To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Bitcoin continues to battle with the upper end of the range it’s been stuck in for the past week. Markets were mixed, some coins ended green on the day while others dipped. Bitcoin was up over 2%, Ethereum closed red, Solana extended its strong run with a 5% gain, and both Sui and Hyperliquid remained in bullish form.

This is a prime opportunity for the bulls. If they can break through the $120K resistance, we could see a retest of the all-time high and a potential push towards $130K before month-end.

Jerome Powell delivered no surprises today, no indication of next week's rate decision, no response to recent criticism or resignation rumours. Despite fake headlines circulating about an official resignation, Powell remains firmly in place, with only a 22% chance of being replaced according to Kalshi. The market still expects two rate cuts later this year, with the first likely in September, a historically bullish setup for risk assets.

Overnight, new tariff deals were made between the United States, Japan, and the Philippines. Markets barely reacted, having become largely desensitised to these smaller announcements. Still, it’s a reminder that tariff tensions haven’t disappeared.

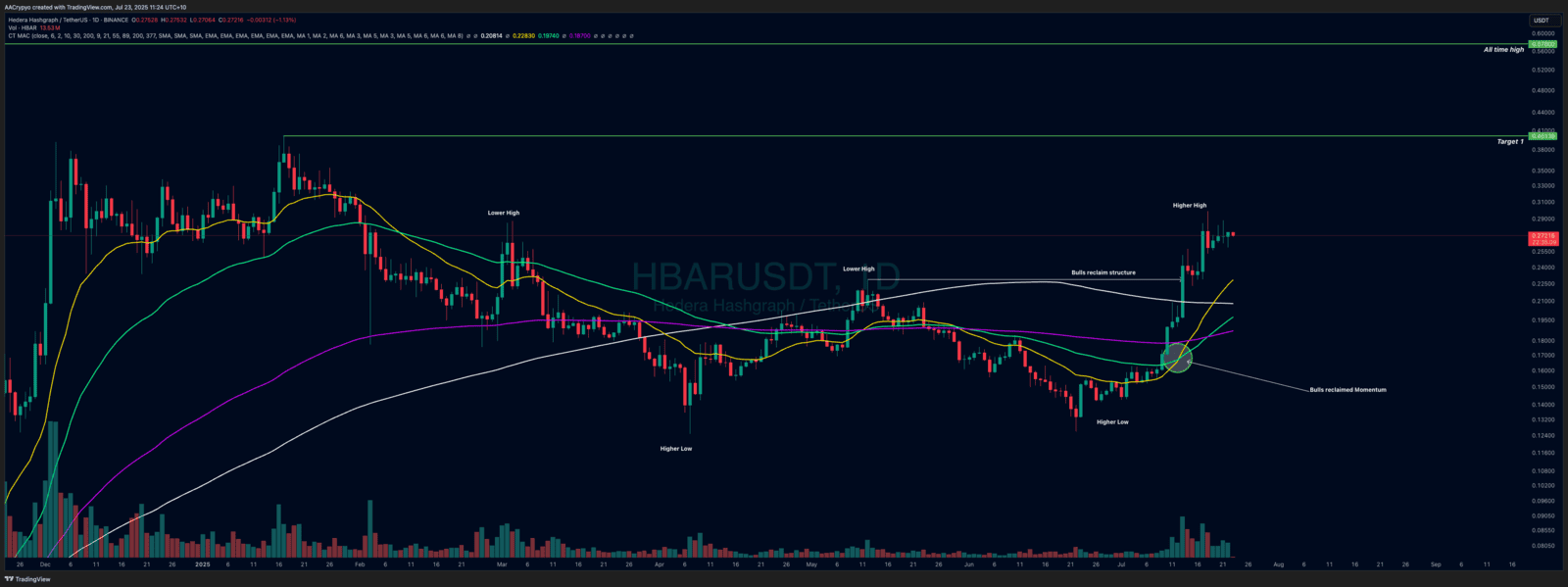

Stormrake Spotlight: Hedera (HBAR) ($0.272)

Stormrake Spotlight: Hedera (HBAR) ($0.272)