To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

A relatively quiet day for Bitcoin and the broader crypto market, while traditional risk-on assets continue to push higher. Bitcoin closed just 0.33% lower than its open, despite briefly trading above $108K intraday. Altcoins, however, continue to struggle, with the total altcoin market cap down another 1.22% yesterday.

Since the Israel-Iran ceasefire, sentiment has clearly shifted back toward risk-on, but the momentum hasn’t fully made its way into crypto. Yes, Bitcoin has bounced nearly 10% from the lows following the US attacks on Iran, but unlike its traditional counterparts, it remains under pressure below its all-time high. The Nasdaq is now in price discovery territory, up nearly 1% and trading above previous all-time highs. Meanwhile, the S&P 500 is less than 0.10% away from setting a new high.

As we noted yesterday, a typical rotation from risk-off to risk-on assets often sees capital first flow out of havens like gold, into traditional equities, and then into crypto. That flow still looks to be in motion. As long as Bitcoin holds this consolidation range without breaking down, a run toward new all-time highs remains in play.

Over the past few weeks, markets have been hyper-focused on the Middle East conflict, but now tariffs are back on the radar. Trump's 90-day pause on his “liberation tariffs” ends in under two weeks. Without deals in place, the tariffs imposed in early April could resume.

Overnight, Trump announced the signing of a trade deal with China. A potential deal with India is now in discussion, and the European Union has confirmed readiness to negotiate as well. These developments could bring some clarity to what has been an extremely volatile economic backdrop through the first half of the year. If these deals hold, the back half of 2025 could see reduced surprises, lower volatility and more policy certainty, which would be welcome news for both investors and market sentiment.

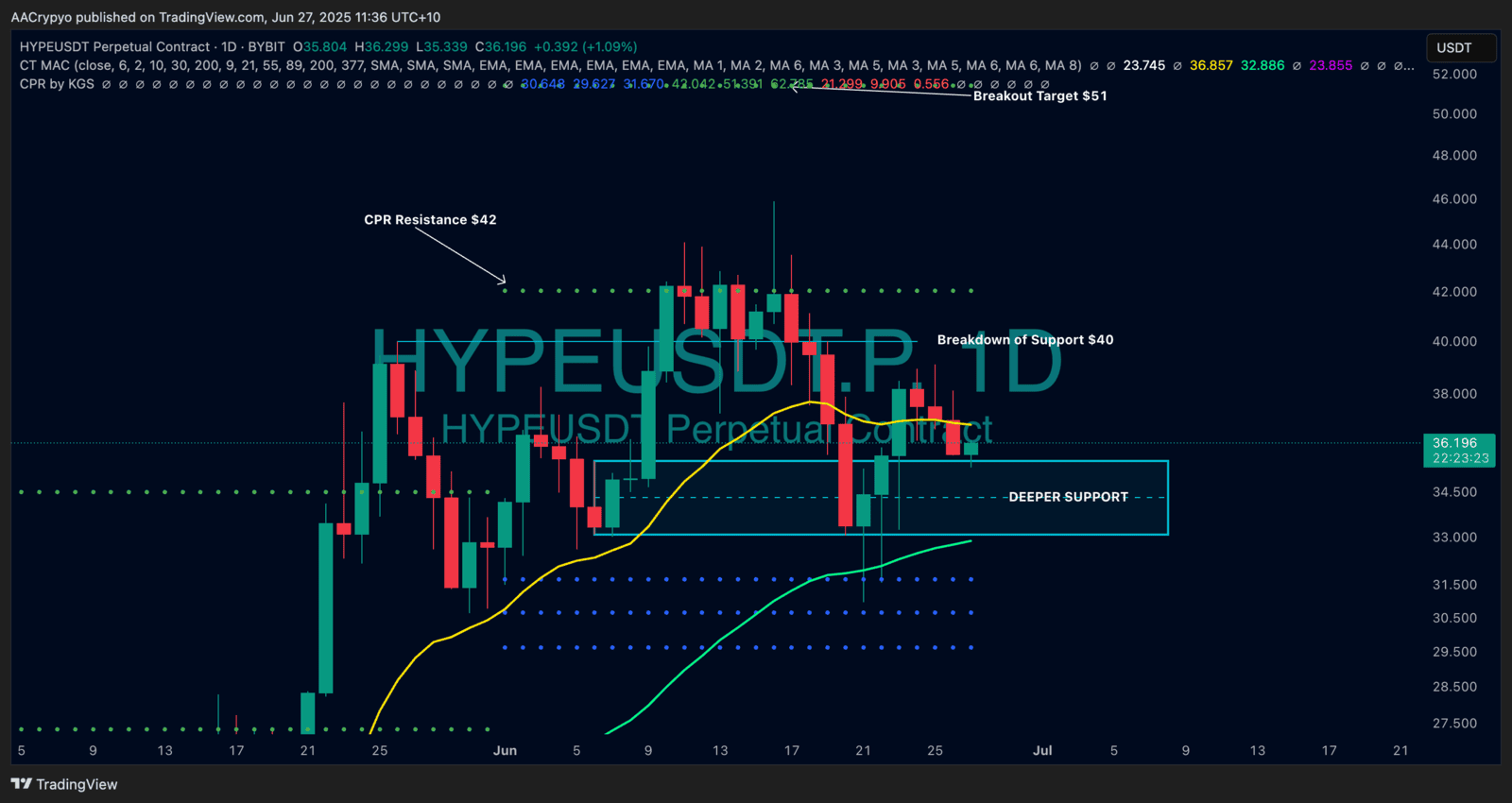

Stormrake Spotlight: Hyperliquid (HYPE) ($36.22)

Stormrake Spotlight: Hyperliquid (HYPE) ($36.22)