To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Bitcoin continues to stumble, unable to gather any meaningful momentum, while precious metals have enjoyed a strong rally this past week. Gold printed fresh all-time highs, and silver followed with impressive gains. However, yesterday marked the first bearish session for gold in over a week, with silver also closing in the red. Despite expectations, the profit-taking in metals has not translated into inflows to crypto, but hope is far from lost.

Instead, flows have rotated into traditional risk-on markets, with both the S&P 500 and Nasdaq posting solid gains of nearly 1% on the day. Both indices are now approaching their all-time highs again, up over 2% on the week, with the Nasdaq recovering nearly 3% from its low earlier in the week. This is a classic example of sentiment-driven capital rotation.

Broader macroeconomic conditions remain at play. Investors were previously fleeing to gold and silver due to uncertainty surrounding tariffs, especially after a court ruled them illegal last week. Trump has continued to push for them, but has now suggested they may need to be rolled back to secure trade deals with the European Union, if the Supreme Court rules against him. At the same time, markets are anticipating a 25 basis point rate cut, although the outcome is never guaranteed.

While metals rallied and Bitcoin pulled back, the rotation appears to be starting. Investors who booked profits in gold and silver are beginning to return to the risk-on space, entering through the traditional markets first. This is how capital typically flows — equities move first, crypto follows. Bitcoin is likely next in line. We could see traditional indices make fresh all-time highs while Bitcoin continues to consolidate at current levels, before capital begins rotating back into digital assets.

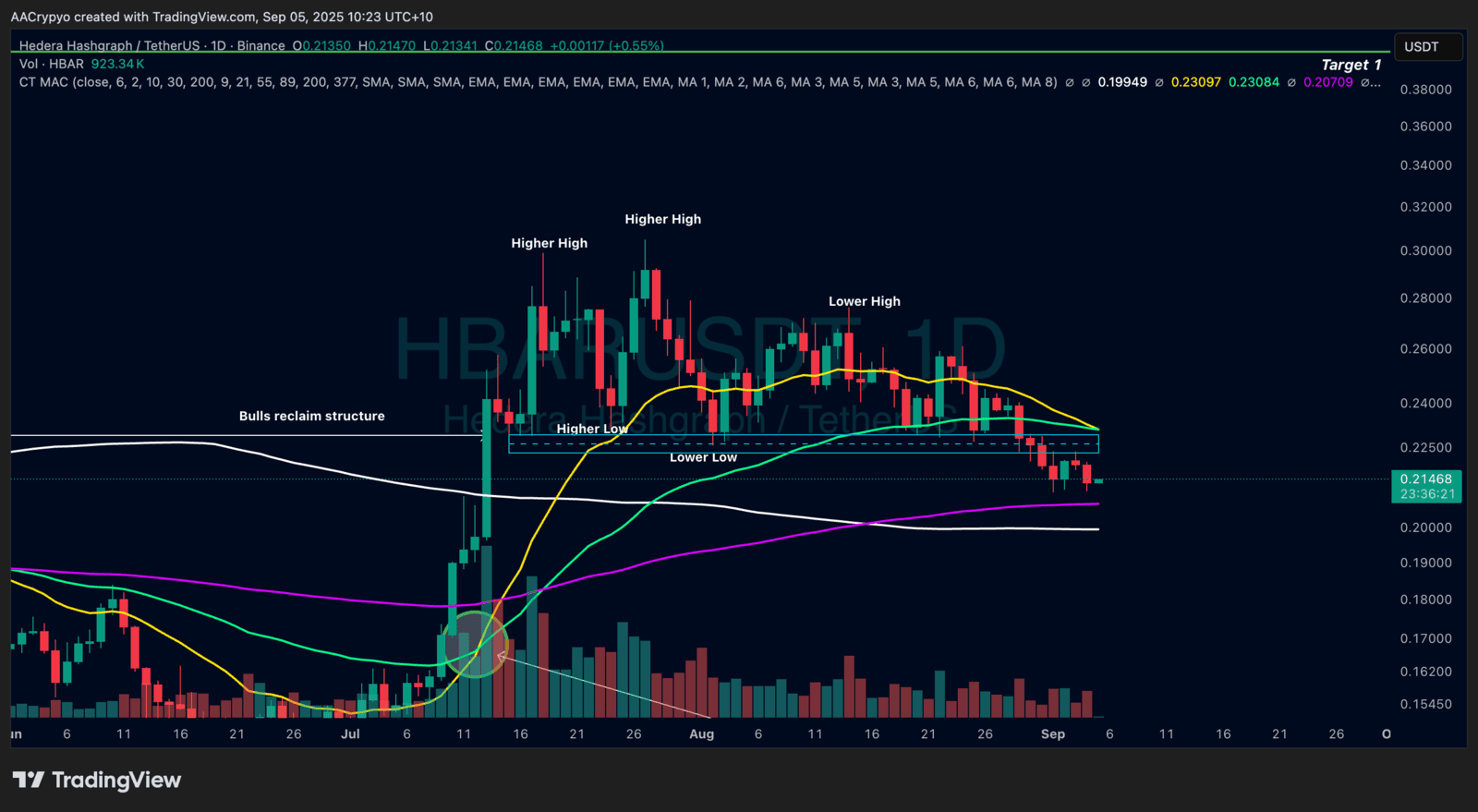

Stormrake Spotlight: Hedera (HBAR) ($0.214)

Stormrake Spotlight: Hedera (HBAR) ($0.214)