To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Yesterday, Bitcoin sentiment flipped back to extreme fear as price dropped to $86K, with many calling for lower levels. But before you could blink, Bitcoin surged above $90k just a few hours later, triggering what is known as a bear trap.

A bear trap occurs when prices break down and appear ready to move lower, which tempts traders and investors to open short positions. Instead, the market reverses sharply and moves higher, trapping and liquidating those shorts. A bull trap is the opposite. Price rallies, traders take long positions, then the market quickly reverses and moves lower.

That is exactly what played out overnight. Bitcoin jumped over 2% in less than an hour, just as it seemed ready to break lower. Shorts were caught offside and liquidated as price moved higher. But before bulls could celebrate reclaiming the key consolidation range that Bitcoin needs to re-enter to have a real shot at turning the year green, the very next hourly candle flipped red. Bitcoin dropped nearly 3% in that single hour, liquidating the late longs who had chased the move in classic bull trap fashion.

Although liquidation volumes remain relatively small compared to the events of 10 October, around $500 million in positions were wiped out over the past 24 hours.

As expected, volatility is building as we move closer to the Bank of Japan’s policy decision, now roughly 24 hours away. Traders should be prepared for more sharp moves leading up to the announcement, during it, and in the reaction that follows.

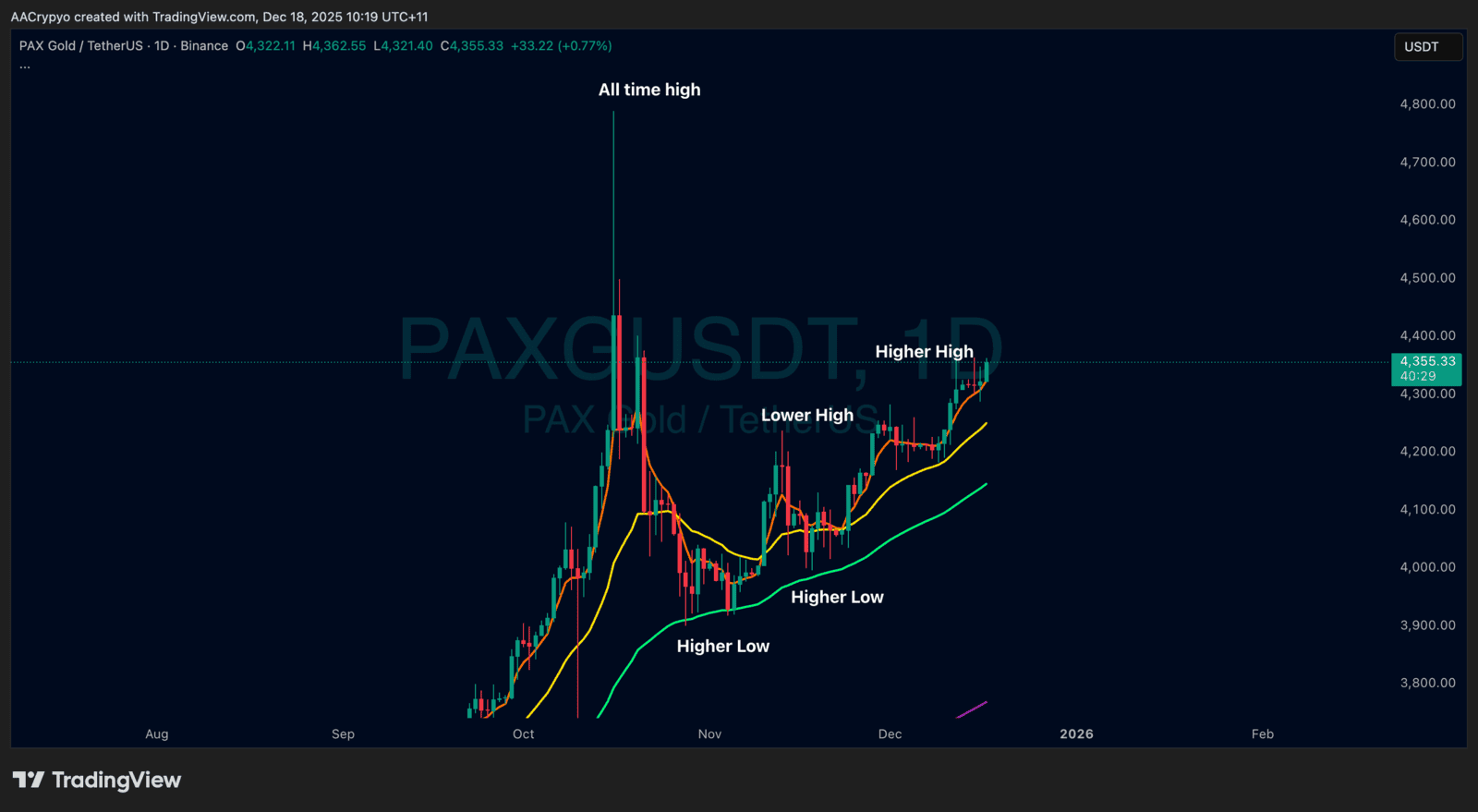

Stormrake Spotlight: Pax Gold (PAXG) ($4,355)

Stormrake Spotlight: Pax Gold (PAXG) ($4,355)