To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Bitcoin has taken a step in the right direction with strong price action yesterday, climbing above $111K. The rally kicked off during the opening hour of the US session for the first time since last week, with BTC gaining over 2% in that initial move. The patient wait for US flows to return to the market appears to have paid off, as the bulls are finally showing signs of life.

Gold has broken into new territory with an all-time high above $3,500, rallying nearly 2% on the day. The question we raised yesterday has now been answered. Bitcoin is following gold’s momentum, moving in tandem as a risk asset hedge. While the S&P500 and Nasdaq closed green, they opened lower than Friday’s close, making it a net-negative day for both indices.

Most of the crypto market joined the relief rally. Solana was up over 5%, Chainlink more than 4%, and XRP climbed nearly 4%. One major name lagged behind. Ethereum. Despite broader market bullishness, ETH struggled to hold gains, hovering around $4,300. The underperformance stems from the Ethereum Foundation announcing it is selling 10,000 ETH (worth $43 million). While the dollar amount isn’t hugely significant, the fact that the sale is coming from the Foundation itself has dented sentiment. Retail tends to react quickly to headlines without digging into context, which has weighed on price action.

In macro news, there was a notable step forward in crypto adoption. The SEC and CFTC have now allowed spot trading of select cryptocurrencies on registered US exchanges. This means Bitcoin could soon be traded directly on the New York Stock Exchange, a major win for institutional access and further adoption.

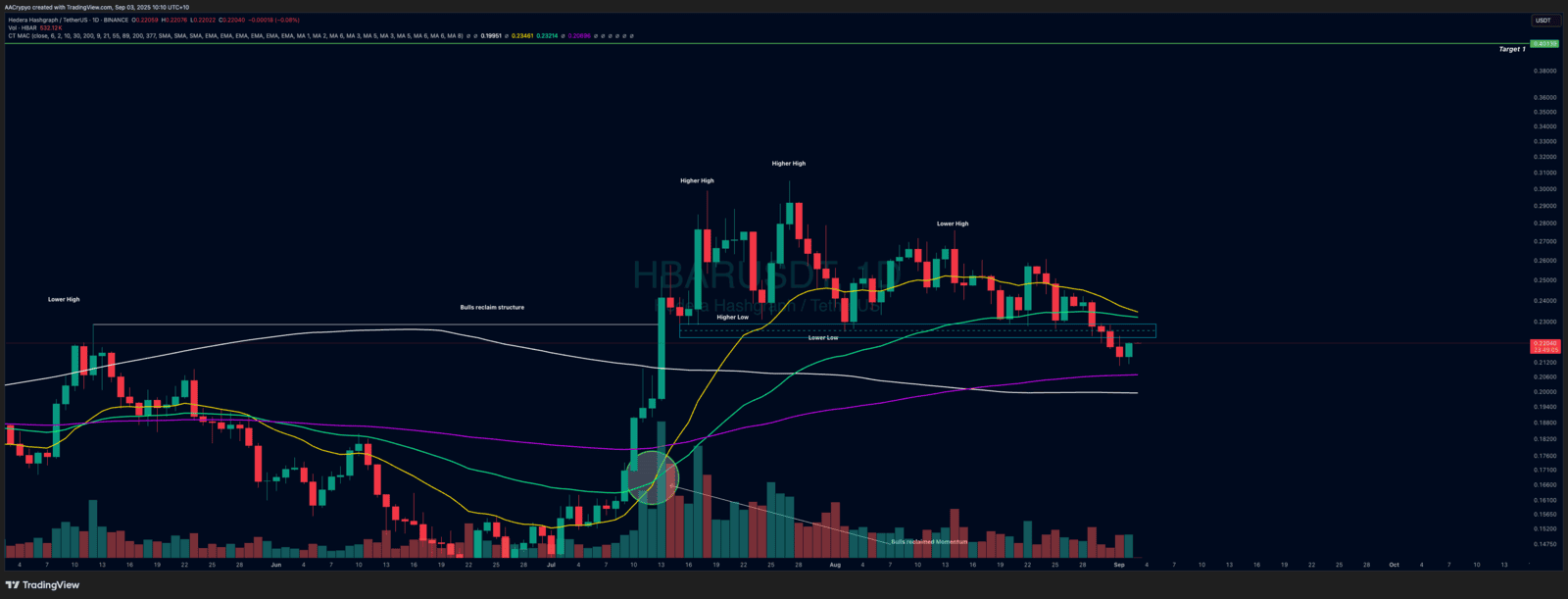

Stormrake Spotlight: Hedera (HBAR) ($0.220)

Stormrake Spotlight: Hedera (HBAR) ($0.220)