To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

It was a slow weekend across the cryptospace as the conflict in the Middle East continues to escalate. Bitcoin remains in a reactive, “wait-and-see” mode. Crypto investors are sitting on their hands while traditional markets continue rotating into risk-off assets amid heightened geopolitical uncertainty.

Despite Trump claiming “we can easily get a deal done between Iran and Israel” and even suggesting it’s “possible” the US could become involved, Iran has told mediators in Qatar and Oman that it won’t agree to a ceasefire while still under attack.

This uncertainty has fuelled rallies in both Gold and Crude Oil. Oil is hovering near $75 per barrel, and analysts warn prices could climb as high as $130. Iran currently produces 3.3 million barrels per day, around 3.5% of global supply. A move to $130 would likely double inflation to ~5%. This all unfolds just days before the FOMC’s next interest rate decision, where no cut is expected. Instead, all eyes will be on Powell’s presser, which should give insight into how the Fed views the inflationary risks tied to this conflict.

Gold is celebrating. Over the weekend, it marked its highest-ever daily close, now less than 2% from it’s all-time high.

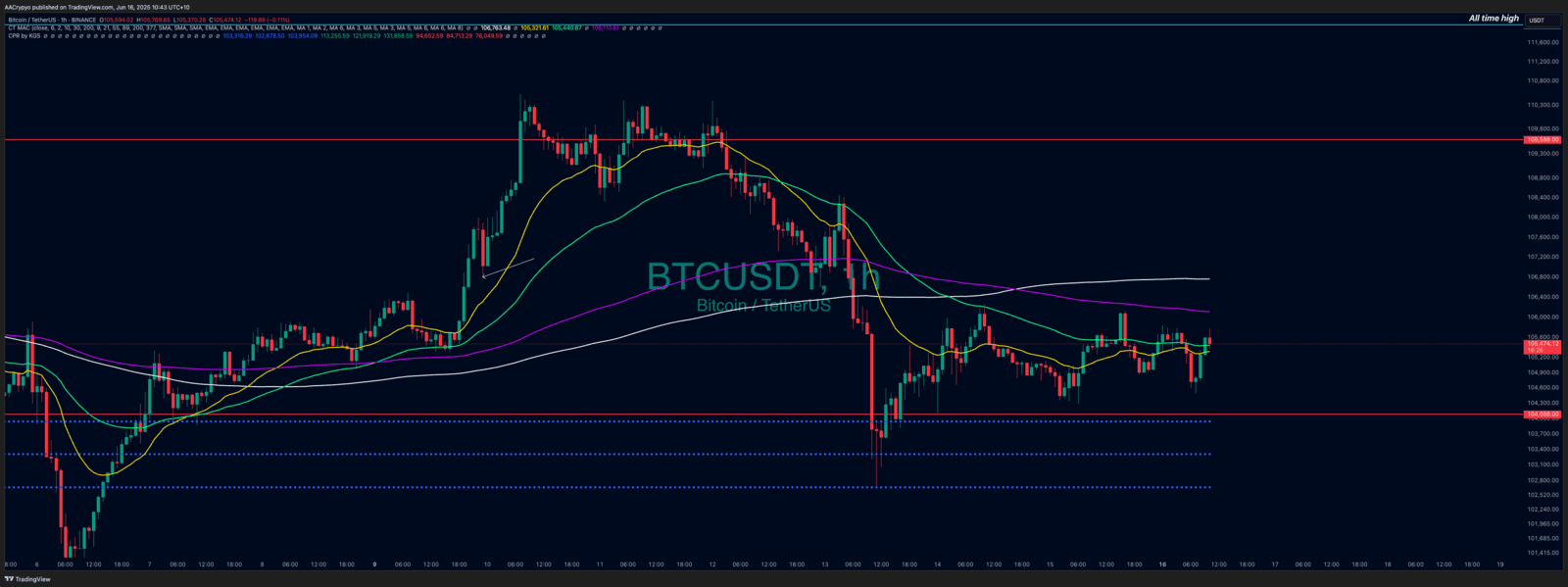

Bitcoin has moved less than 1% since Saturday’s morning note, and the broader market remains subdued. The coming week will be shaped by the Middle East conflict and Powell’s remarks on Thursday. Market sentiment has stabilised around a 60 reading, still in the “greed” zone. If Bitcoin does pull back further, it should be viewed as an opportunity to accumulate. Historically, war has often marked strategic buying zones with strong returns over time.

Stormrake Spotlight: Hyperliquid (HYPE) ($41.37)

Stormrake Spotlight: Hyperliquid (HYPE) ($41.37)

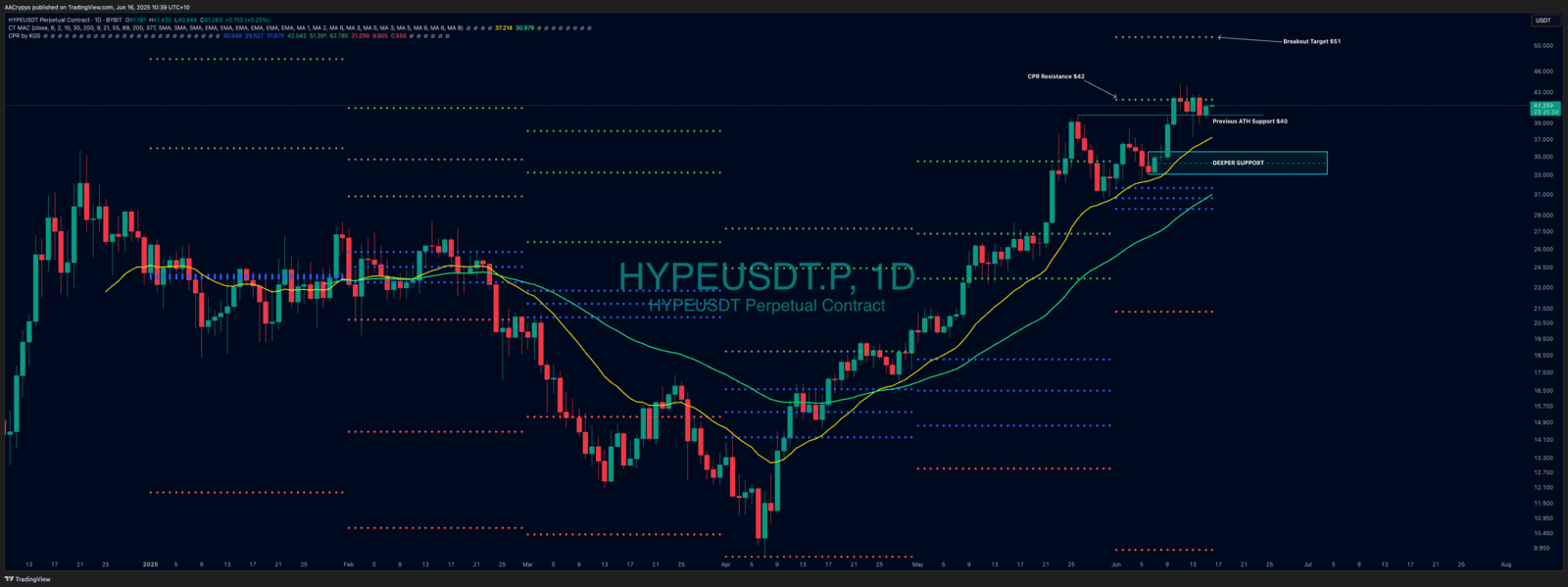

Hyperliquid returns to the Stormrake Spotlight. First featured in early January at $25, HYPE is once again making waves, now trading above $41. After bottoming at $9.30 in early April, HYPE has been the standout performer.

While most of the market has pulled back due to macro tensions, HYPE has not. Instead, it’s entered a bullish consolidation phase, currently holding above its previous all-time high. A clean break above $42 should see a move toward $52. On the downside, deeper support lies at $33, though this would likely only be tested if Bitcoin were to retrace well below $100K, a scenario that currently seems unlikely.

BTC/USD Key Levels and Price Action:

BTC/USD Key Levels and Price Action: