To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Bulls fought hard to reclaim Bitcoin, but it didn’t take long for momentum to flip. Since Tuesday morning’s high, Bitcoin has pulled back over 4%, printing a bearish engulfing candle on the daily, a clear sign of weakness. This weakness is reflected not just in price action, but in sentiment too, as the Fear & Greed Index dropped 16 points back into neutral territory at 52, the largest single-day decline since early April (Liberation Day). The move follows renewed escalation in the Israel-Iran conflict, which continues to weigh heavily on broader market sentiment.

US Involvement Looms Large

Fears are rising that the US could enter the Middle Eastern conflict. While Washington already supplies military equipment to Israel, as Trump publicly boasted, they have yet to engage Iran directly. That may be about to change. Israeli Prime Minister Netanyahu has stated he believes the US will join the war within days. Meanwhile, the Pentagon has increased air deployments in the region.

New reports suggest US strikes on Iran, including potential hits on nuclear sites, are “on the table,” according to White House officials. Trump is reportedly considering these options. In response to rising tensions, the US has closed its embassy in Israel for the rest of the week.

The writing’s on the wall. All signs point to direct US involvement. The question now is, would that drag China or Russia into the fold? For now, it’s speculation. But if a broader war does break out, we can expect significant market volatility and a swift move to risk-off assets. Gold would likely rally sharply, while Bitcoin may see an immediate sell-off.

Still, as covered in yesterday’s note, smart money has historically used such geopolitical corrections as strategic entry points. Just two months after similar events, Bitcoin has typically rebounded and traded higher.

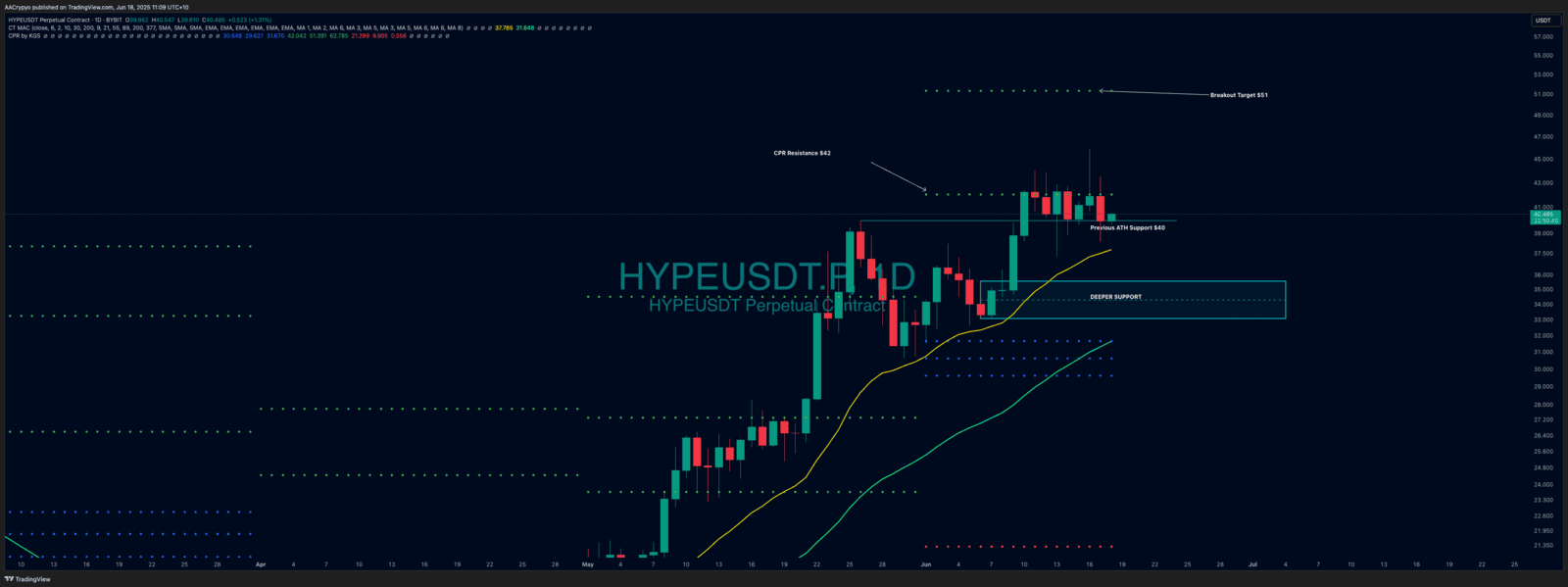

Stormrake Spotlight: Hyperliquid (HYPE) ($40.48)

Stormrake Spotlight: Hyperliquid (HYPE) ($40.48)

Source: