To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Yesterday was another day where panic sellers suffered while smart money benefitted. It was a volatile session that ended in liquidations for over-leveraged positions. Bitcoin broke below the support level that had held through the weekend and quickly moved lower, shifting sentiment as it dropped under $115K (falling nearly 2.5% at its lowest point during the day). Altcoins followed suit, suffering even more. Over $500 million in leveraged positions were wiped out, with more than 80% being longs.

The X timeline fell apart. Sentiment flipped from calls for $150K–$200K to bear market predictions in just a few days. Yesterday, every second person was calling the top, saying the bear market had begun, or comparing the move to 2021. For those unfamiliar, that cycle saw Bitcoin set a marginal new all-time high just weeks after the previous one, before rolling over into a long bear market. Less than a week ago, the fear and greed index was at 75, in extreme greed. Following the pullback, the latest reading has dropped to 56. It's still in greed territory but is quickly approaching neutral.

Sentiment and social media can shift very quickly. This is why staying grounded in your conviction and tuning out the noise is so important when investing.

Waking up this morning, Bitcoin is back above $116.5K and up nearly 2% from the intraday low. Ethereum has bounced nearly 3% from its low. The standout performer remains Chainlink (LINK), which is still green on the day and continues its outperformance since the start of the month.

In macro, Zelensky and other European leaders concluded their meeting with Trump at the White House this morning, with more signs of progress emerging around ceasefire negotiations in Eastern Europe. Ukraine has reportedly proposed a $100 billion US weapons purchase in a bid to secure security guarantees from Trump. Putin, meanwhile, has continued to demand recognition of the Donbas region in exchange for a ceasefire. Zelensky has held his ground, saying “it would be impossible” to give up territory to Russia.

However, after the White House meeting and a 40-minute phone call between Trump and Putin, it has been reported that Putin has agreed to a trilateral meeting with Trump and Zelensky within the next two weeks.

These developments are encouraging. We can likely expect headlines on this front to pause until that meeting takes place, allowing markets to refocus on broader momentum, at least until Jerome Powell’s Jackson Hole speech, scheduled for midnight on Friday.

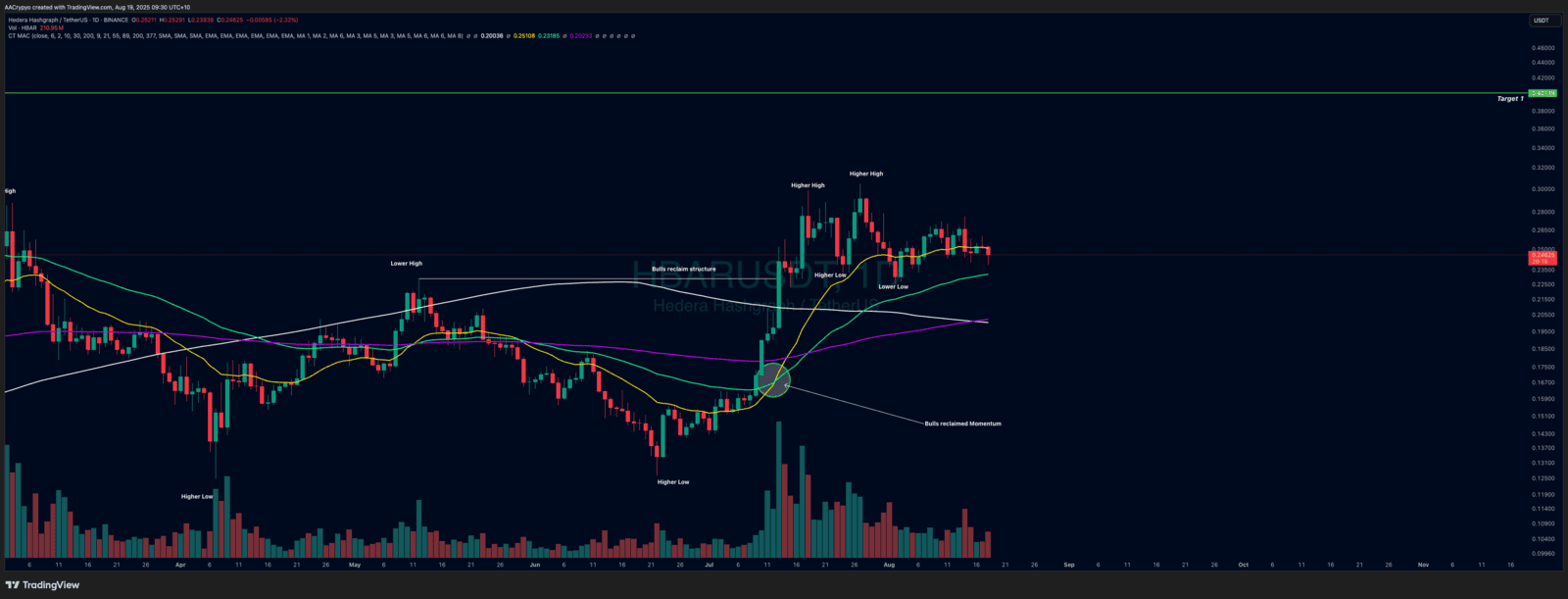

Stormrake Spotlight: Hedera (HBAR) ($0.246)

Stormrake Spotlight: Hedera (HBAR) ($0.246)