the US and China, while the European Union pushed back against Trump's sweeping 50% tariff on steel imports. Despite the geopolitical noise, Bitcoin shook off its recent bearish streak, closing both Saturday and Sunday in the green—a strong start to the month.

Trump’s across-the-board 50% steel tariffs have rattled even close allies. Both Australia and the EU have expressed strong disapproval, with the EU stating it “strongly regrets” the move and is preparing “countermeasures.” This comes just a week after Trump threatened a similar tariff on the entire EU, only to delay its implementation until July to allow for negotiations. Brussels argues that the tariff hike “undermines” ongoing efforts to reach a trade deal.

Meanwhile, the US-China feud continues to unravel any recent progress. Diplomatic barbs are being traded almost daily. China labelled the US as the “biggest threat” to regional peace and stability, while Pete Hegseth warned on Friday that China is “credibly” preparing for military action, calling the threat “imminent.” US Treasury Secretary Bessent accused China of withholding critical industrial goods, further fraying trade relations. Although both sides agreed to a 90-day tariff pause to negotiate, signs of progress are limited. Trump is reportedly planning a call with Xi later this week to break the deadlock.

Looking ahead, Jerome Powell— the man who moves markets with a single word—is set to speak tomorrow morning. Questions will likely centre on Trump’s tariff moves, recent court rulings, and the broader state of the US economy. With an interest rate decision due later this month, current expectations suggest an almost 100% probability of no change in rates.

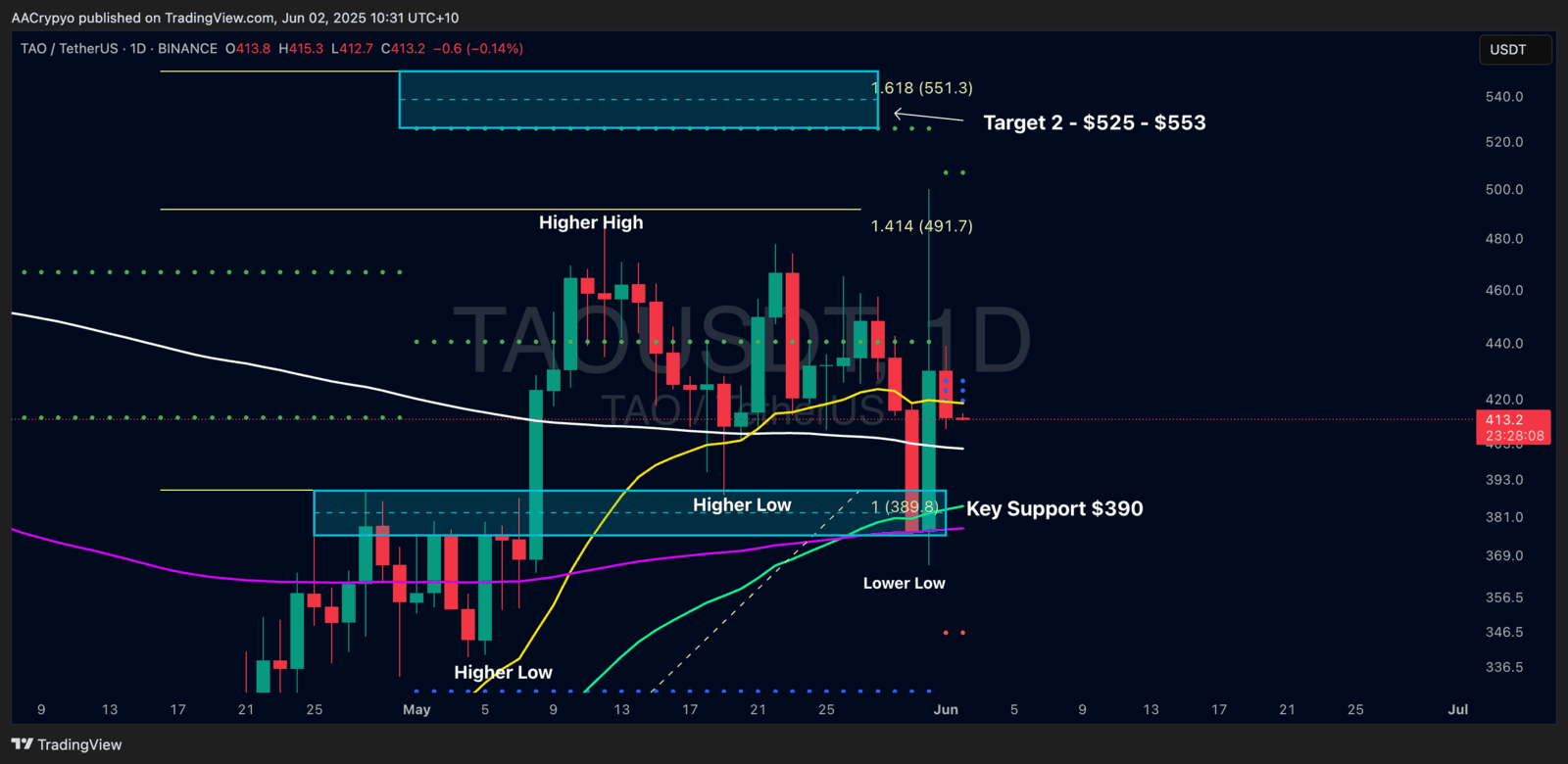

Stormrake Spotlight: Bittensor (TAO) ($413)

Stormrake Spotlight: Bittensor (TAO) ($413)

Since Saturday’s Morning Note, TAO is up over 12%, rebounding cleanly from the $390 support level highlighted on the chart—a bullish signal showing strong demand at this key area. While TAO remains in a broader bearish structure, characterised by a series of lower highs and lower lows, the weekend’s bounce indicates the bulls are not done yet. A reclaim of the 21EMA, which currently acts as resistance, would open the door for a higher high and potentially flip the structure in favour of the bulls.

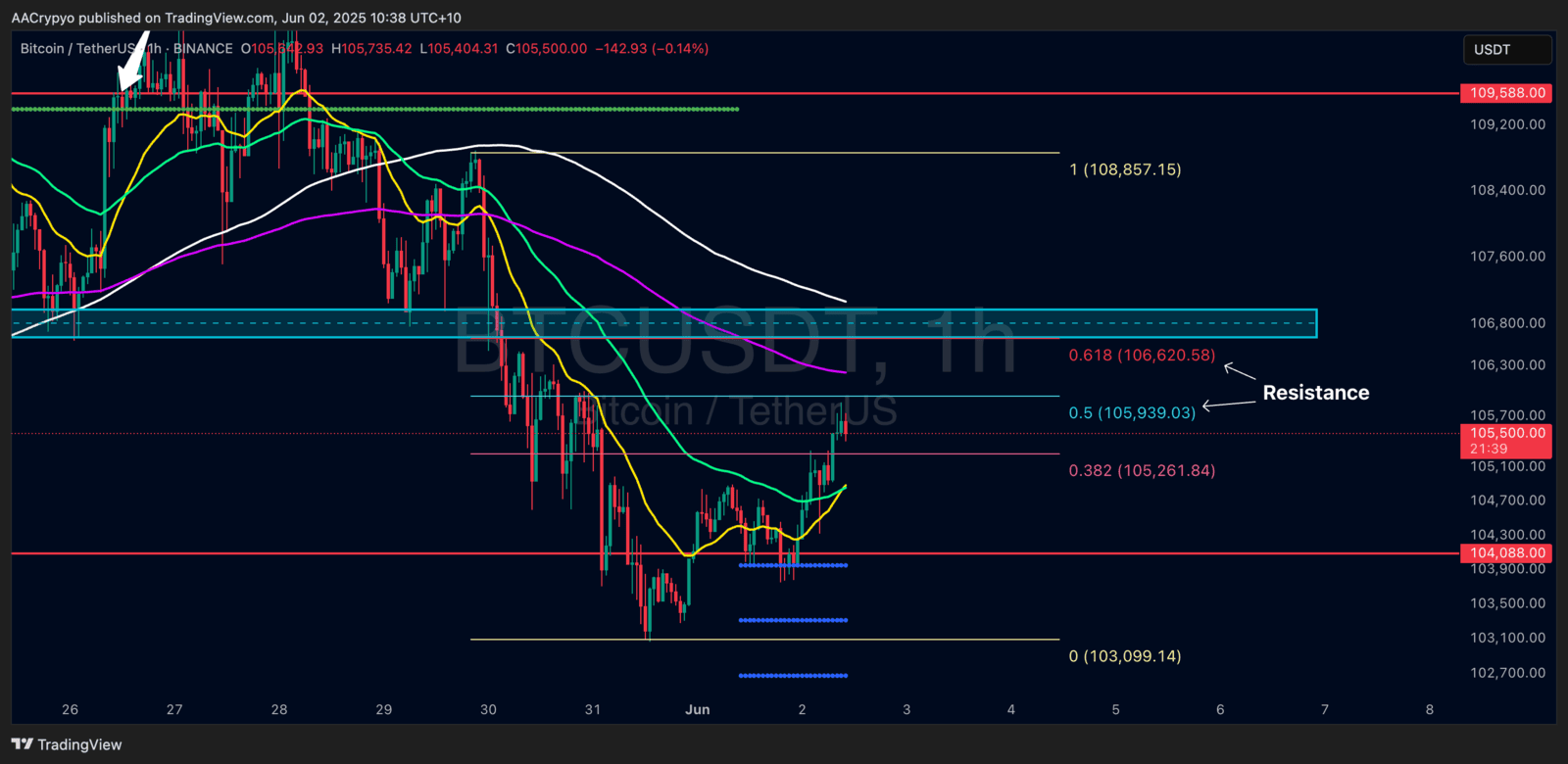

BTC/USD Key Levels and Price Action:

BTC/USD Key Levels and Price Action:

Source: