To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Waking up to another failed rally attempt, Bitcoin is under pressure again as bears step in and defend another key liquidation level. We are now approaching $100K for the fifth time in just over a week, and each attempt is making this support zone weaker.

The US session was relatively flat across traditional indices, but precious metals saw strong bullish momentum. Gold rose nearly 2%, reclaiming $4,200, while silver led the charge with a 4% move and now sits less than 2.5% away from a new all-time high. Despite this risk-on tone in metals, the sentiment did not translate to Bitcoin.

Bitcoin briefly pushed above $105K before the US session opened, but once again failed to hold higher levels. Bears stepped in aggressively, loading up shorts and continuing to put downward pressure on price. As mentioned yesterday, there is close to $1 billion in short positions on Binance alone that would be liquidated if Bitcoin hit $108.5K. Across all major venues, the broader liquidation figure sits at $4 billion. This is why rallies are being so heavily defended. Bears are in control and they are not letting go.

Currently, even a bounce to $105K would put $1 billion of shorts at risk, so this level could mark a final stand for the bulls.

Why is this potentially the final stand? Not only because of the mounting short interest, but also because we are retesting $100K again. The general principle with support and resistance is simple. The more a level is tested, the weaker it becomes. This is the fifth attempt. Support is wearing down and the market knows it. It is not just a technical level but a key psychological one. If $100K fails, a move into the low $90Ks is very likely. Keep in mind that Bitcoin opened 2025 at $93.5K. If we lose $100K, Bitcoin could be battling to stay green on the year, which is a stark contrast to what most were expecting just a few months ago.

Still, there is one important historical fact. Bitcoin has never posted two red years in a row. If 2025 ends in the red, history would suggest that 2026 could be a strong recovery year. Of course, past performance is not indicative of future results, but the pattern is worth watching.

Sentiment continues to deteriorate. The Bitcoin Fear and Greed Index now sits at 15, firmly in extreme fear territory, and at its lowest reading since 27 February. Bears are getting bolder, adding more shorts and selling spot Bitcoin to drive the price lower. The overall structure remains bearish unless Bitcoin can reclaim $112K, which would not only flip momentum back to the bulls but also wipe out at least $7 billion in short positions.

Historically, Bitcoin has at least doubled following the McRib’s return. Will it do so again? We will have to wait and see.

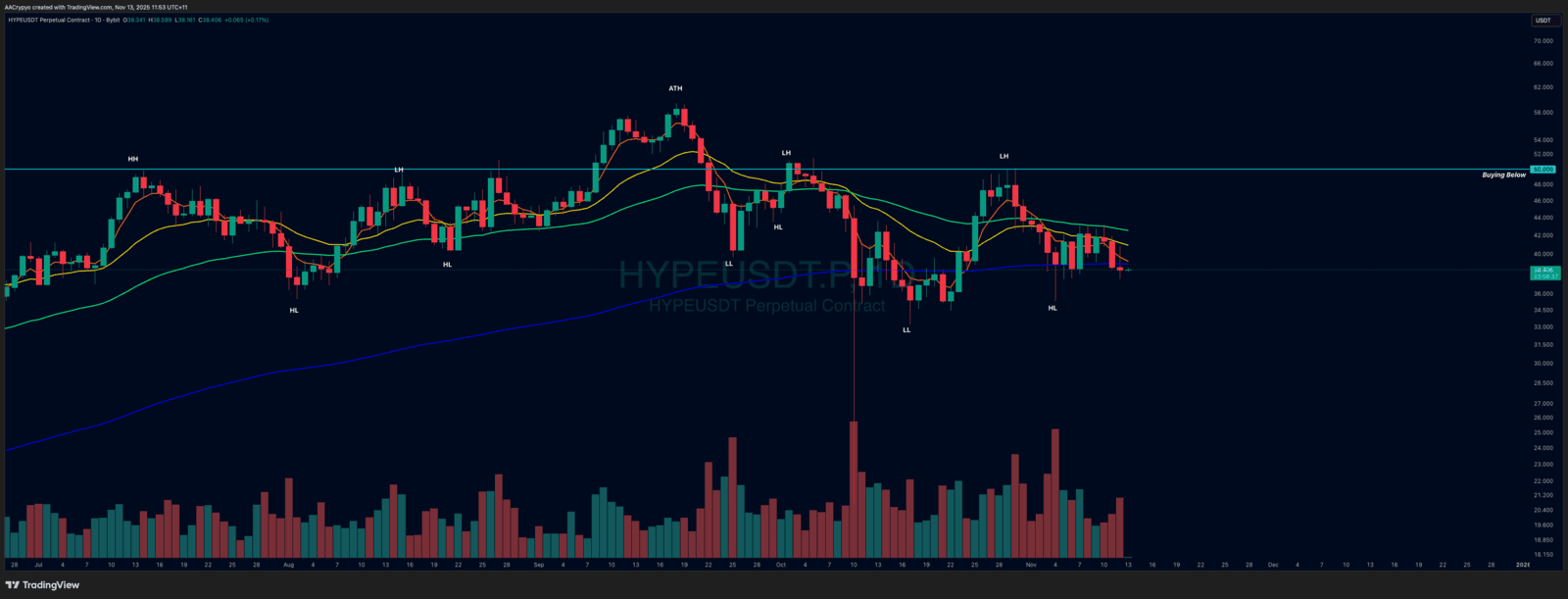

Stormrake Spotlight: Hyperliquid (HYPE) ($38.40)

Stormrake Spotlight: Hyperliquid (HYPE) ($38.40)