To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

For the first time this week, Bitcoin has posted a bearish US session, dropping nearly 3% within the hour after yet another failure at the yearly open. It now sits back at $90K. As a result of the overnight dip, sentiment has slipped back into extreme fear, with the index printing 23.

We are now three weeks on from Bitcoin’s low at $80K. Since then, price has bounced over 10% and largely remained in consolidation. Sentiment has stayed subdued, but bears have lost some steam to push price lower. They continue to defend the yearly open, while bulls lack the strength to reclaim it for now but have shown enough demand to keep Bitcoin from breaking down further.

This week marked the first half of what has been a volatile fortnight. US interest rates and Jerome Powell took centre stage. The outcomes leaned bullish and were felt across traditional markets, with indices hovering near all-time highs. Gold and silver continue to lead, while Bitcoin remains locked in a month-long range.

Looking ahead, next week should be the peak of December’s volatility. The Bank of Japan is set to announce its rate decision, which is likely to include a hike. Historically, this does not bode well for risk-on assets. Higher rates raise the cost of borrowing yen, leading to a potential unwind of the yen carry trade. This forces institutions to sell off risk assets like equities and crypto to repay the borrowed yen. The decision and press conference are scheduled for Friday, and markets should expect heightened volatility around the event. It could also be the final major macro catalyst of the year and may decide whether Bitcoin closes 2025 in the green or red.

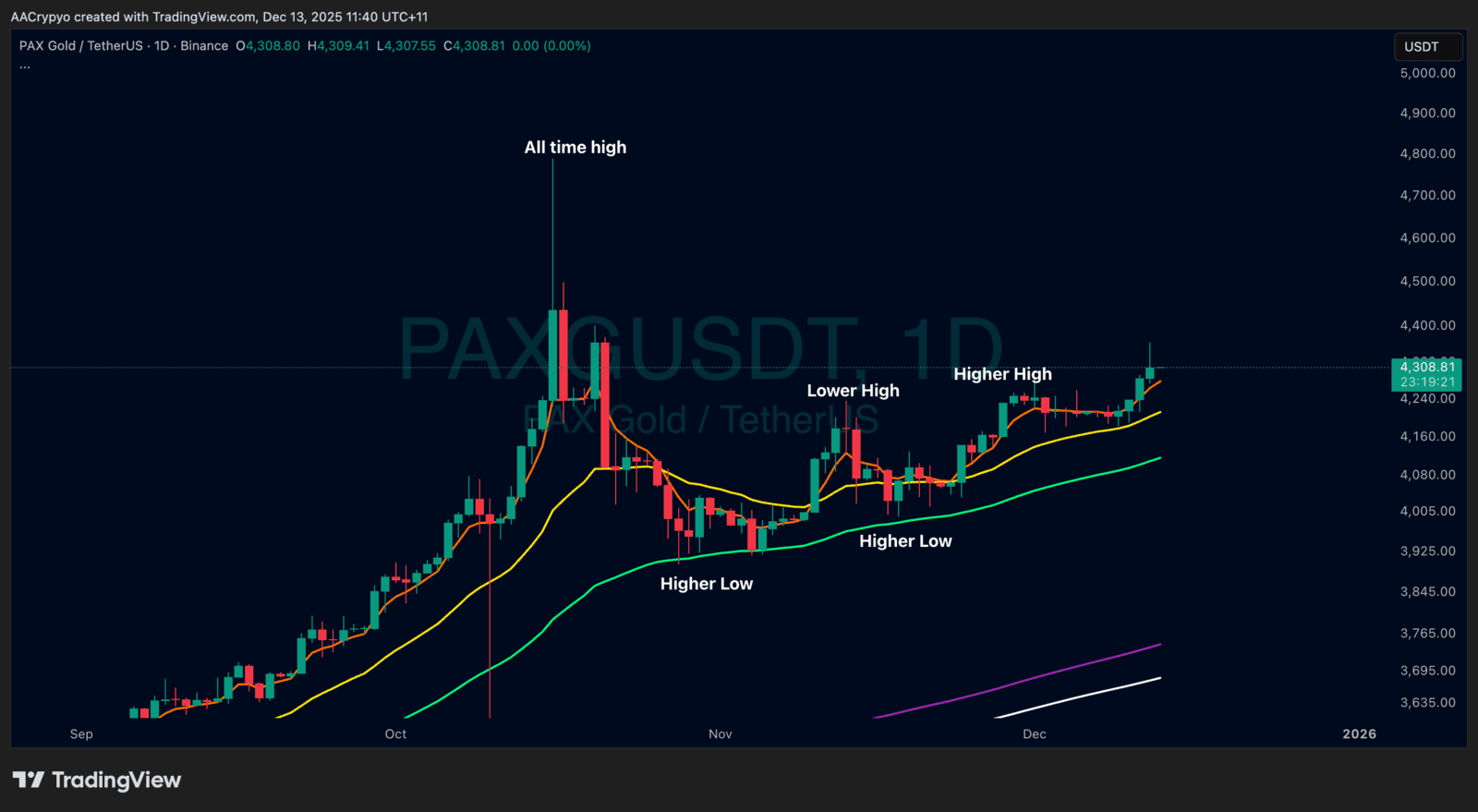

Stormrake Spotlight: Pax Gold (PAXG) ($4,308)

Stormrake Spotlight: Pax Gold (PAXG) ($4,308)