To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Yesterday, we covered how silver was manipulated for over a decade following JP Morgan’s acquisition of Bear Stearns’ books and short positions during the Global Financial Crisis.

Now, attention turns to Bitcoin.

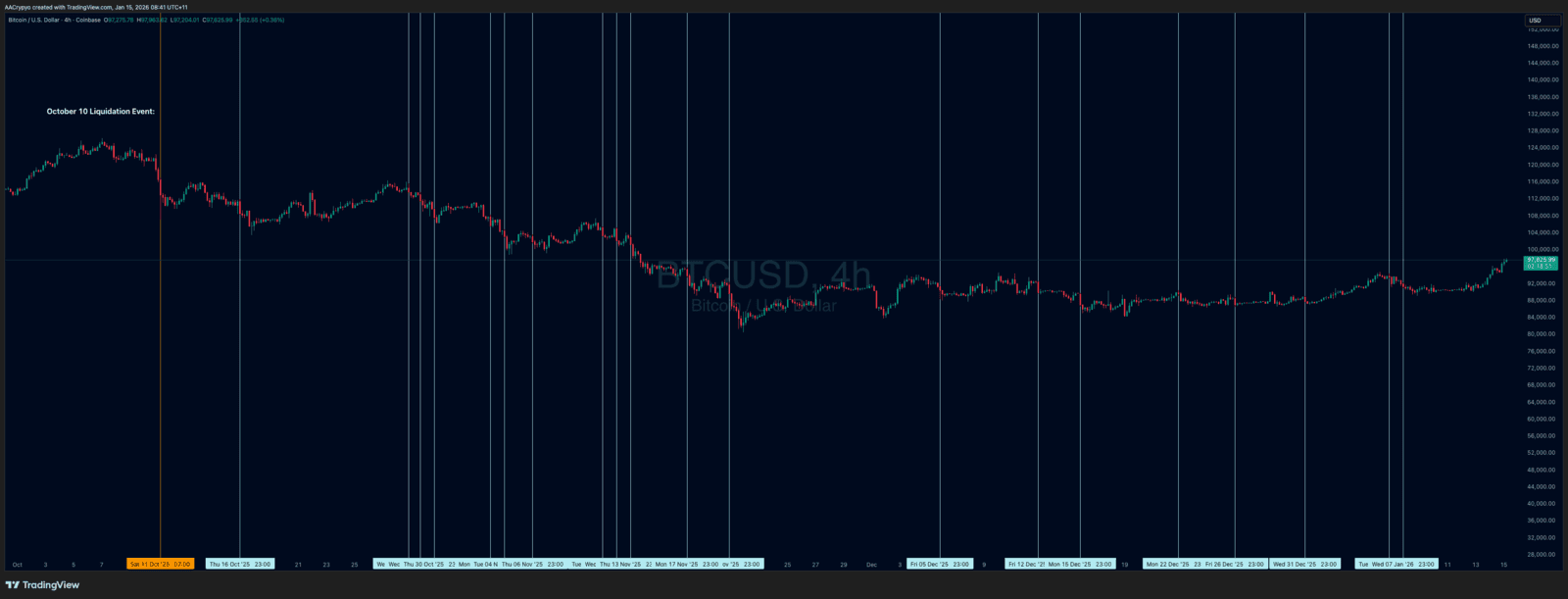

Since the October 10 capitulation, Bitcoin has been a major underperformer, diverging sharply from other risk assets. While equities and commodities push to all-time highs, Bitcoin remains down over 20% from its all time high. This underperformance has triggered questions about whether price suppression is in play, and whether we’re seeing echoes of what happened in the silver market.

We know that several market makers were hit hard in October, left with significant holes in their balance sheets. To stabilise, those that survived shifted their priorities from providing liquidity to preserving capital.

In the aftermath of the crash, we saw clear structural shifts in market behaviour. Quote sizes shrank, spreads widened, and risk appetite dropped. More notably, assets were offloaded not in a panic but through deliberate and systematic selling. The goal was to reduce exposure, rebuild capital buffers, and stay within internal risk limits.

There’s also been consistent chatter that not all market makers survived the event. Some are rumoured to have been absorbed or backstopped by larger players or exchanges. While specific deals are rarely public, the pattern fits with previous periods of stress.

A useful comparison is the Bear Stearns collapse. When JP Morgan took over, they didn’t just acquire the company, they inherited its positions. Those didn’t disappear; they had to be managed and gradually unwound, which led to over a decade of silver price manipulation.

If failed market makers were absorbed by exchanges or larger funds in October, the same logic applies. The distressed inventory doesn’t vanish. It eventually has to be redistributed into the market. When that happens in a low-liquidity, low-risk appetite environment, it can lead to sustained, flow-driven selling that suppresses prices even without any formal coordination.

That’s exactly what we’ve seen in recent months.

Bitcoin and altcoins struggled to sustain any rallies. Each attempt was met with aggressive selling, driving prices lower, classic signs of a seller-dominated market. It’s visible in the charts: rallies faded quickly, and momentum consistently failed to follow through.