To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

It was a quiet overnight session for Bitcoin, holding steady around $115K with a modest gain of less than 0.20%. But the same can’t be said for altcoins. Hyperliquid led the charge among majors, while several others came close to posting double-digit gains on the day. It has been a strong 48 hours for alts, especially considering the drawdowns over the weekend. While most, if not all, remain below their Friday levels, the bounce has opened clear accumulation opportunities, which still remain as the broader crypto market trades below all-time highs.

Most of the volume overnight was in the traditional space. The Nasdaq and S&P500 both recovered well and are now less than 2% from their respective all-time highs. Meanwhile, gold and silver printed fresh highs, with silver surging over 4% and now trading above $52. It seems trade war and tariff concerns have cooled for now, as risk assets across the board have moved higher since last weekend’s threats. That is a welcome signal for all markets, especially crypto, which took the hardest hit. Still, the Bitcoin Fear and Greed Index sits in fear territory at 38, unchanged from yesterday despite BTC holding above $115K.

More than likely, we have seen the lows for this move. If Bitcoin can clear $118K, the all-time high discussion will be back on the table and ‘Uptober’ can resume in full. Until then, the market is still offering plenty of discounted entries for quality projects. Make sure you are taking advantage.

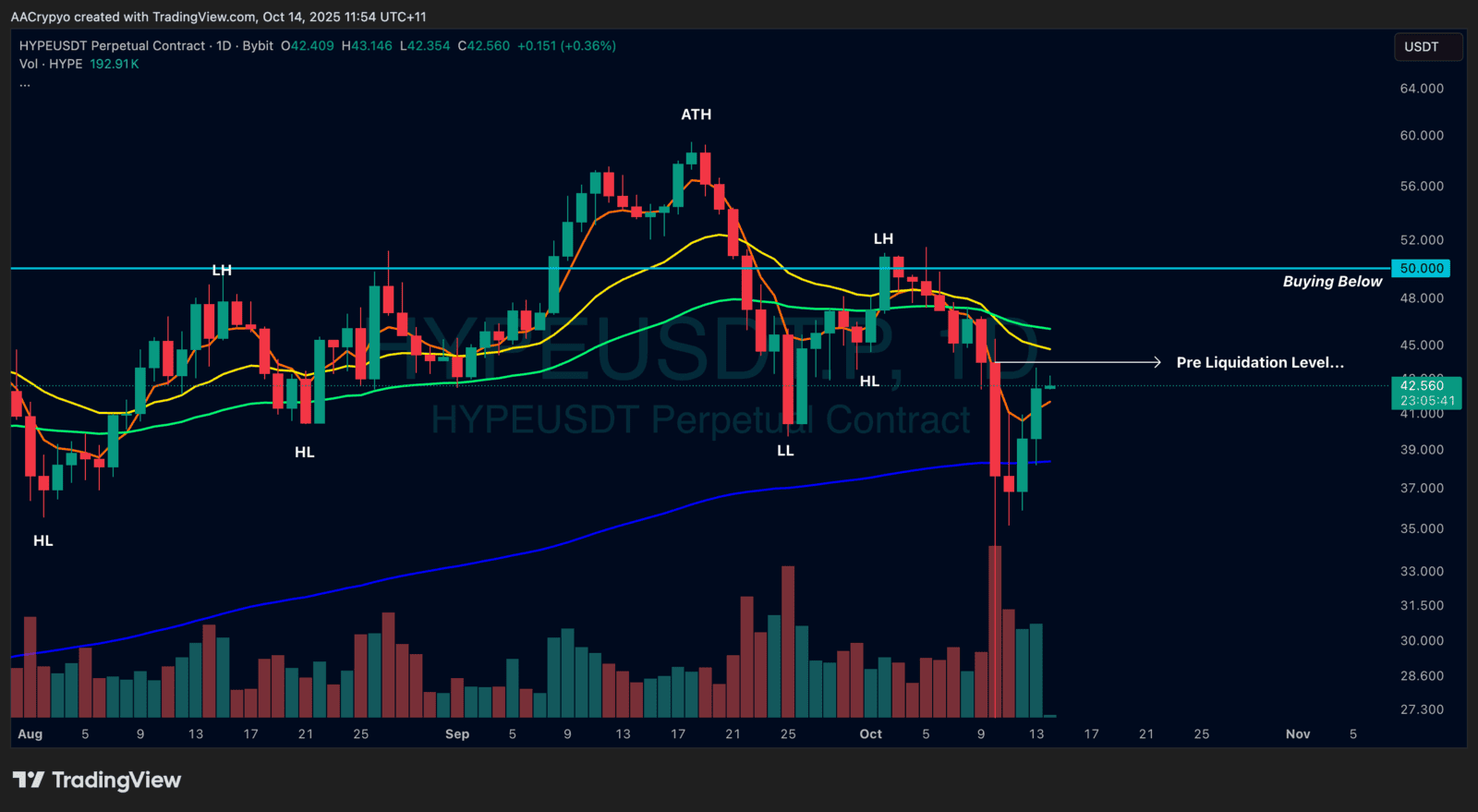

Stormrake Spotlight: Hyperliquid (HYPE) ($40.14)

Stormrake Spotlight: Hyperliquid (HYPE) ($40.14)