To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

We have a big macro week ahead, with a potential breakthrough in the conflict in Eastern Europe on the cards, and Jerome Powell set to speak following last week’s conflicting inflation data.

Just a few days after his meeting with Russian President Vladimir Putin, President Trump is set to meet Ukrainian President Volodymyr Zelensky and European leaders in Washington to discuss the war. Although no agreement was struck last week, there was reported progress: Putin would accept a ceasefire in exchange for the Donbas region, which has seen the bulk of the fighting since the war began. That proposal is anathema to Zelensky, who has consistently said Ukraine will not hand over the Donbas for peace. That stance may be tested at the upcoming meeting. It would be Zelensky’s first return to the White House since their contentious meeting in February. Trump posted on Truth Social, “BIG PROGRESS ON RUSSIA. STAY TUNED!” overnight ahead of the talks. Reports suggest he backs ceding the Donbas to secure peace and is leaning on Zelensky to agree.

The meeting is scheduled within the next 24 hours, so we should expect headlines. If a ceasefire is agreed, it would be bullish for risk-on assets and could extend the recent strength towards fresh all-time highs.

That story is likely to dominate the week until Friday, when Jerome Powell speaks at the Jackson Hole Symposium. His remarks should offer clarity on last week’s mixed inflation prints: CPI came in line with forecasts and even fell year on year, whilst PPI overshot expectations and pressured risk-on markets.

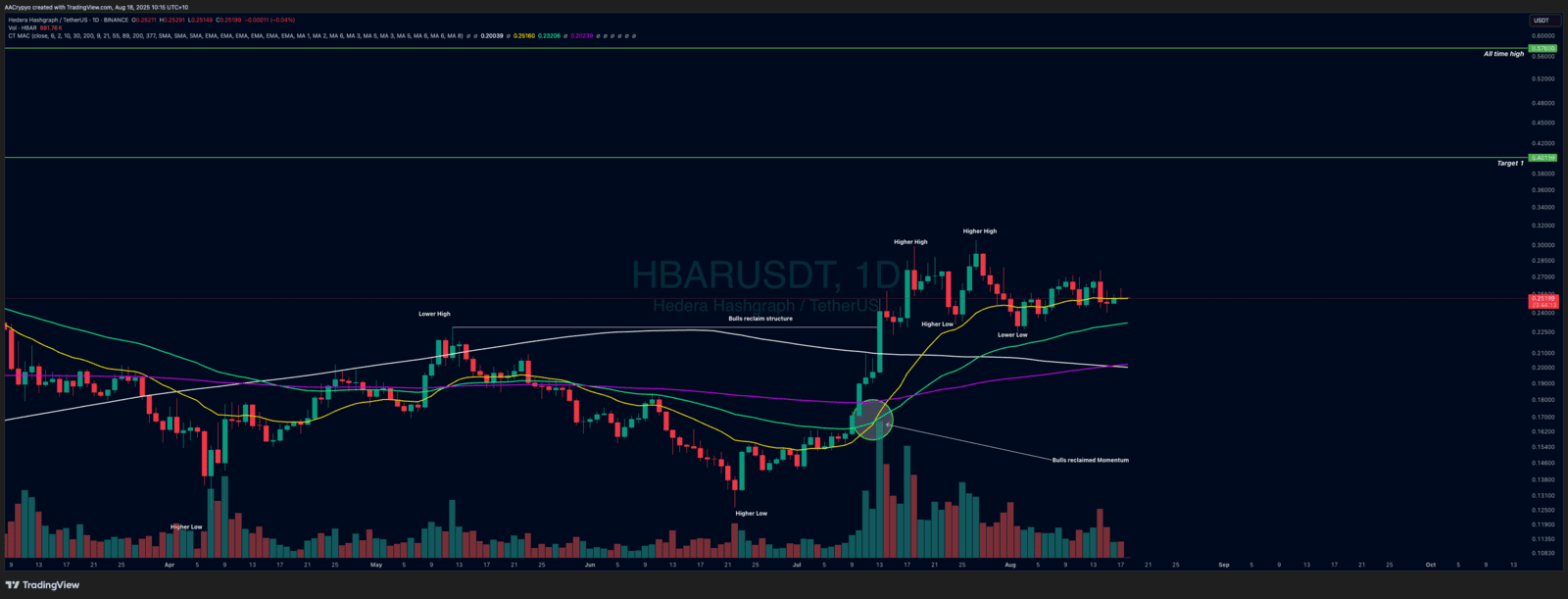

Stormrake Spotlight: Hedera (HBAR) ($0.252)

Stormrake Spotlight: Hedera (HBAR) ($0.252)