To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

I asked whether this was a relief rally or the start of something more sustained, and the last 24 hours have all but answered that. Over $120 billion has re-entered the crypto space. Bitcoin is up over 2% and pushing toward $112K after effortlessly breaking through key resistance levels. The bears seem to be running out of steam as the bulls continue their comeback, with BTC now up over 7% from Friday’s low.

There is no debate about which asset has dominated this year. It is gold. Opening 2025 at $2,600, it now trades above $4,200, up over 60%. It has reached a point where people are queueing for hours at physical bullion stores. Despite many calling this a top signal, gold continues to rally and just set another all-time high in the past 24 hours. It now approaches $4,400 an ounce.

The question now is when will it pause, if at all. Some form of consolidation or profit-taking seems inevitable. Once that happens, we are likely to see rotation, and those flows will probably find their way into Bitcoin and other risk-on assets.

Elsewhere, AWS going down triggered widespread technical issues across major crypto platforms. Coinbase users could not access the app, Base Network experienced outages, What Exchange, a decentralised exchange, went offline, and even Robinhood, the most used trading platform in the US, was down.

This highlights a major systemic flaw. Too many platforms rely on a single infrastructure provider. One service going down should not cripple access across multiple industries. That said, Stormrake clients remained unaffected, with uninterrupted access to their funds and full withdrawal capability despite the AWS disruption.

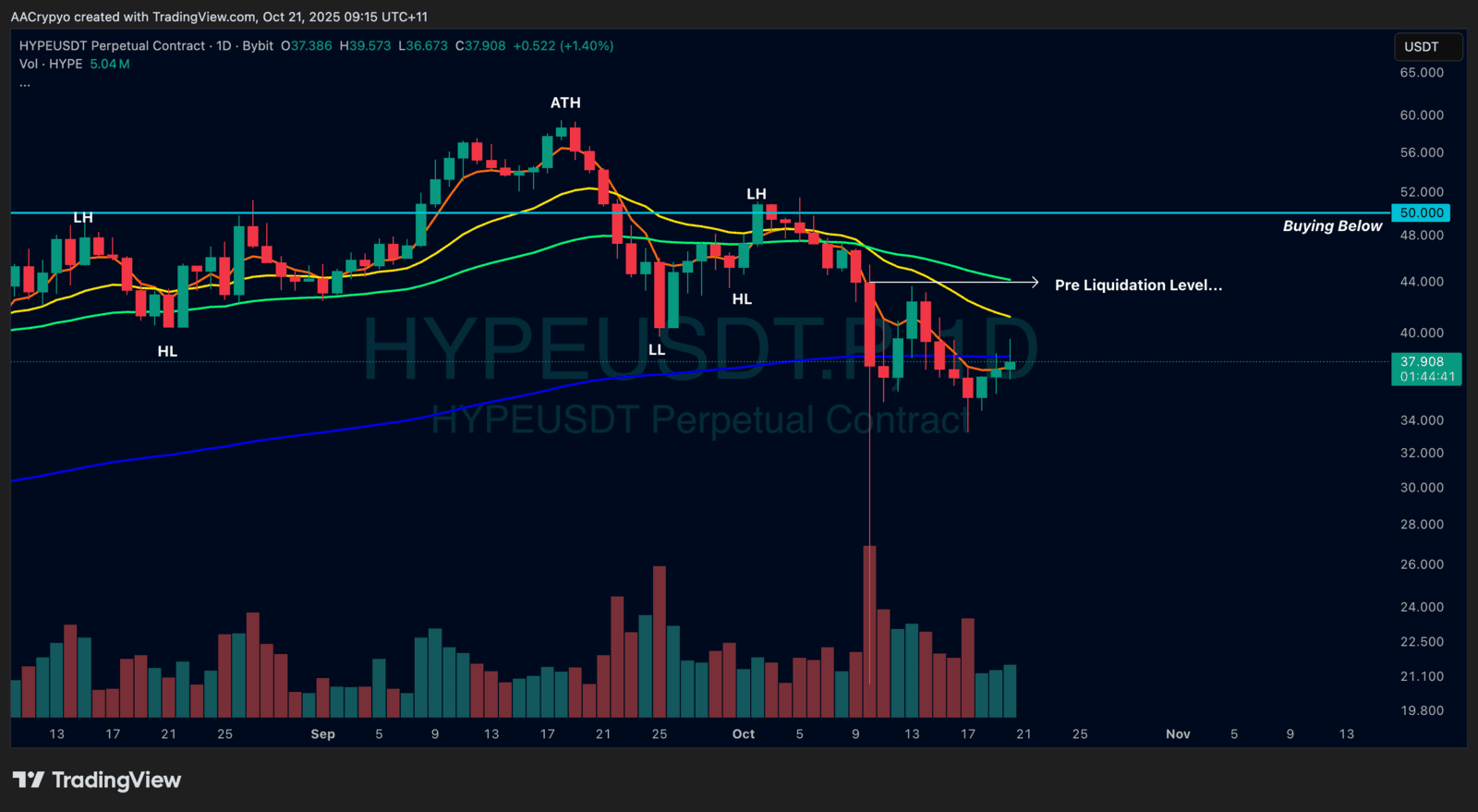

Stormrake Spotlight: Hyperliquid (HYPE) ($37.90)

Stormrake Spotlight: Hyperliquid (HYPE) ($37.90)