To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Gold, which began as a status symbol and was revered as the “flesh of the gods” in Ancient Egypt around 3000 BC, has remained a constant through changing empires, conflicts and economic shifts. Across thousands of years, gold has maintained its position as the go to store of value. Why? It is scarce, difficult to extract, cannot be manufactured in a lab, and has a truly limited supply. These traits make it resilient in the face of currency debasement.

For over 5,000 years gold is still the quintessential risk off asset. Silver, its long time counterpart, has followed suit. In times of uncertainty, investors continue to move into gold. Its track record speaks volumes, outlasting currencies and systems, consistently preserving value, whether measured against the Great British Pound, the US Dollar or any other fiat currency used in global trade. It was, at one point, the global monetary system itself.

When Bitcoin was first created, it quickly picked up the label of ‘digital gold’ due to its programmed scarcity, capped supply and mining difficulty. For a time, the correlation between Bitcoin and gold was positive, particularly during the early stages of adoption. But since 2020, we have seen a clear divergence. Gold typically rallies during risk off periods, while Bitcoin performs better in high liquidity and risk on environments.

The past 12 months have shown this divergence more clearly than ever. The two assets now share more in monetary characteristics than in price action. Heightened global uncertainty from tariffs, trade wars, geopolitical tension and structural economic fragility has kept investors cautious. As a result, gold has outperformed while Bitcoin has underperformed. This dynamic is not new and we have covered it many times.

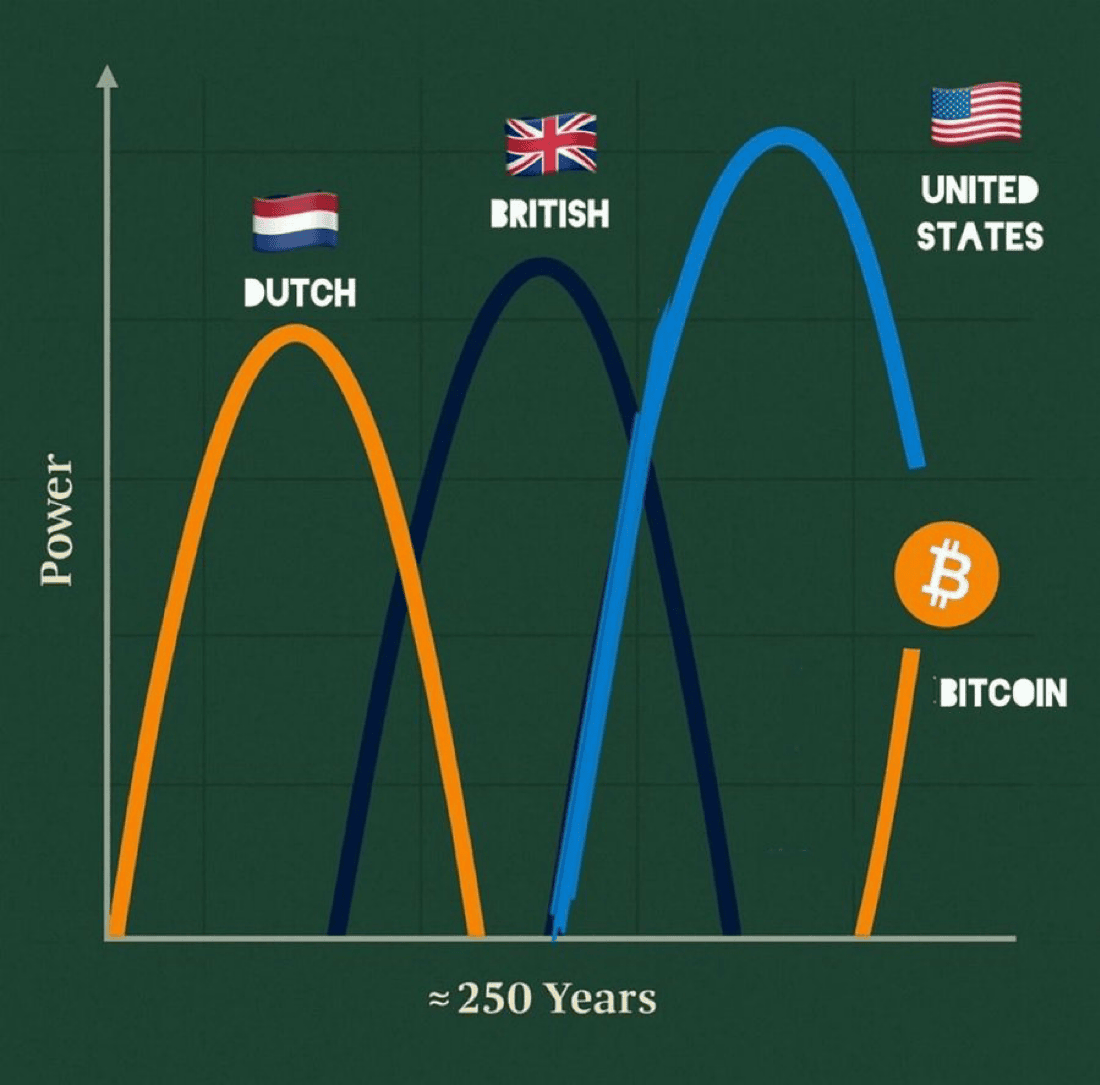

But we are not here to argue that Bitcoin is the new safe haven or a replacement for gold. What is emerging now is a different thesis, one built around a potential global monetary reset. As fiat currencies continue to erode in purchasing power and trust in traditional systems weakens, many investors are looking for an alternative. The US Dollar, still the dominant global currency, is rapidly losing ground. Not just in value, but in credibility. Countries are increasingly exploring alternatives and reducing their reliance on USD.

Enter Bitcoin, not as digital gold but as peer to peer cash, built for a trustless world. It stays true to its original purpose, enabling value transfer without the need for a third party. The advantages Bitcoin holds over other alternatives are clear. It is highly divisible, borderless, and can be transacted and settled within minutes at minimal cost. These qualities make it one of the most suitable candidates to become the next global reserve currency.

So no, Bitcoin is not trying to replace gold as the next safe haven. Nor is it just a high beta tech stock or a risk on speculative asset. What we are seeing is a bet. A growing conviction that Bitcoin could become the next global reserve currency in the wake of a broader monetary shift. The reset has begun.

Stormrake Spotlight: Pax Gold (PAXG) ($4,962)

Stormrake Spotlight: Pax Gold (PAXG) ($4,962)