To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

It seems the bears may be starting to lose their grip on the market. Bitcoin is slowly climbing back above $115k, while altcoins are beginning to rebound, with Ethereum leading the charge. ETH is up over 6% and looks poised to break out against Bitcoin once again.

The broader market was green across the board as traditional risk-on assets recovered sharply. After shedding over $1 trillion in market cap on Friday, equities bounced back by more than $1 trillion today, fuelled by strong large-cap tech earnings and renewed AI enthusiasm. Trump was quick to celebrate the rally, declaring that “there will be many more days like this,” despite his own actions often being the trigger for market dips.

One of the drivers behind the recent correction was the renewed tension with Russia and the threat of sanctions on nations that continue to trade with them. India reaffirmed over the weekend that it would maintain trade with Russia. In response, Trump announced overnight that the US will continue raising tariffs on Indian goods. Interestingly, markets largely shrugged this off. What actually moved sentiment was a different Trump post entirely – his comments about Sydney Sweeney.

Following the release of Sweeney’s new American Eagle ad, the retailer’s share price jumped more than 30%, with a 12% spike on the ad drop and another 20% overnight after Trump praised both the ad and Sweeney.

With the market now showing signs of bullish recovery, those who had the conviction to buy during the pullback are likely to be rewarded. Meanwhile, traders who overextended on leverage were hit hard. Over $1.6 billion worth of leveraged positions have been liquidated since the start of the month, serving as yet another reminder that holding spot ultimately proves the safer strategy.

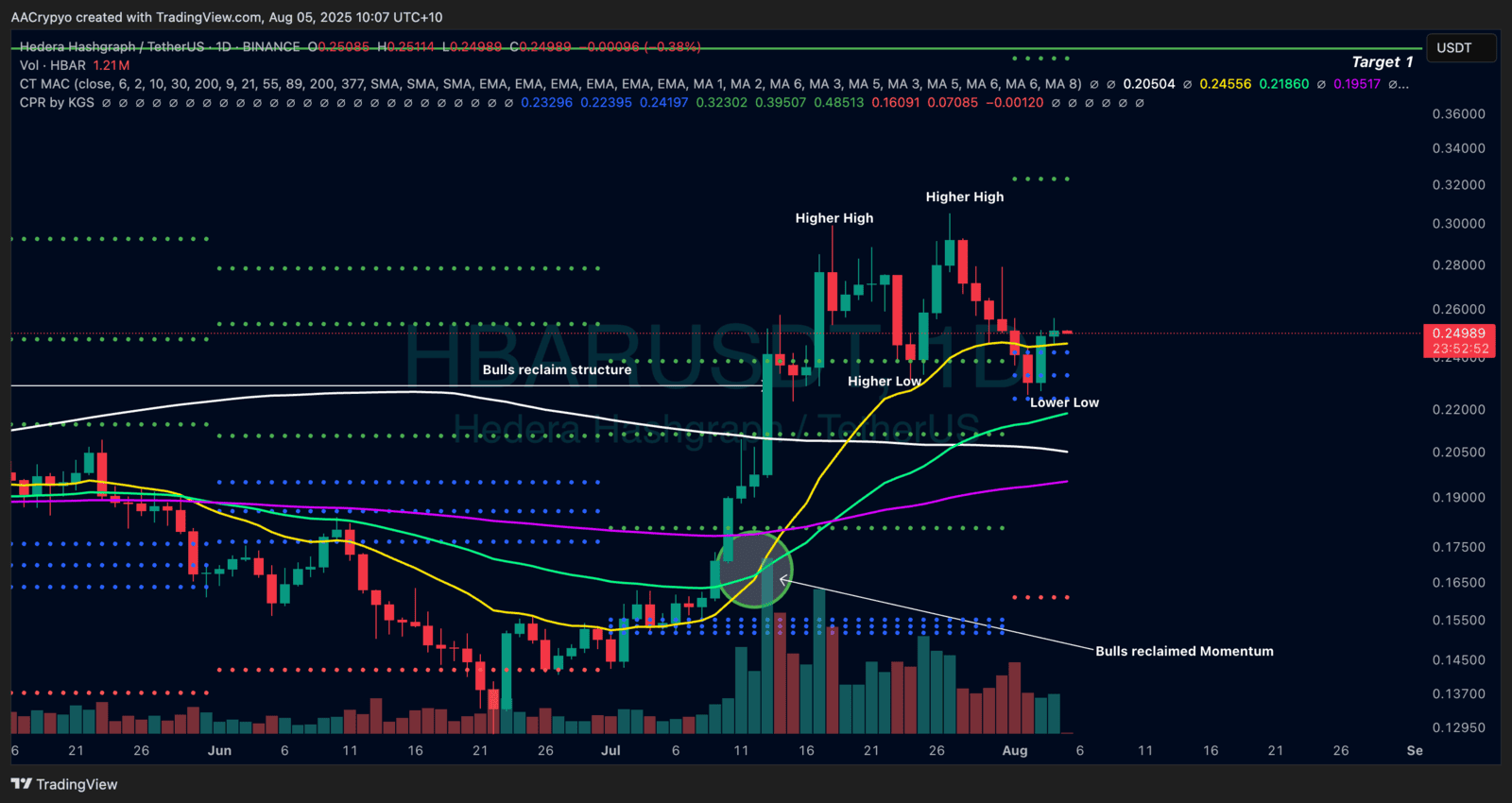

Stormrake Spotlight: Hedera (HBAR) ($0.250)

Stormrake Spotlight: Hedera (HBAR) ($0.250)