To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

As expected, volatility arrived with last night’s CPI release. Before the data dropped, Bitcoin was trading at $118k and looking set to extend its short-term pullback, while altcoins were sliding further. The numbers themselves were not overly dovish, but both core and headline CPI month-on-month matched forecasts, and headline CPI year-on-year came in at 2.7%, below the 2.8% forecast. That softer reading was enough to give risk-on assets a boost and became the ignition bulls needed to reclaim control.

In the 30 minutes following the release, Bitcoin rallied almost 1%, with Ethereum jumping over 2%. This morning, after the market had time to digest the data, Bitcoin is back at $120k, up more than 1% on the day. The real standout, however, is Ethereum, now up nearly 9% at over $4,600 and less than 6% from its all-time high. For Ethereum holders, this is a welcome relief and a sign the milestone could soon be reached. The wider altcoin market has also moved higher, trading above Monday’s pre-pullback levels. Sentiment has climbed to 73, well into greed territory and edging towards extreme greed.

The rally was not limited to crypto. Traditional risk assets responded strongly to the CPI numbers, with both the S&P 500 and Nasdaq closing at fresh all-time highs. Market expectations for a September rate cut continue to rise, with the market now pricing in a near 95% probability of a 25 bps cut at the next FOMC meeting.

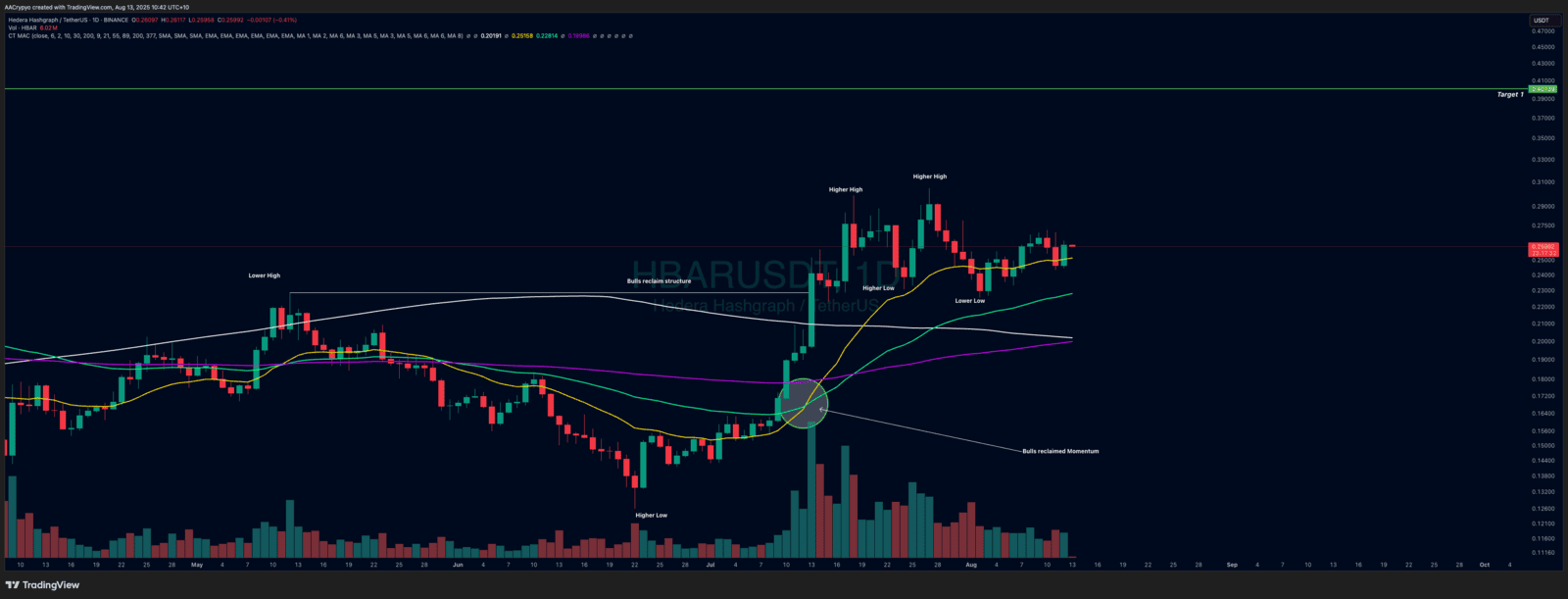

Stormrake Spotlight: Hedera (HBAR) ($0.259)

Stormrake Spotlight: Hedera (HBAR) ($0.259)