To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

The last 24 hours have marked a full recovery for Bitcoin as investors regained their risk appetite. BTC is up over 6%, erasing its early week weakness and re-entering the familiar range we saw throughout most of last week. It was a clear risk on session with the Nasdaq rallying on the back of strong performance from tech stocks.

It is as if Monday’s pullback never happened. We are back at weekend price levels and this move appears to be driven by institutional flows rather than speculative noise. Spot Bitcoin ETFs posted a record breaking $5.1 billion in volume over the last 24 hours. This suggests the rally was supported by real spot buying and sustained volume which is a healthy sign for the strength of this potential recovery.

On the macro front, Trump has effectively confirmed Kevin Hassett as his intended pick for the next Federal Reserve Chair. Hassett is currently the Director of the National Economic Council of the United States and is well known for his dovish stance. He has previously supported Trump’s calls for more aggressive rate cuts and is expected to maintain a similar stance if appointed. The official decision is expected before Christmas.

Markets responded positively to the news. There is now an 89% probability of a 25 basis point cut next week and a 65% chance of at least three rate cuts in 2026. This shift has boosted sentiment and adds further weight to an already bullish macro outlook for the year ahead.

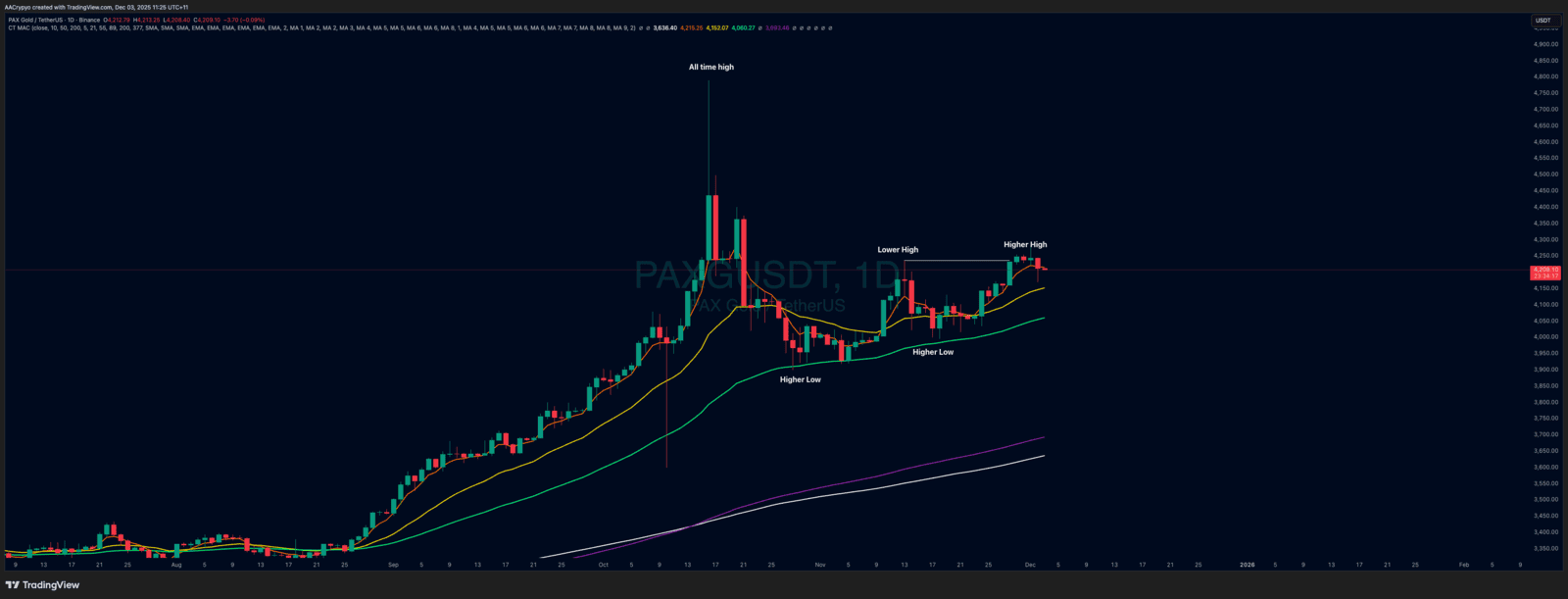

Stormrake Spotlight: Pax Gold (PAXG) ($4,209)

Stormrake Spotlight: Pax Gold (PAXG) ($4,209)