To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

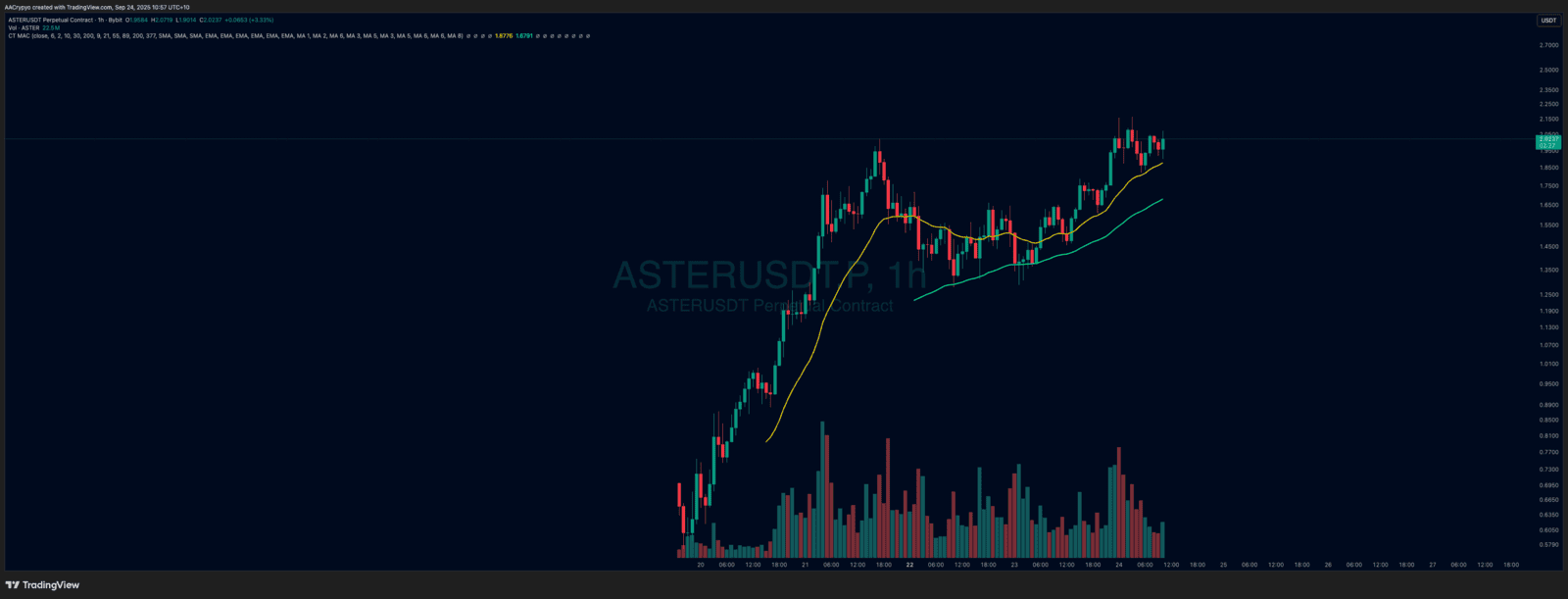

The bulls are fighting to hold the key support and previous all-time high at $112K. As the broader crypto market consolidates, ASTER continues to leave the space in awe, climbing another 20+% and pushing back above $2.

This consolidation period, following a record liquidation event, is a positive sign. It shows there’s strong buying interest around current price levels, which managed to absorb significant sell pressure. The fact that we remain above $112K confirms that the bull run is still intact. This should be seen as an opportunity to accumulate more Bitcoin and strong altcoins ahead of what is shaping up to be a pivotal Q4.

Meanwhile, capital continues to flow into hard assets such as gold and silver. Gold has printed another all-time high at $3,791, already up over 2% since the start of the week. Silver has pushed above $44 for the first time since August 2011. Both the S&P 500 and Nasdaq retreated slightly in the overnight session following cautious remarks from Federal Reserve officials and renewed concerns about the sustainability of the current AI-driven equity rally. But both indices remain at all-time highs and should not be faded. This kind of broad market strength inevitably trickles down into crypto. It’s no coincidence we are consolidating just days before ‘Uptober’…

Stormrake Spotlight: Aster (ASTER) ($2.02)

Stormrake Spotlight: Aster (ASTER) ($2.02)